ONESOURCE Determination features

Answers for a multitude of "what-if" indirect tax questions

Simplify tax compliance and remove the burden from tax and IT teams with ONESOURCE Determination's powerful features and seamless integrations

Cloud-native capabilities

Leverage cloud-based technology and automation to simplify indirect tax determination without the risks and expense of managing an in-house tax engine.

Determination Anywhere

Deploy ONESOURCE Determination as close to the origin of tax calculation as possible with edge computing. Maximize calculation speed, minimize latency, and deliver the benefits of a cloud-based tax engine with enhanced control.

Zero-downtime updates

Get the latest tax rates, rules, and security measures automatically applied to your system without downtime. In 2023, we handled over 2.8 million tax rate and product taxability changes for customers.

Auto scaling and self-healing

Ensure optimal performance and reliability by automatically adjusting tax computing resources based on demand and repairing failures without human intervention.

Transaction volume

Minimize latency and improve output by taking advantage of ONESOURCE Determination's ability to calculate correct tax amounts for 10 million transactions per hour with response times of 40 milliseconds per transaction.

Reap the rewards of efficient automation tools and cloud-based technology with ONESOURCE Determination

Have questions? Contact a representative.

Advanced tax tools

Our advanced tax tools boost reporting capabilities, streamline certificate management, and provide reliable insights to guide your business forward.

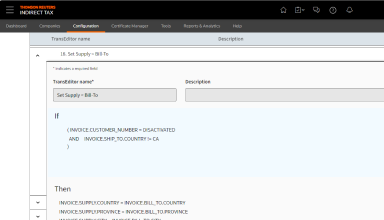

Model scenario

Obtain accurate forecasts for your business by creating transaction scenarios to test configurations and model the impact of business and tax changes.

Reporting and analytics

Gain efficiency and confidence with fast and flexible reporting for compliance, reconciliation, audit defense, and data analysis. Containing a library of summary and detail-level, production-ready reports, you can choose the type of data that best meets your immediate reporting needs and create custom reports.

Certificate Manager

Simplify the certificate validation process with a centralized repository for your customer's tax exemption certificates. Certificate Manager offers reminders, reporting, customizable email templates, and a portal where customers can enter their own certificates.

Transaction editors

Achieve the desired tax result by resolving potential transaction issues without requiring users to modify data in source systems.

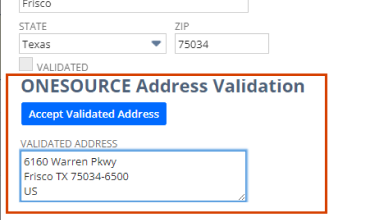

Address validation

Accomplish more accurate tax calculation by quickly cleansing, verifying, and storing addresses with USPS CASS-certified address validation.

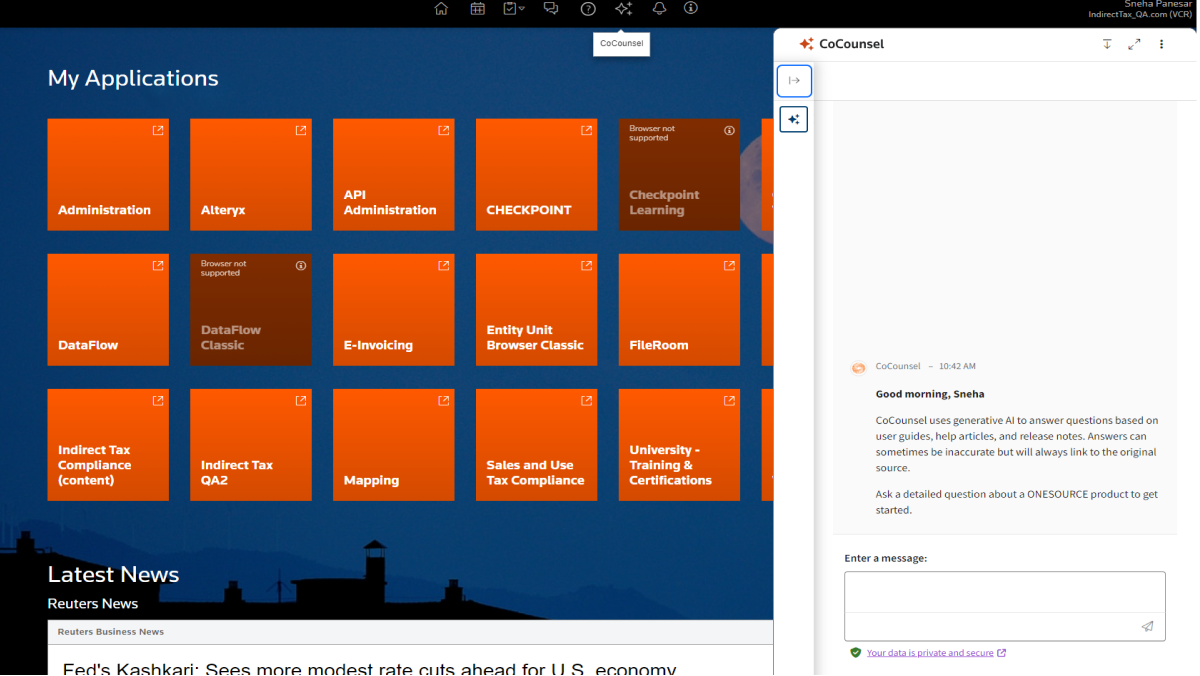

Generative AI product support

Rely on the real-time, chat-based support of ONESOURCE with CoCounsel for quick and accurate answers to your product questions, ensuring efficient and reliable help whenever you need it.

Make quick work of indirect tax reporting, certificate management, and more with ONESOURCE Determination

Have questions? Contact a representative.

Integrations and partnerships

Decrease deployment costs, customizations, and ongoing maintenance with the help of pre-built integrations that minimize interference with your business systems.

Pre-built integrations for 60+ financial systems

Automate your indirect tax workflow with a selection of ready-to-use integrations that seamlessly connect enterprise resource planning (ERP), point-of-sale (POS), e-commerce systems, or other systems with ONESOURCE Determination.

ONESOURCE Determination integrations for SAP

Reduce implementation and ongoing maintenance costs using pre-built, certified, and endorsed applications for SAP ERP, SAP S/4HANA, SAP Ariba, and more.

ONESOURCE Determination integrations for Oracle

Host ONESOURCE Determination within the Oracle Cloud infrastructure or connect your systems with any of the premade integrations including Oracle ERP Cloud and others.

Microsoft Dynamics 365 for Finance and Operations

This powerful integration enables companies to extend the functionality of their ERP software to handle every step of the sales and use tax process, delivering SaaS capabilities along with robust features.

Seamlessly connect all your business systems with ONESOURCE Determination

Have questions? Contact a representative.

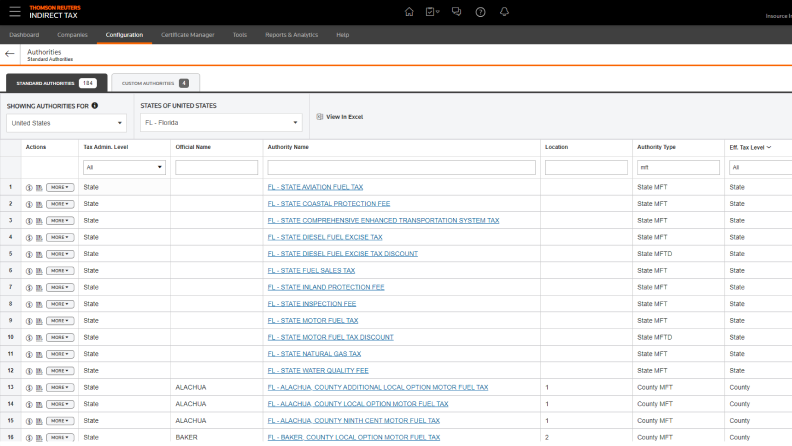

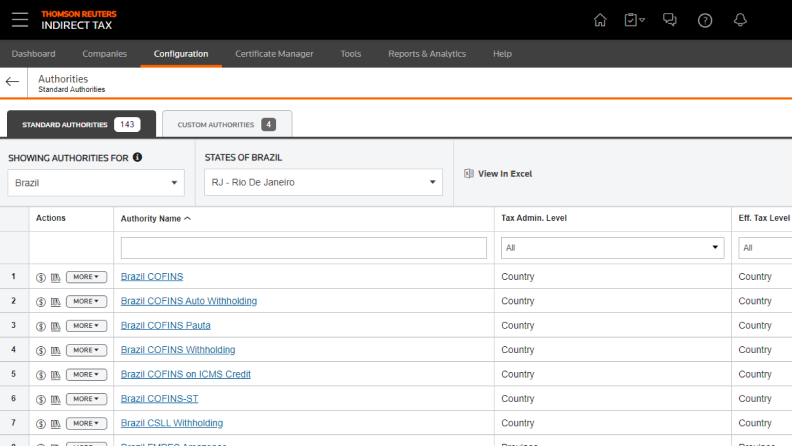

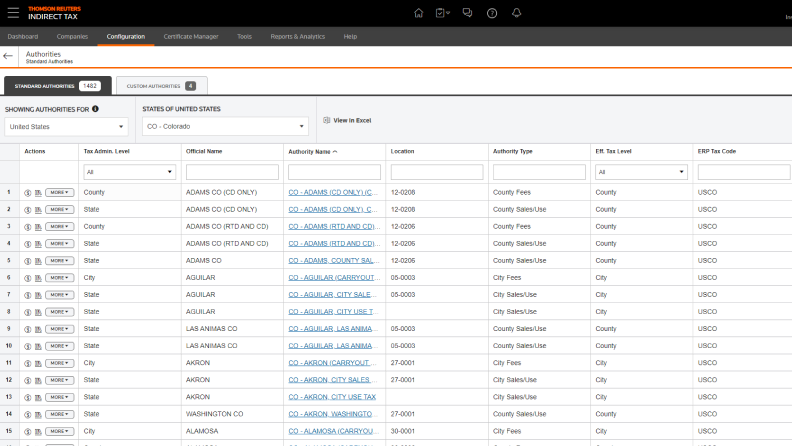

Superior tax content

This solution covers rates, product and service taxability, and calculation logic for more than 205 countries and territories, encompassing over 460,000 product and service codes across more than 60,000 global tax jurisdictions.

Automatic updates

The Thomson Reuters "no downtime updates" ensure that connected systems are always using the latest rules and rates without having to interrupt any tax calculations.

Global reach

Supporting over 205 countries and territories across all industry types, ONESOURCE Determination enables businesses to manage tax consistently from one tax calculation engine.

Certified content

In 2023, we made over 2.8 million changes to the content that powers ONESOURCE Determination, offering a low-maintenance solution for both tax and IT departments. ONESOURCE is SOC 1 and SOC 2 certified annually.

Inform your actions with ONESOURCE Determination's superior tax content

Have questions? Contact a representative.

Questions about ONESOURCE Tax Determination? We're here to support you.

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us