Cloud Audit Suite

Complete audits faster, with absolute confidence

Work from anywhere with cloud-based technology and secure, real-time updates — Cloud Audit Suite is your end-to-end solution to manage accurate and efficient audit and assurance engagements

Get multiple solutions in one comprehensive suite of products

Manage workpapers with Engagement Manager

Confidently expedite your engagement management with automated transaction analysis to identify risk, full trial balance capabilities, workpaper management, and financial statement reporting functionality.

Learn more about Engagement Manager

Have questions?

Contact a representative

Work through the audit process with Guided Assurance

Experience a guided, start-to-finish audit preparation, compilation, and review tool.

Learn more about Guided Assurance

Have questions?

Contact a representative

We created this video prior to our brand announcement in 2024: Checkpoint Engage is now called Guided Assurance.

Communicate efficiently and securely with Confirmation

Easily send and request online confirmations securely, eliminating traditional methods prone to error and even fraud. Only Confirmation provides a global network of validated responders that guarantee you get a response.

Learn more about Confirmation

Have questions?

Contact a representative

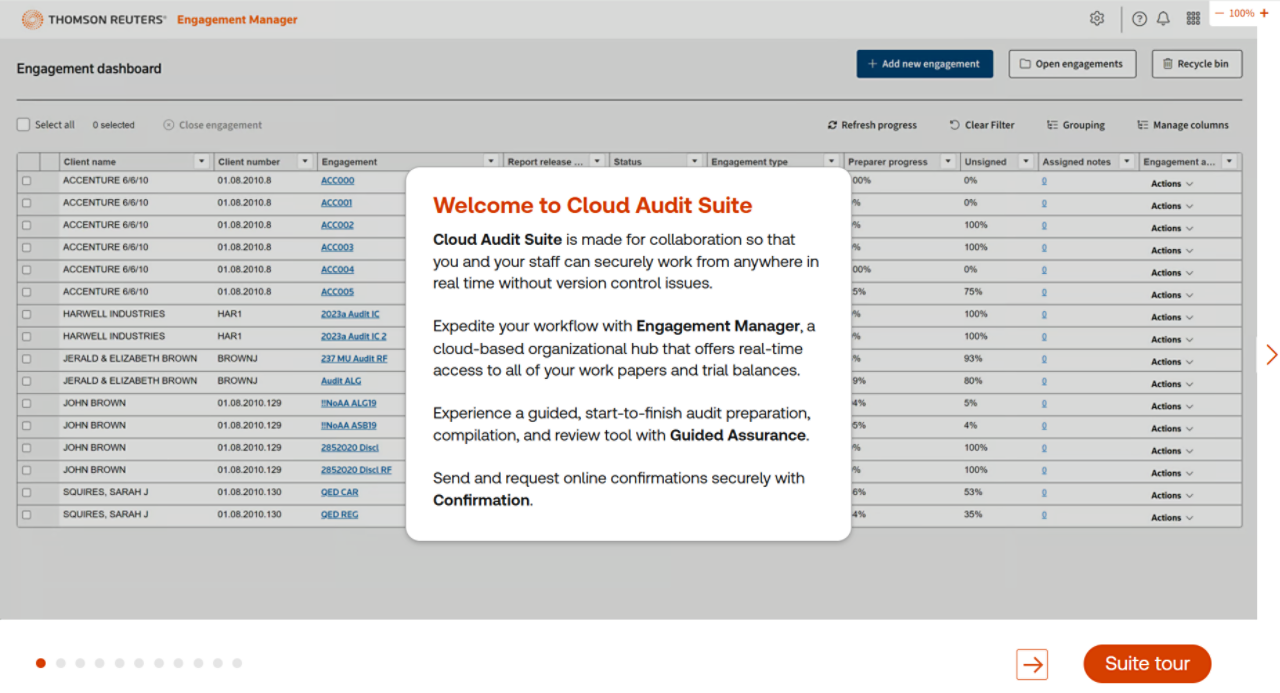

Explore the Cloud Audit Suite self-guided interactive product tour

Experience firsthand how a fully integrated cloud-based audit solution helps complete quality audit and assurance engagements faster and more accurately.

Take a tour

Take your audit practice into the future

Audit Intelligence

The future of audit is here with a suite of AI-powered solutions.

See the difference

Confidently manage and complete audits faster with the latest technology and AI-powered solutions.

Explore the unrivaled capabilities of Cloud Audit Suite

Cloud-based technology

Securely access your audit online, from anywhere, with a cloud-based solution that updates your data and stakeholders in real time.

Seamless workflow

Simplify your audit process with an end-to-end solution, including the only online confirmation service and integration with third-party analytics.

Leading methodology

Rely on our audit methodology, backed by experienced editors and authors, that ensures the materials are accurate to help you pass peer review.

Real-time collaboration

Work from the same document at the same time as your colleagues without worrying about version control.

Innovative tools

Keep staff engaged and confident with tools that help them do their jobs more effectively, including a single-form process across 22 different industries.

Secure confirmations

Manage your online confirmation process without leaving the Cloud Audit Suite platform.

See if Cloud Audit Suite is right for your firm.

Our quick 7-question quiz will help you assess whether our audit tools are a good fit for your business. You’ll get instant results with your personalized recommendations.

Questions about Cloud Audit Suite? We're here to support you.

800-968-8900

Call us or submit your email and a sales representative will contact you within one business day.

Contact us