-

5,243+

businesses rely on us to process their payroll

-

524+

accounting firms partnered with to provide client payroll services

Payroll Services for Accounting Firms

Payroll that works for you— not the other way around

Offering payroll services shouldn’t mean adding complexity to your accounting firm. With myPay by IRIS you can expand or enhance your firm’s offerings effortlessly.

-

Full Back-Office Support

Offload payroll processing, tax filings, compliance, and administration—without sacrificing your role as your clients’ go-to advisor. Payroll stays part of your service offering, but the work stays off your plate.

-

Accurate, On-Time Payments

Payroll done right, every time. Your clients’ employees are paid accurately and on time, preventing disruptions and strengthening client relationships. No delays. No headaches.

-

No Payroll Liability

Managing payroll comes with risks, but you don’t have to take them on. We handle quarterly and annual tax filings, ensure compliance with changing regulations, and assume full payroll tax liability—so your firm stays protected.

Compliance without the complexity

Payroll tax rates, changing regulations, and compliance risks shouldn’t slow your firm down. With myPay, you never have to worry about payroll tax compliance—we handle it all.

- Automatic tax calculations and filings. Accurate and on time, every time.

- Full tax liability protection. If the IRS or your local tax agency contacts you, we handle it.

- Stay ahead of regulatory changes. Our tax experts monitor legislation to keep your firm and your clients compliant.

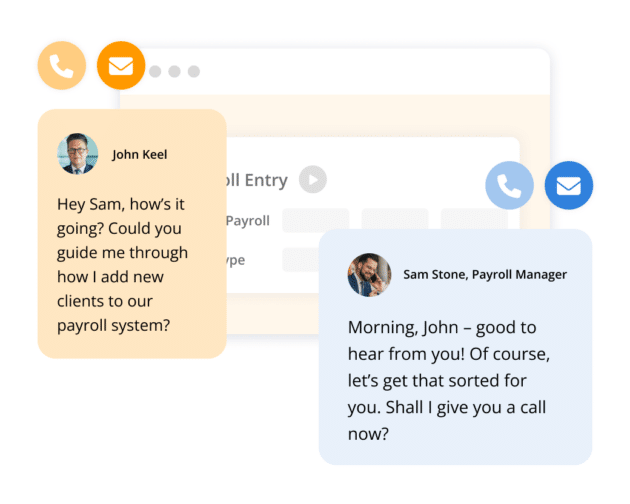

Get a payroll expert on your side

With myPay, you get more than just a payroll service—you get a payroll partner. Unlike big providers that funnel you into call centers, we offer direct access to a dedicated payroll specialist who understands your firm and your clients.

- One-on-one support for an assigned payroll expert

- No more waiting on hold—reach your specialist directly

- Proactive guidance to help you manage payroll efficiently

Customers say it best

Free guide

Grow Your Firm with a Payroll Partner

With the right partner, you can transform payroll from a burden into a business advantage. Discover how to expand your offerings without the hassle, risk, or overhead of in-house payroll services.

Frequently asked questions

-

myPay is a fully managed payroll service, not just software. Simply enter your payroll information through our secure portal anytime, 24/7. We handle processing, tax filings, and payments—ensuring your clients’ employees are paid accurately and on time. You can choose to receive an electronic file of payroll checks for printing or have direct deposit stubs securely delivered to employees via their private online portals. No manual processing. No compliance headaches. Just seamless payroll. Need to pay employees abroad? Check out our global payroll.

-

Absolutely. MyPay works behind the scenes, so you remain your clients’ trusted advisor. We handle the payroll processing, but your firm stays front and center—offering payroll services without the operational burden.

-

Yes, your firm has full control over client interactions. Through our Referring Accountant program, you can refer clients to IRIS for payroll services while still earning a share of the revenue. The program includes three tiers of revenue share and waived fees, depending on the number of clients you refer.

-

We automate payroll tax calculations, file taxes on your behalf, and assume tax liability, ensuring compliance at every step. If the IRS or local tax authorities ever reach out, we handle it—so you don’t have to.

-

Unlike payroll software that still requires you to manage compliance and processing, myPay does the work for you. We’re a fully managed payroll solution, meaning we handle payroll processing, tax filings, and payments—while you keep payroll in your service lineup without the workload.

-

With myPay, you get a dedicated payroll specialist—not a call center. You’ll have direct access to an expert who knows your firm and your clients, so you can get fast, reliable answers when you need them.

-

100%. Whether you’re adding new clients or expanding services, myPay grows with your firm. You can seamlessly scale your payroll offering without adding in-house payroll staff or increasing overhead.

Creative Software Solutions Corp is D/B/A myPay Solutions located at 880 Technology Drive, Ann Arbor MI 48108 NMLS # 1445015

As of October 26, 2022, IRIS Software Group welcomed Creative Software Solution Inc. to the IRIS Software Group portfolio of accounting and payroll products and solutions to better serve the CPA market in the Americas.

Make payroll a profit driver

Why wait? Let’s make payroll effortless for your firm.

Related products

-

IRIS HCM

Simplify global HR and payroll with a complete platform designed for compliance, efficiency, and seamless workforce management.

-

IRIS Payroll Software

Run payroll with confidence using flexible, compliant solutions built for businesses of any size.

-

IRIS Document Management

Take control of client documents with secure, automated workflows that streamline storage, retrieval, and compliance.