Foreign-trade zone software

Achieve cost savings and operational efficiency with ONESOURCE Foreign-Trade Zone Management

Maximize cost-savings opportunities, expedite shipment importing and exporting across borders, and direct your zone operations with the necessary tools. A market leading solution for improving cash flow, avoiding duties, and integrated with all key players in the supply chain. Over 600 zones managed. Customers save over $1b annually.

Enhance saving opportunities while maintaining compliance with FTZ software

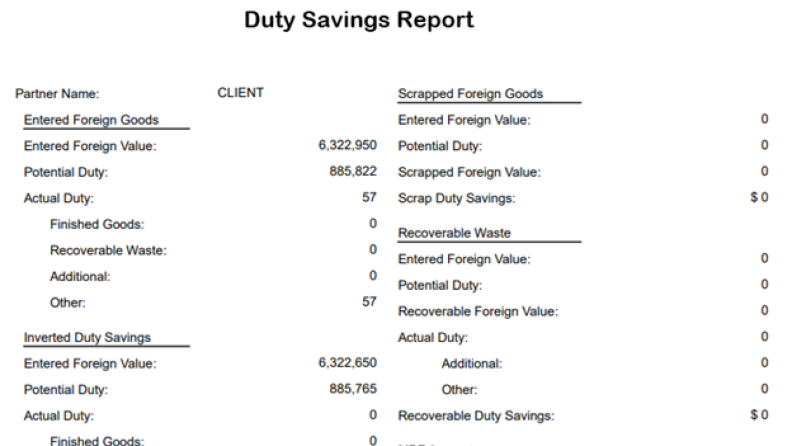

Get duty and fee savings throughout the importing, exporting, and manufacturing process

Eliminate, defer, or reduce U.S. Customs and Border Protection duty payments by taking advantage of inverted tariffs, duty-free re-exports, and merchandise processing fee cap.

Explore more features

Have questions?

Contact a representative

Improve speed to global markets and increase competitiveness

Deliver goods directly to the foreign-trade zone without customs application and approval delays — resulting in faster inventory turnover and improved cash flow.

Explore more features

Have questions?

Contact a representative

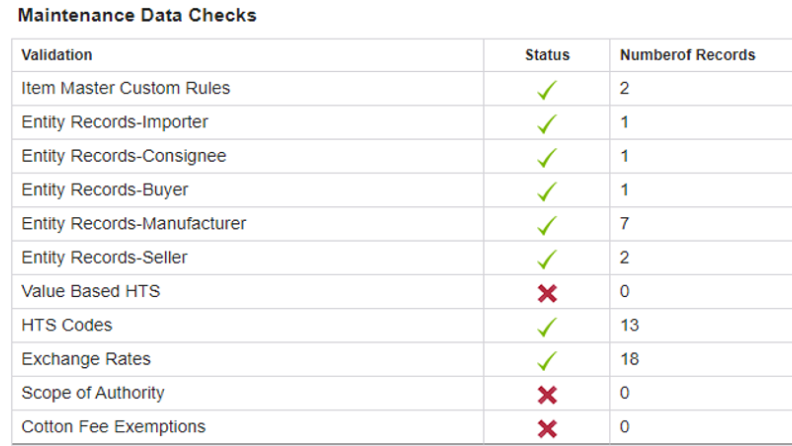

Increase efficiency in your supply chain with automated reports

Save valuable time by automating the creation of required reports for the FTZ Board and CBP. Reports include warehousing details, use of materials, supply chain records, and customs classifications.

Explore more features

Have questions?

Contact a representative

Make global trade operations as simple as possible

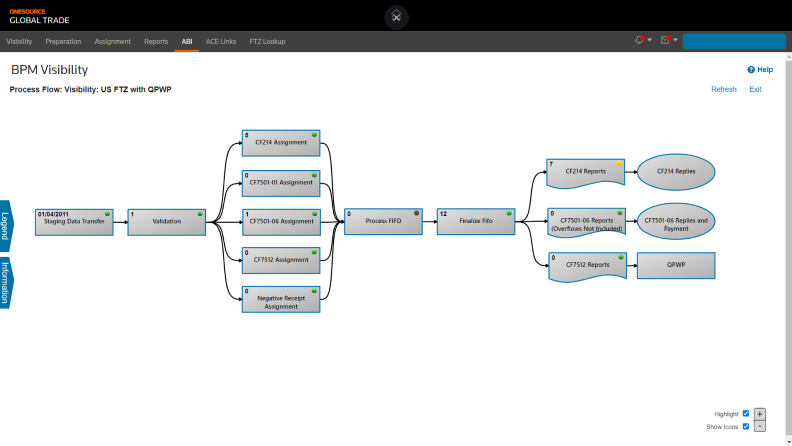

Manage global trade operations — single or multiple subzones — from one web-based platform. Platform abilities include e-filing all CBP documentation, such as entry filings, e214, and QP/WP.

Explore more features

Have questions?

Contact a representative

Operate an expedited, more efficient supply chain with ONESOURCE FTZ Management

Automotive and manufacturing

Take advantage of duty exemption: re-exports, scrap, loss, destruction, and zone-to-zone transfers are duty-free. Inverted tariffs are also an excellent way for FTZs to eliminate or reduce duty liability.

Apparel and retail

Capitalize on a merchandise processing fee cap and better manage inventory to achieve shorter cycle times, increased inventory turnover, and better traceability in your supply chain.

Pharmaceuticals

Utilize FTZs to help reduce costs for yield loss and scrap. FTZs can also help pharmaceutical companies better manage regulatory requirements.

More than 3,000 firms in the U.S. use FTZs to eliminate, defer, or reduce duties, taxes, and fees

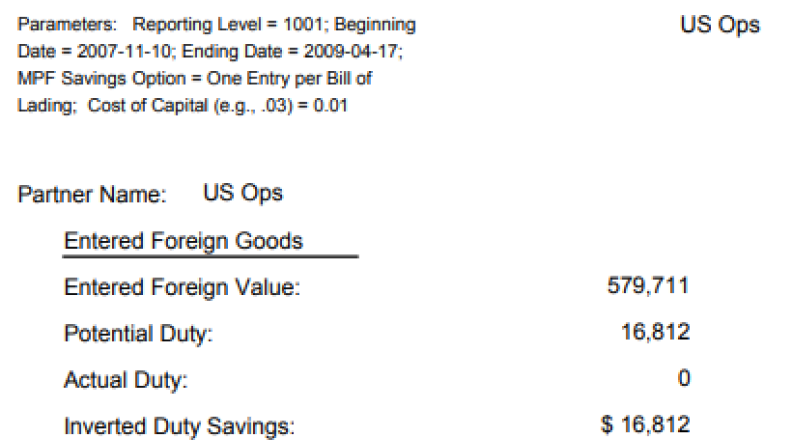

Get relief with inverted tariffs

In some cases, tariffs on U.S. component items or raw materials have a higher duty rate than the finished product. A major benefit of operating in an FTZ is that you can elect to pay whichever duty is lower. The duty rate for many finished products is zero, eliminating any costs associated with importing the raw materials and goods. When you choose to pay the lower duty rate on a finished product, you take advantage of inverted tariff savings.

FTZs help you experience cost savings and a better cash flow

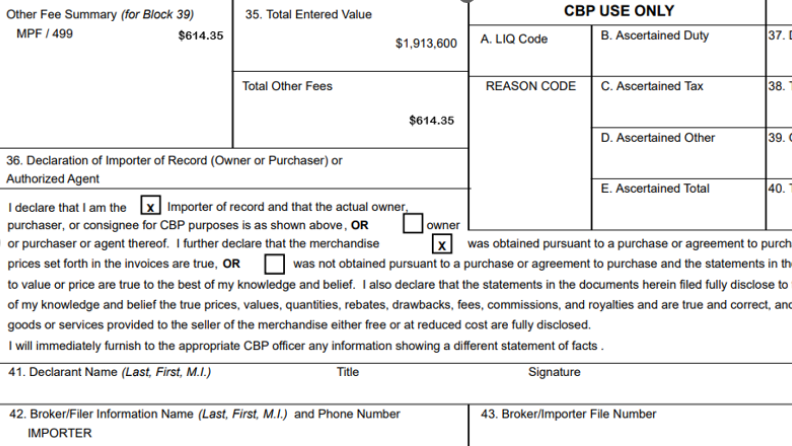

Take advantage of cost savings with weekly entries

In an FTZ, you can file one customs entry per week rather than per shipment. Doing so can greatly reduce the merchandise processing fee (MPF) you must pay with every entry filed. Fewer entries convert to lower fees, which can save thousands of dollars annually.

Improve cashflow with deferred duty payments

Because FTZs are not considered part of U.S. Customs territory, you don't need to pay duties on merchandise upon admission. Duty payment is deferred until the goods are removed from the FTZ and entered into U.S. commerce.

Lower your insurance premiums with foreign-trade zones

Control inventory more closely by bringing goods into an FTZ warehouse you manage. Typically, for insurance purposes, the duty paid on imported merchandise is included in the insurable value of your inventory.

Questions about ONESOURCE FTZ Management? We're here to support you

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us