ONESOURCE Determination Software for indirect tax compliance

ONESOURCE Determination provides companies of any size with the indirect tax software they need to get tax right the first time, every time. Our indirect tax solution allows you to:

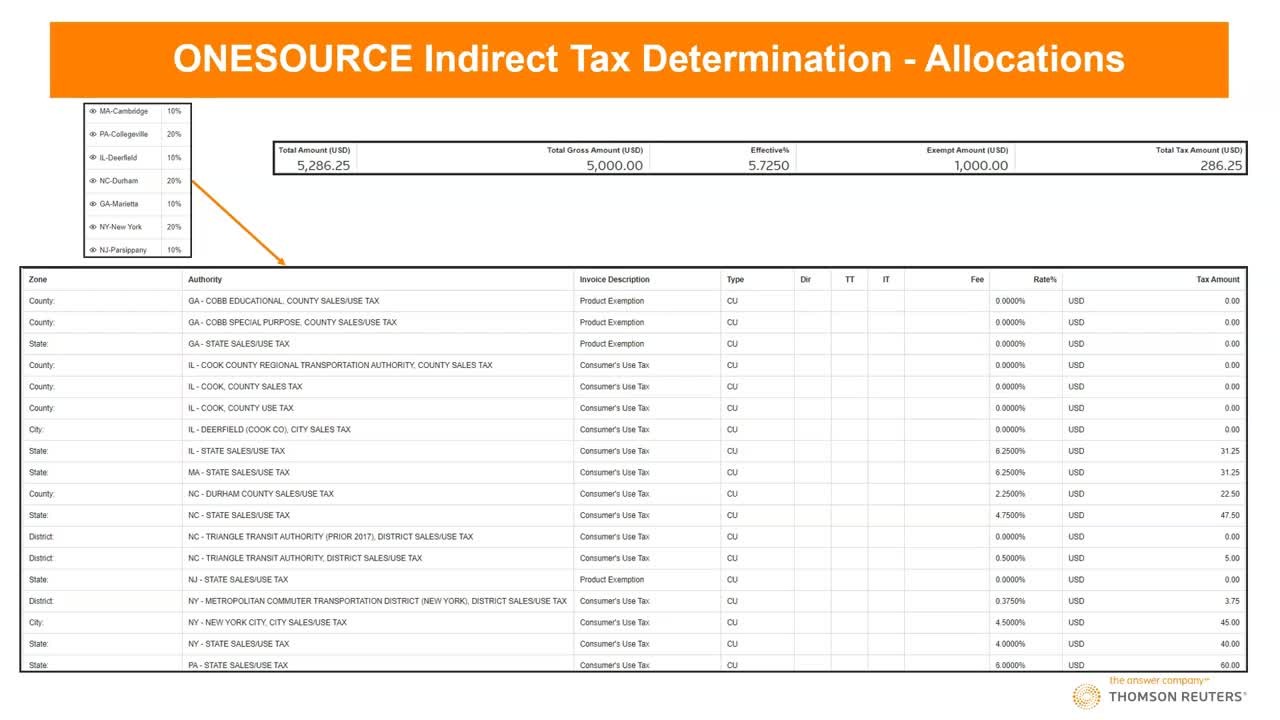

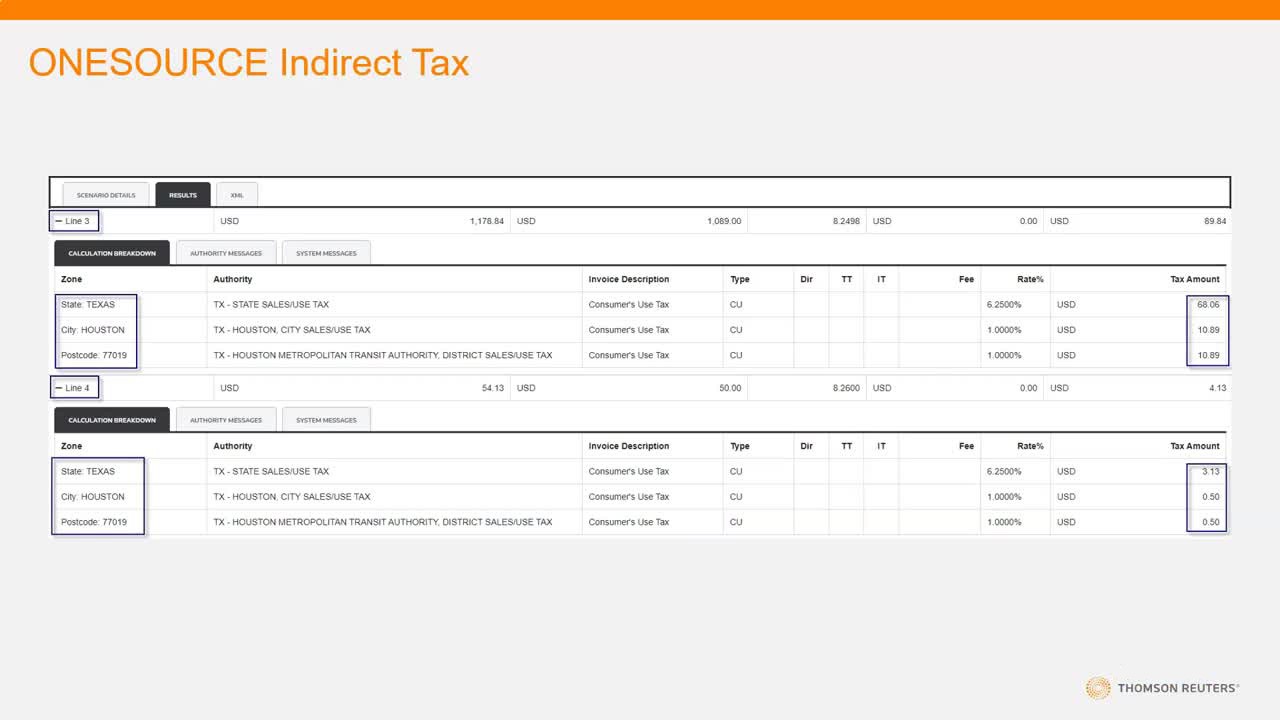

- Automate indirect tax decisions with our intelligent tax determination engine

- Calculate correct indirect tax in milliseconds, with the ability to handle high volumes of transactions

- Integrate with your existing business systems

- Scale as your business does, with seamless and flexible cloud-native software

Indirect tax automation built for your business

ONESOURCE Determination is indirect tax software that’s built for accuracy and adaptivity, to give you a true business advantage.

Automate sales tax for increased accuracy and reduced risk

With sales tax automation through ONESOURCE Determination, you can free up valuable time to focus on higher value-added work and building a business advantage.

- Reduce risk by automating manual processes and reviews

- Partner with the sales tax expertise you need for the long-term

Flexible to deliver a tailored indirect tax automation solution

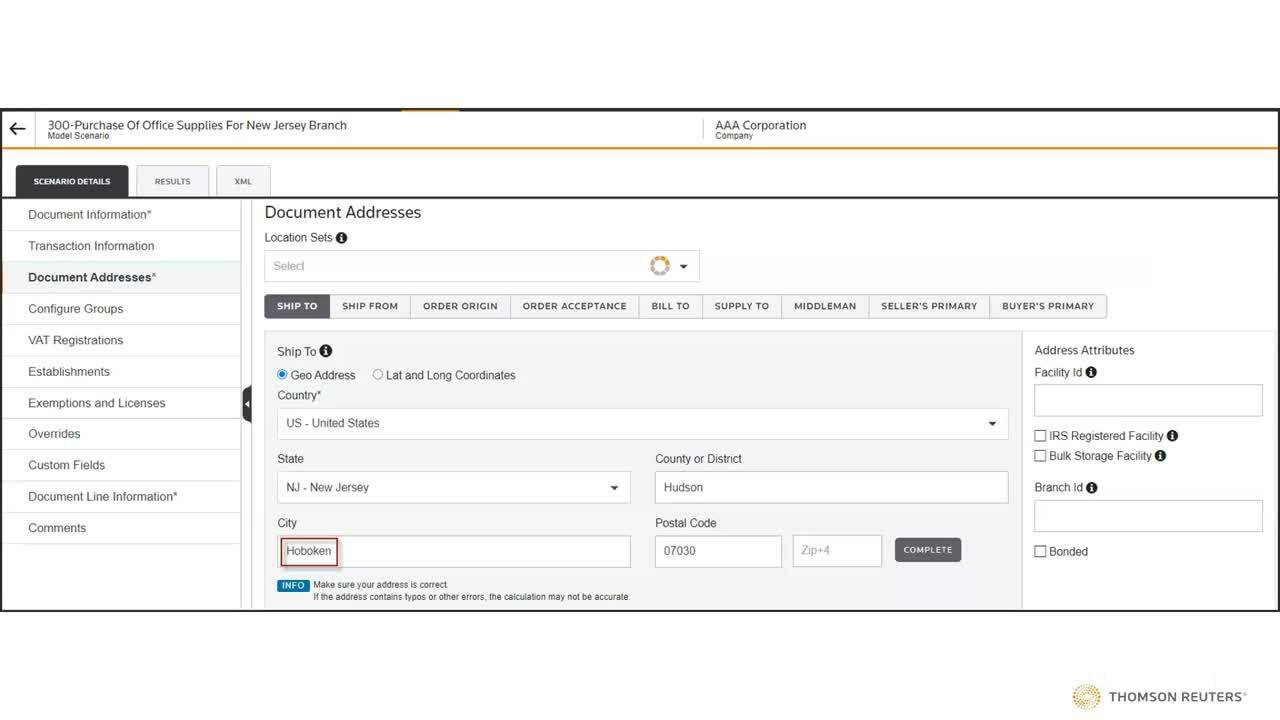

ONESOURCE Determination is configured to your business’s exact needs, to fit within your transactional systems and sales tax policy.

- Cloud-native enterprise sales tax solution, with automatic scaling and zero downtime for upgrades

- Seamless integration with business systems, such as ERP, P2P, O2C, and ecommerce

Freeing up time for strategic work

With sales tax automation through ONESOURCE Determination, you can free up valuable time to focus on higher value-added work and building a business advantage.

- Reduce risk by automating manual processes and reviews

- Partner with the sales tax expertise you need for the long-term

What you get with our indirect tax software

Accurately calculate your global indirect tax with an end-to-end automated solution for sales, use, and excise tax, GST, and VAT.

Connect to ERP, financial, billing, and e-commerce payment systems through pre-built and custom integrations.

Reduce the risk of audit-triggering mistakes, thanks to our in-house expertise backed by SSAE 18 and ISAE 3402 certified processes.

Ensure all your indirect tax liability needs are met with our tax engine that handles corporations of all sizes and geographic reach.

We wanted to use a simple system, a single set of rules that the tax department could control — not IT and not the end user — to make sure that our tax liability was accurate.