Tax and accounting

Tax automation solutions

Boost operational efficiency and simplify compliance with tax technology that mitigates risk and improves decision-making

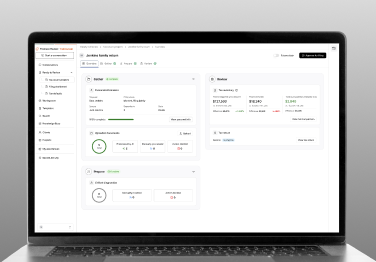

For tax and accounting firms

Tax workflow and management for small business owners and your accounting teams.

Automate the gathering and preparation steps for 1040 returns with a cloud-based, agentic-AI tax workflow solution that enables tax professionals to focus on strategic work and grow their firms.

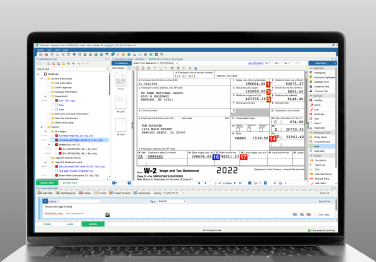

Eliminate data entry with our industry-leading scan-and-populate tax solution, which automates 4 to 7 times as many documents as the alternatives and exports data directly to your tax preparation software.

Automate your firm’s delivery and e-signing process with this powerful accounting solution. Provide a seamless client experience while reducing errors, saving time, and streamlining your workflow.

Easily manage digital workpapers and, in conjunction with 1040SCAN, automatically organize them into a standardized index that follows the flow of the tax return.

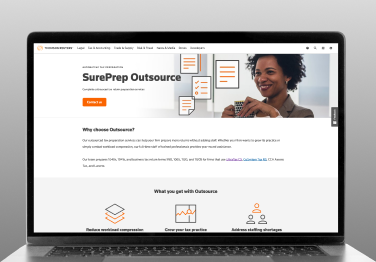

Help your firm prepare more returns without adding staff with our tax preparation services. Whether your firm wants to grow its practice or simply combat workload compression, our full-time staff of trained professionals provides year-round assistance.

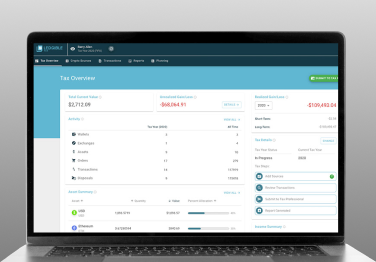

Streamline workflow and compliance with this cryptocurrency tax reporting software, as well as calculate taxes, trace transactions, and automate reporting.

Omnichannel tax compliance and management at scale.

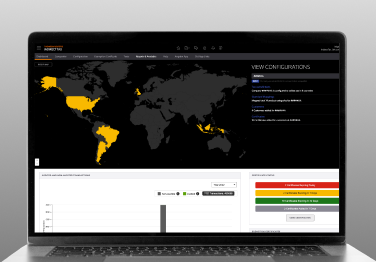

Market-leading global tax determination software that automates tax calculations. Report on sales and use tax, GST, VAT, and excise tax using the latest rates and rules.

Manage the accurate tracking and validation of sales tax exemption certificates through this powerful software. Save time by letting customers upload certificates via a secure, online portal and see fewer exemption status disputes, audits, or penalties.

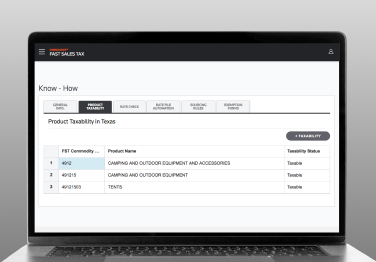

Quickly access on-demand sales and use tax rates through this easy-to-use sales tax software. Identify appropriate product taxability statuses, search sourcing rules, and learn from step-by-step tax guidance.

Tax provision software to help automate your corporate financial close and streamline the tax provision process. Drill down and filter data, close faster, file taxes earlier, and free up time to grow your business.

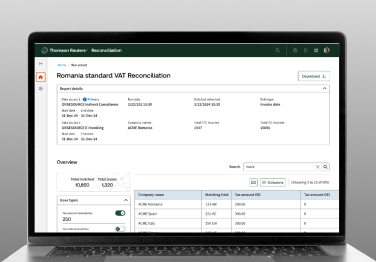

ONESOURCE Reconciliations software automates e-invoice reconciliation, detecting discrepancies, and ensuring full compliance. Request a free demo today.

Streamline workflow and compliance with this cryptocurrency tax reporting software, as well as calculate taxes, trace transactions, and automate reporting.

Discover more about our tax planning and preparation solutions

For tax and accounting firms

Tax planning

Bring more value to your client relationships and gain the expertise needed to advise clients on everything from new regulations to business expansion.

Tax compliance

Complete more tax returns in less time with a shortened workflow and increased productivity.

Research powered by AI

Tax research tools powered by artificial intelligence and machine learning to get targeted search results in less time.

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us