Corporate tax and reporting solutions

Reliable, connected, and intelligent tax solutions

Trusted by Fortune 500 and large corporations, our content-enabled tax and reporting solutions are helping you make confident decisions and run better businesses

Harness the power of our tax and reporting solutions

We have trusted content built and updated by our in-house specialists to ensure compliance with the latest legislation. Automated end to end standardised workflows support your entire tax and reporting lifecycle meaning you don’t have to do the heavy lifting.

NextGen API enabled technology means you can improve data accessibility and streamline tax and reporting workflows by leveraging data across various applications. This enables you to reduce your IT burden and gives you confidence that robust data security protocols are met.

Using robust tax governance processes gives you control and the ability to better support tax decision-making and manage tax risk. Seek confidence in your data integrity with comprehensive audit trails and inbuilt checking and validation procedures, numbers you can trust.

See firsthand how our products can help

Time-consuming returns and audits are a thing of the past. No matter what your role is, take advantage of solutions to help you understand the compliance rules where you operate, streamline data entry, give you real-time visibility and so much more.

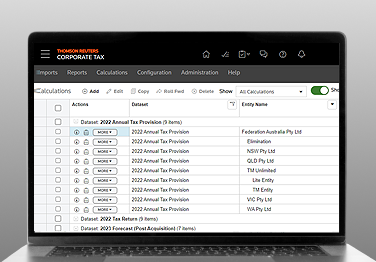

Out of the box tax solution purpose built for corporates in Australia and New Zealand

Swift, accurate corporate tax compliance, designed to streamline work and super charge your data. Elevate your tax strategy with robust tax data management.

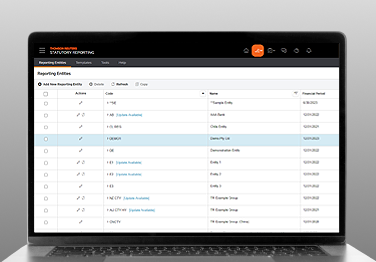

Big 4 content validation 45+ jurisdictions; global oversight, local insight

Prepare and submit accurate financial statements with Big 4 content validation across 45+ jurisdictions. Scale and standardise your statutory reporting.

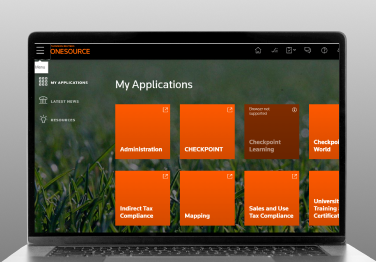

Expert, certified and trusted tax content driving complete compliance

Real-time rates, rules and indirect tax content managed by intuitive software so you can save time and mitigate risk.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.