TAX SOFTWARE FOR TAX PREPARERS

Less time spent on returns and more time returned to you with UltraTax CS

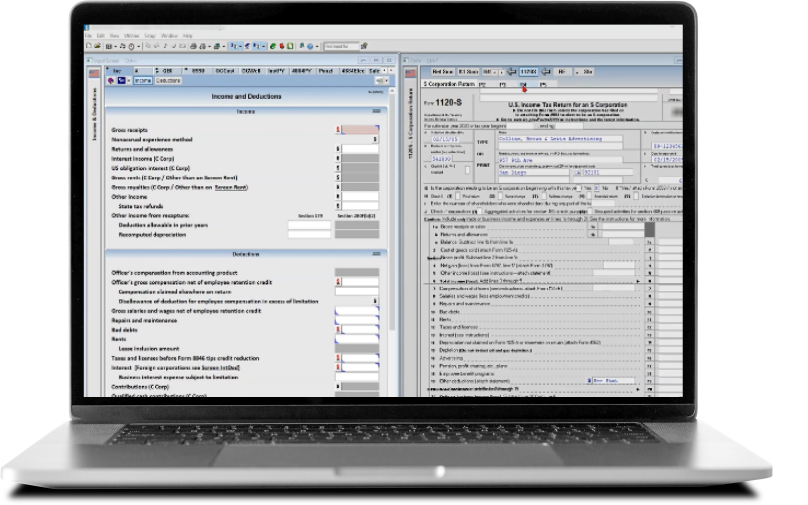

Professional tax preparation software to reduce your workflow time and increase your productivity

A thorough solution for end-to-end tax compliance

Access an extensive scope of returns and forms

UltraTax CS offers a full line of federal, state, and local tax programs, including 1040 individual, 1120 corporate, 1065 partnership, 1041 estates and trusts, multistate returns, and more to handle all client opportunities.

Explore more features

Have questions?

Contact a representative

Ensure form accuracy with calculations to handle various levels of complexity

Confidently handle a variety of client scenarios with considerable calculation capabilities available in UltraTax CS that process and preview data as it is entered.

Explore more features

Have questions?

Contact a representative

Eliminate repetitive data entry with seamless data sharing

With UltraTax CS, you can easily transfer and share information. Data only needs to be entered once into a client’s return and it will populate all relevant fields across other tax returns.

Explore more features

Have questions?

Contact a representative

The value of UltraTax CS

See how UltraTax CS works

Learn about how this tax software simplifies operations, saves time, and reduces workload for tax preparers.

Our 2025 version is available now.

Find out why these tax professionals chose UltraTax CS

“Our firm chose UltraTax because it provides a really great balance between ease of use, simplicity in training, and depth of functionality."

Frank Stitely

Member/Partner, Stitely & Karstetter, PLLC

“We have used UltraTax for 20 years and it is just a fit for our firm. The integration has been key along with the great community of other firms that use it and willingness to help each.”

Shayna B. Chapman

Founder & Chief Strategist, Shaynaco LLC

"I would recommend UltraTax and in my opinion, is the best tax software on the market because of the way it has changed the way we operate and do business.”

Patrick C. Ballard

Owner, Ballard & Company, Ltd. CPA's

See more testimonials

Frequently asked questions

- Instant tax preparation checklist. Start each year with a list of fields where you had entries last year but have not yet made an entry this year, and flag missing items to send a client email reminder.

- Data sharing between returns with tax ID numbers. Reduce duplicate data entry and eliminate the need to manually link 1120S, 1065, or 1041 returns to the 1040 return.

- Seamless integration. Save time with data entry and boost firm efficiency with an integrated workflow system to eliminate transcription errors and ensure accuracy.

- Multiscreen flexibility. Enjoy synchronized views of data submission, forms, prior year input, diagnostics, and more through the convenience of up to four separate monitors.

- Multistate tax return submission. Preparation and review are quick and easy using the apportionment grid for business returns and multistate allocation grid for Schedule C or K-1 income across states.

- Pre-submission automated diagnostics. Ensure the accuracy of your clients' tax returns before you file through dynamic diagnostics that will flag any areas for missing values.

Custom pricing for UltraTax CS is available based on the number of users, tax returns, and states and jurisdictions of operations.

UltraTax CS supports multiple tax forms, including 1040, 1041, 1120, 1120C, 1120S, 706, 709, 990, and 5500, as well as more than 200 individual and business state and local tax returns.

To transmit electronic returns — and 1040, 1120, 1065, 990, or 1041 electronic extensions — follow these steps.

- Click the CS Connect button on the UltraTax CS toolbar or choose Utilities > CS Connect to open the CS Connect dialog.

- In the Options tab, click the Electronic Filing: ($) Transmit returns switch to set it to “Yes.”

- Click the Electronic Filing tab to view a list of electronic returns ready for transmission.

- In the “Clients available to transmit” pane, highlight the clients whose returns you want to transmit during the next CS Connect session and click the Select button. The selected clients move to the “Clients queued to transmit” pane.

- After all the returns you want to transmit are listed in the “Clients queued to transmit” pane, click the Options tab. The selected returns are now queued and ready for transmission to us using CS Connect.

- Click the Connect button. You will be prompted to verify your login via the Thomson Reuters Authenticator app on the mobile device you paired with your account. After you confirm your credentials, UltraTax CS will transmit the returns listed in the “Clients queued to transmit” pane in the Electronic Filing tab.

For more details, please use our Help and How-to Center

To get acclimated using UltraTax CS, we provide training through written documentation, videos, and virtual or on-premise expert instruction customized for your firm's specific needs. We can give you a thorough overview of the latest best practices in the profession and help you make the most of your investment in UltraTax CS.

Learn more about our professional services for implementation and learning programs

UltraTax CS is a part of the CS Professional Suite and integrates seamlessly with all CS products, including Accounting CS, Accounting Payroll CS, Practice CS, and more.

Using advanced data sharing, paperless processing, and the web, our full suite of top-rated, integrated products combines and shares data to create a customizable solution that will save time and boost productivity. Companies using UltraTax CS report over 50% time savings because of CS Professional Suite data integration.

Get answers to your questions through phone, e-mail or chat, as well as 24-hour access to our state-of-the-art Help and How-to Center with thousands of articles and content.

Absolutely. UltraTax CS offers organizers and data collection tools to ask your clients questions about their use of virtual currencies. Data mining functionality within UltraTax CS could help you target these clients and proactively communicate next-step information in a client newsletter.

Here are the most common scenarios when virtual currency has tax implications:

- Selling or exchanging. The sale or exchange of virtual currency, including for goods or services in commercial transactions, must be included as a capital gain or loss.

- Mining. Virtual currency that was mined must be included in gross income. If this constitutes a trade or business and the mining activity is not undertaken by the taxpayer as an employee, then the net earnings resulting from those activities constitute self-employment income and are subject to the self-employment tax.

- Compensation. Virtual currency received as payment for goods or services must also be included in gross income.

- Payments. Wages paid or payments made to an independent contractor, employee, or other service provider using virtual currency must be considered.

Thomson Reuters partners with Ledgible, the only cryptocurrency tax platform designed specifically for professionals. Firms can streamline the workflow process and save time by connecting with their client’s crypto portfolio and properly reporting transactions. Ledgible integrates with UltraTax CS and GoSystem Tax RS, providing structured automation of crypto activity. To learn more about Ledgible Crypto Tax Pro, contact our sales team at 800-968-8900.

Questions about UltraTax CS?

We’re here to help.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us