Thomson Reuters + Alteryx

Are you ready to unleash your data potential?

Now more than ever, data is at the heart of unlocking efficiencies within your business. Imagine what you could do with all your business’s data at your fingertips: enhanced scenario modeling, streamlined trend analysis, and proactive planning to be nimbler in the face of change. But what if your data is stuck in disparate systems, locked away and unable to be used to its full potential? That’s where Thomson Reuters ONESOURCE and Alteryx change the game.

Thomson Reuters® ONESOURCE™ is the industry’s most powerful corporate tax technology platform and drives global tax compliance and accounting decision-making around the world. Our clients depend on cutting-edge workflow, comprehensive automation, and analytics to support their data reporting requirements. Our partnership with Alteryx solves the challenge of data collection, transformation, and load for ONESOURCE™ customers and prepares data for enhanced reporting and analysis. This puts the data you need at your fingertips, when and how you need it.

By licensing Alteryx through Thomson Reuters, you can:

- Simplify your order and renewal process with our packaged offerings

- Eliminate 90% of manual effort within the quarter with a streamlined implementation process, sparking optimization for years to come

- Enjoy exclusive benefits, such as access to connectors at highly reduced prices

Useful links

Alteryx names Thomson Reuters 2020 Rookie Partner of the Year recognizing our efforts to amplify analytics across the globe.

• Multiple Data Sources • Gathering & Centralizing • Mapping & Transformation • Formatting & Alignment • Reprocessing of Changes • Cleansing & Maintenance

• Scheduled Execution • Automated vs. Manual • Repeatability & Consistency • Auditability

• Issue Identification & Validation • Inquiries & Insights • Comparatives • Management Reporting • Visualization & Analytics

A unique solution tailored to your needs

Just like most things in life, there’s no “one size fits all” when it comes to your company’s tax automation needs. One of the ways ONESOURCE makes data more accessible across your tools is through our unique partnership with Alteryx. Watch our video series to see how you can get more out of your ONESOURCE solutions than you ever thought possible.

Expand your tax provision visibility, accuracy, and efficiency

Scenario plan faster than ever before

Stay on top of important deadlines and tasks

Maximize ROI

-

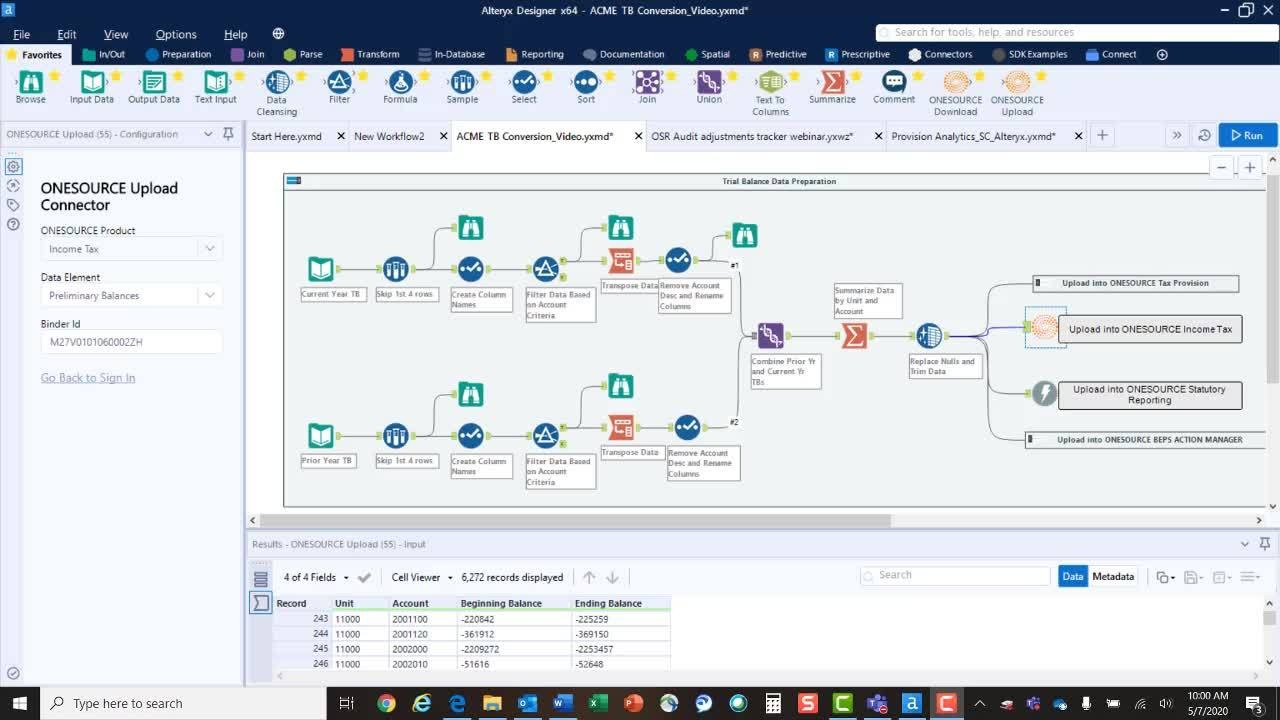

99%Automation and controls for tax provision, trial balance acquisition, data cleansing and upload

-

6-8Days per quarter eliminated with clean up and merging of state apportionment data

-

100+Hours saved with book tax depreciation and basis difference maintenance

-

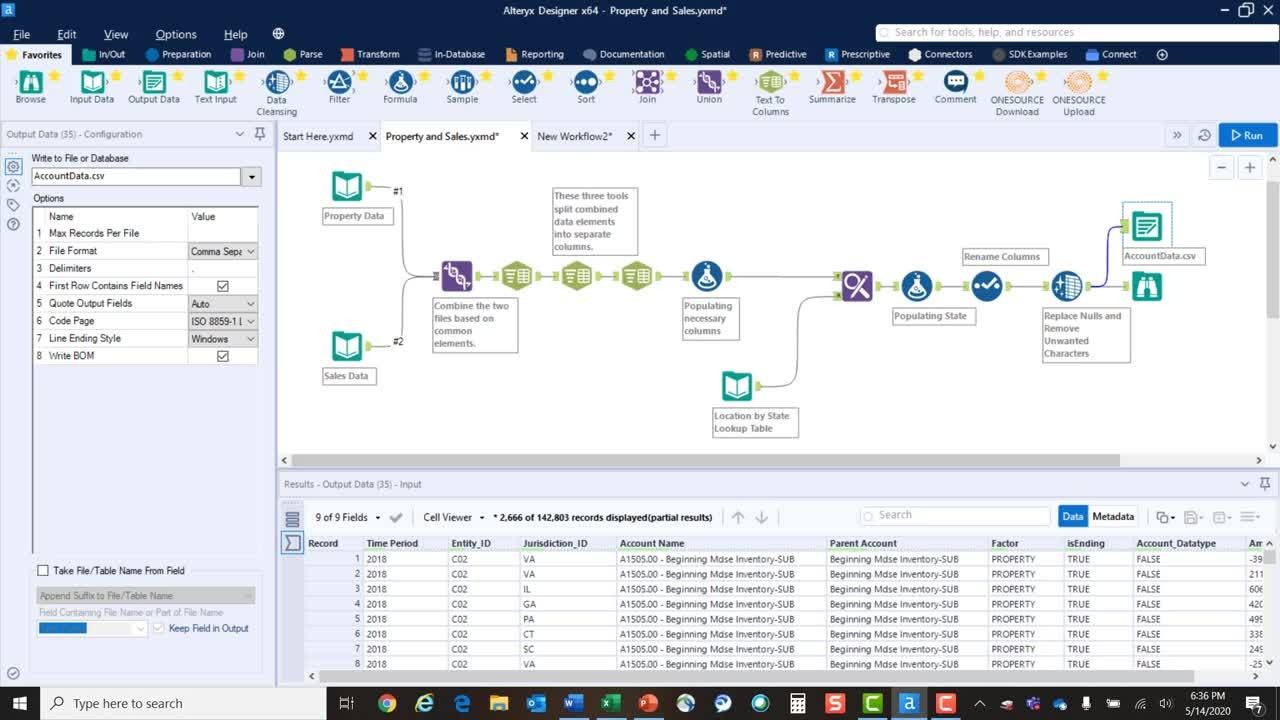

2-4Days per month eliminated with sales and use tax data pull and upload

-

4Days per month eliminated for balance sheet and flux reporting

Working together

Alteryx and ONESOURCE™ support the holistic lifecycle of tax

Data Preparation & Formatting

Data Manipulation & Tax Sensitization

Centralization, Organization & Computation

Primary Source of Tax Information

Flexible Reporting & Analytics

Additional resources

Ready to start a conversation?

Need more information about how our solutions can work for you? Drop us a line and someone from our sales team will get back to you.