AI for tax preparation

Complete tax returns faster with Ready to Review

Leverage agentic AI to automate the preparation of 1040 returns, allowing your team to focus on high-value advisory work and strategic firm growth

Streamline your tax workflow with intelligent automation

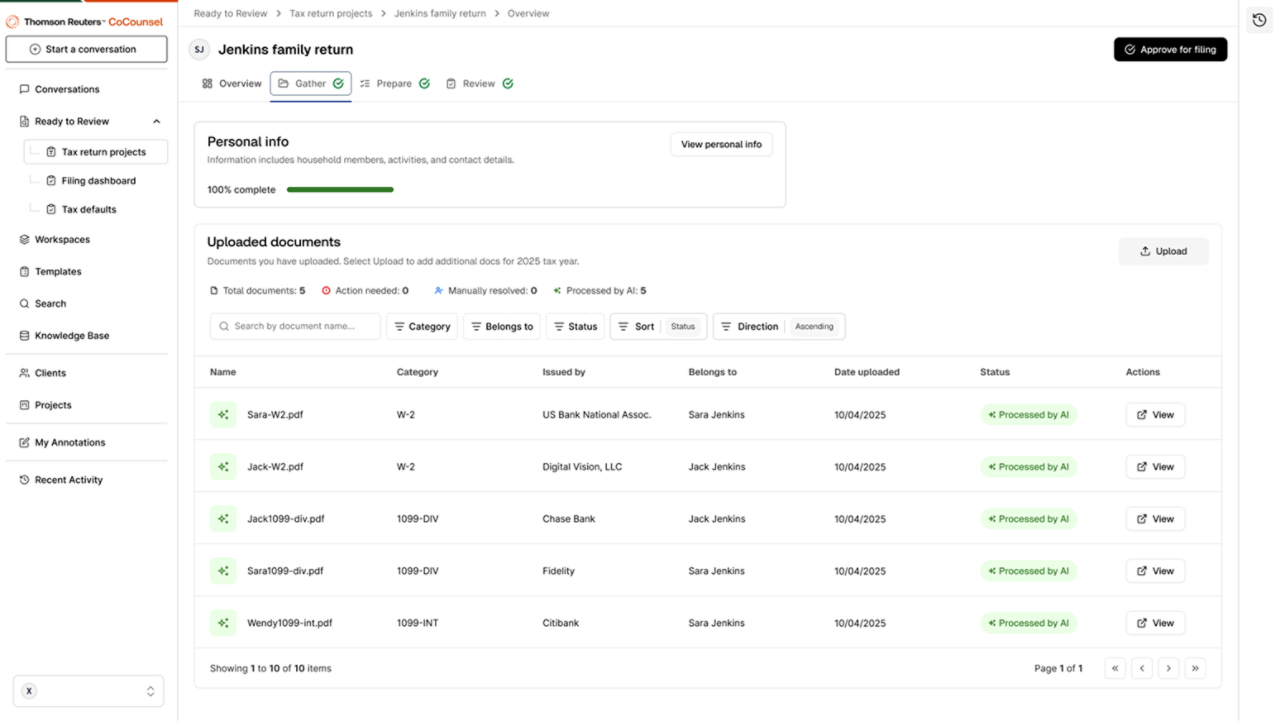

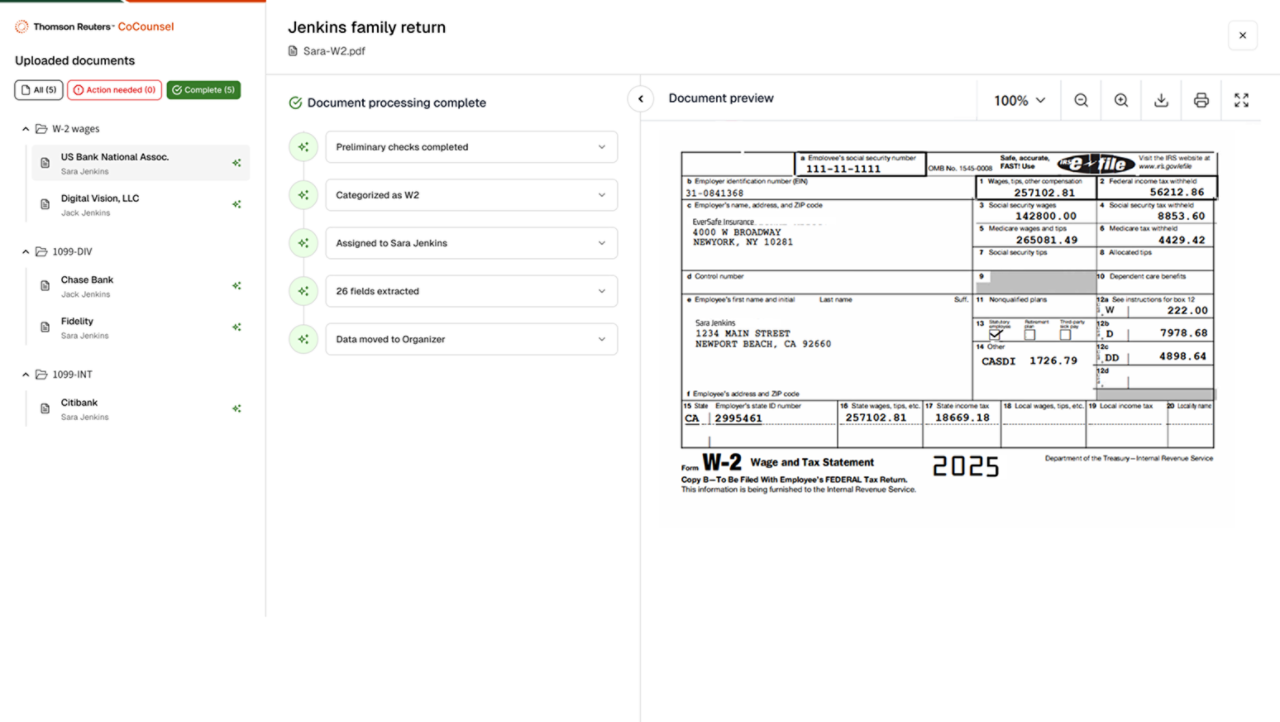

Automated document extraction and verification

Scan client documents and previous returns, extract relevant data, and categorize information automatically with agentic AI. This automation eliminates manual data entry, reducing errors and ensuring that nothing gets missed.

Explore more features

Have questions?

Contact a representative

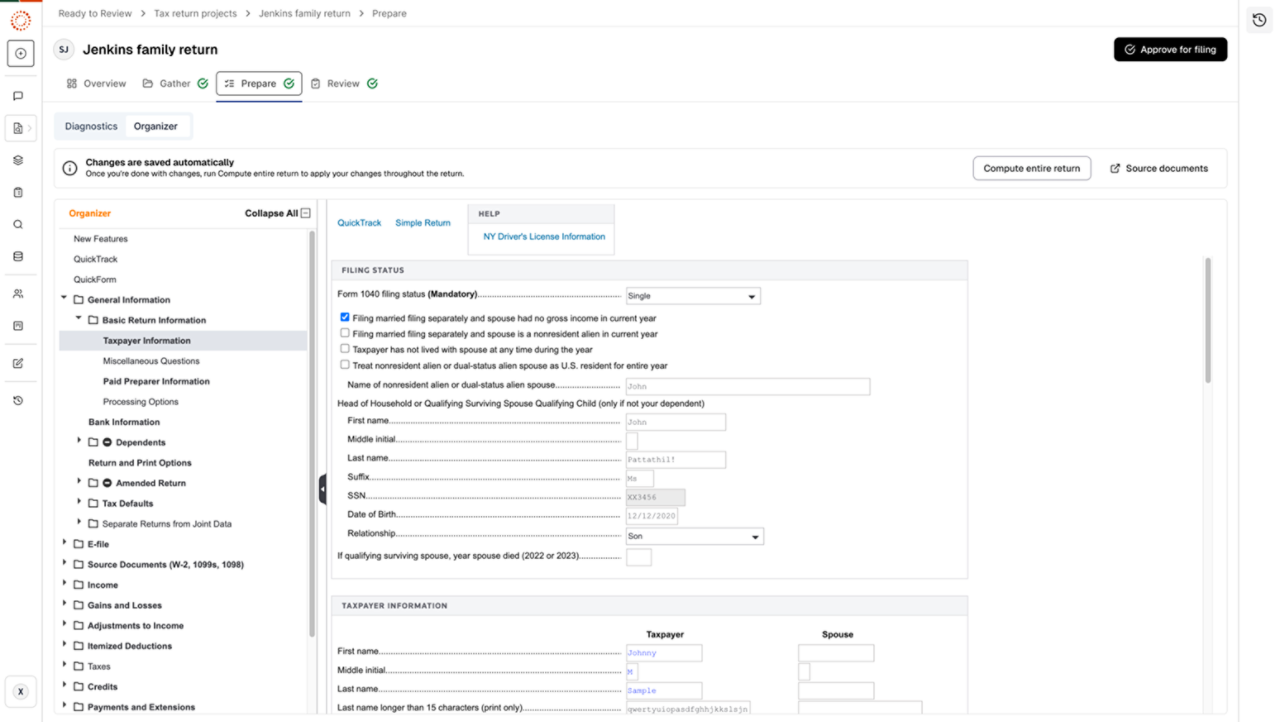

Single-platform simplicity

Simplify your tax workflow and reduce the need to switch between multiple systems with our single, user-friendly platform. A simplified workflow improves efficiency and enhances your experience.

Explore more features

Have questions?

Contact a representative

Scalable and reliable tax engine

Ensure the accuracy and efficiency of the tax-return preparation process, knowing our agentic AI uses the most scalable and reliable tax engine that can handle a growing number of returns without compromising performance.

Explore more features

Have questions?

Contact a representative

Tailored solutions for every role in your firm

Partners and directors

Automate routine tasks, allowing your firm to manage more returns with your existing staff and effectively focus on strategic growth initiatives to enhance profitability.

Managers

Free up your team's valuable time by automating data extraction and verification, enabling them to confidently handle more complex returns and provide better client service.

Tax staff and preparers

Onboard faster and work more efficiently with agentic AI that handles repetitive tasks so you can develop advisory skills, enhance client services, and add more clients to build the business.

Unlock the full potential of your tax workflow

Spend more time on strategic work

Automate the gathering and preparation stages of your firm's process to manage more returns with existing staff and shift focus to profitable advisory services and client relationships.

Increase profitability and efficiency

Significantly reduce the time your firm spends on manual tasks, allowing you to take on more clients and increase your firm's profitability without needing to expand your existing team.

Address talent challenges

Offer a modern, technologically advanced environment that attracts and successfully retains top talent, ensuring your firm stays highly competitive in today's tax and accounting industry.

Frequently asked questions

Upload the client's source documents and the prior-year return, then review the agentic-AI-prepared simple 1040 draft, including verification links back to the source documents and diagnostics. Use your current client portal for client review and signatures, then e-file as usual.

Ready to Review eliminates manual data entry and document sorting, prepares a draft return with diagnostics already addressed where possible, and centralizes the review process. Your team spends less time on routine tasks and more time advising clients.

Agents verify inputs against source documents and run data through the Thomson Reuters tax engine, providing two‑year comparisons and categorized diagnostics to surface issues early and maintain a clear audit trail.

Implementation is straightforward: provision access in CoCounsel Tax, define your document intake process, and begin uploading client documents and prior returns.

Yes, we built Ready to Review with robust security measures to protect your client data, including encryption, secure data storage, and compliance with industry standards.

Questions about Ready to Review? We're here to support you.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us