Tax, audit and accounting software and research solutions

Explore our tax, audit and accounting, and research solutions to help manage both day-to-day tasks and future growth

Corporate solutions

Manage your end-to-end tax lifecycle and compliance needs with our comprehensive range of content driven solutions.

Accounting solutions

Expand your team’s capabilities with premier tax and accounting software and research solutions.

Tax, audit, and accounting solutions

Leading software to help make your business a one-stop, full-service resource.

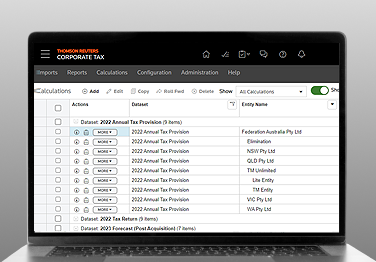

Out of the box tax solution purpose built for corporates in Australia and New Zealand

Swift, accurate corporate tax compliance, designed to streamline work and super charge your data. Elevate your tax strategy with robust tax data management.

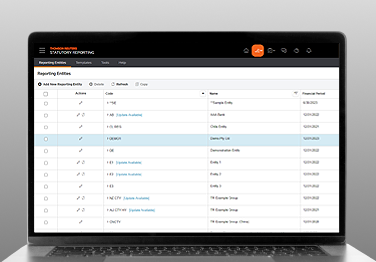

Big 4 content validation 45+ jurisdictions; global oversight, local insight

Prepare and submit accurate financial statements with Big 4 content validation across 45+ jurisdictions. Scale and standardise your statutory reporting.

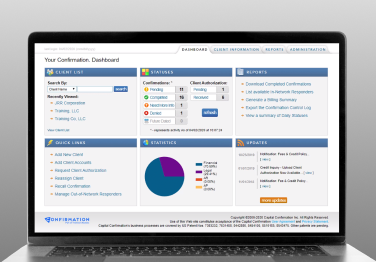

One digital authorisation for all your audit confirmations

Confirmation provides an easy, fast, and secure way to send more than 100 confirmation types to anyone, anywhere in the world.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.