AI @ Thomson Reuters

Generate results with AI accounting software

Discover how you can apply AI in your role

Here are some of the ways tax and accounting professionals are leveraging Thomson Reuters AI capabilities:

Explore current AI capabilities

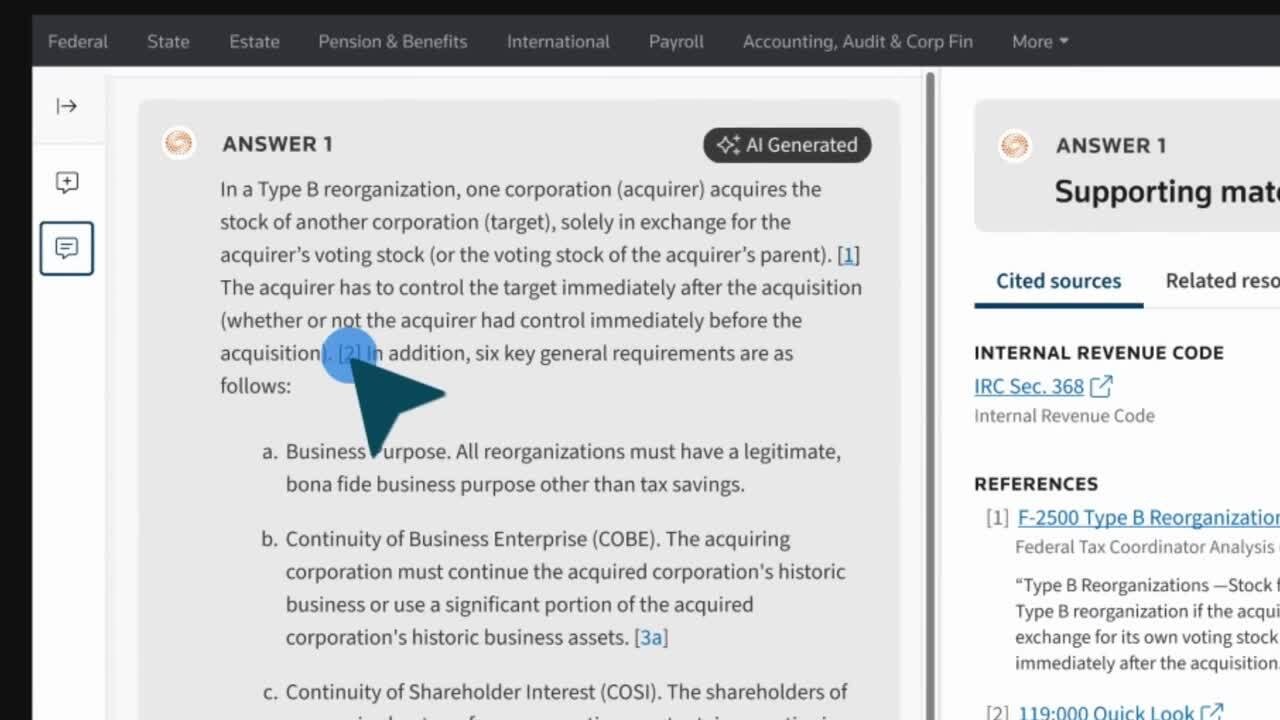

Checkpoint Edge with CoCounsel

AI-Assisted Research on Checkpoint is redefining how tax professionals work. This conversational interface will deliver straightforward answers to your questions just as if you were speaking directly to a trusted subject matter expert or advisor.

SurePrep 1040SCAN

1040SCAN auto-verifies optical character recognition data for 65% of standard documents, greatly reducing the need for manual data entry.

- Save time while completing tax returns for previous clients while also ensuring accuracy.

- Preemptively see what fields you used for a client before based on their tax documents.

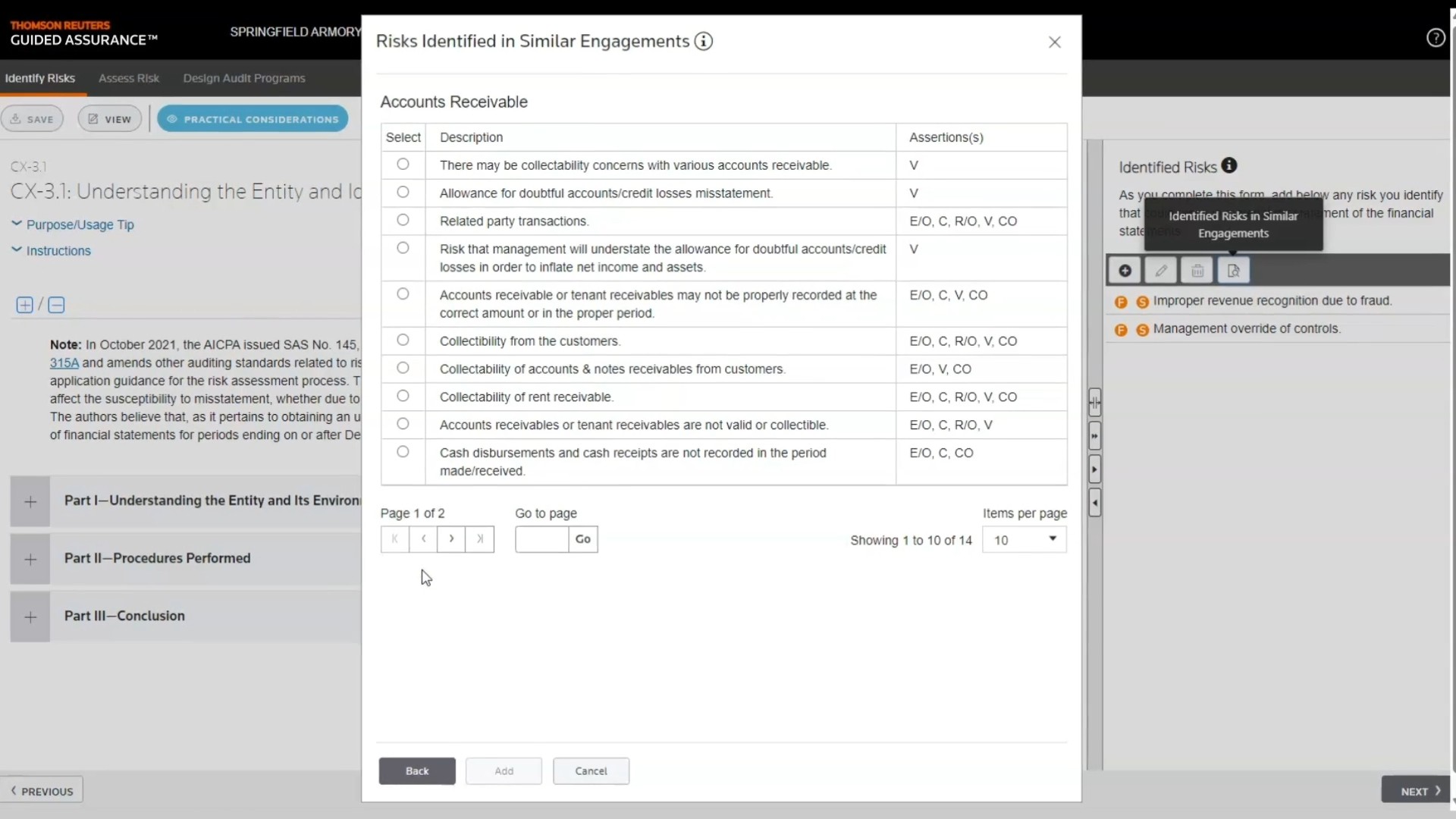

Cloud Audit Suite

Assisted Decision Making uses AI to help with key judgments such as risk identification and designing responses in a new way.

- See how other firms are identifying and responding to audit risks in similar audits.

- Ensure anonymity with the automatic removal of firm and client names for risks flagged by other auditors.

Audit Intelligence Analyze

Automated analyzing capabilities will allow auditors to understand data populations more thoroughly and know where risk resides for reduced testing time and a higher level of confidence in their work.

AI features in development

Auto-categorization for TaxCaddy

Auto-categorization is an AI-powered solution designed to streamline the tax document-gathering process. By automatically splitting and categorizing uploaded tax documents, it will efficiently address document requests generated by CPA firms.

Hear real-life success stories of implementing revolutionary AI solutions

Peter Mayolo of Mayolo & Associates gives his reasonings to trust AI-Assisted Research on Checkpoint Edge versus other AI chat Tools.

Discover why WRC CPA has benefitted from using Cloud Audit Suite in their processes.

Brent Forbush explains the advantages of using AI-Assisted Research on Checkpoint Edge.

Related insights

Explore additional blogs and white papers that delve into the future of AI within the tax and accounting industry.

Request a consultation

Fill out the form below and one of our product experts will be in contact with you soon.