ONESOURCE Tax Provision

Tax Provision software

Why choose Tax Provision software

Time, accuracy, and efficiency are critical when it’s time for your corporate financial close. With tax provisioning software, you speed up the process of reporting your company’s current and deferred income taxes for the current year. A single, user-friendly platform automates all steps. Thomson Reuters ONESOURCE Tax Provision software calculates corporate tax estimates in seconds and lets you quickly review data with filtering and drill-down capabilities. Plus, you can easily move data from tax provision to other direct tax solutions, so you only have to enter it once. Automation during the tax provision process results in more efficiency across the tax lifecycle, which means closing faster, filing earlier, and freeing up time to grow your business.

What you get with our Tax Provision software for corporations

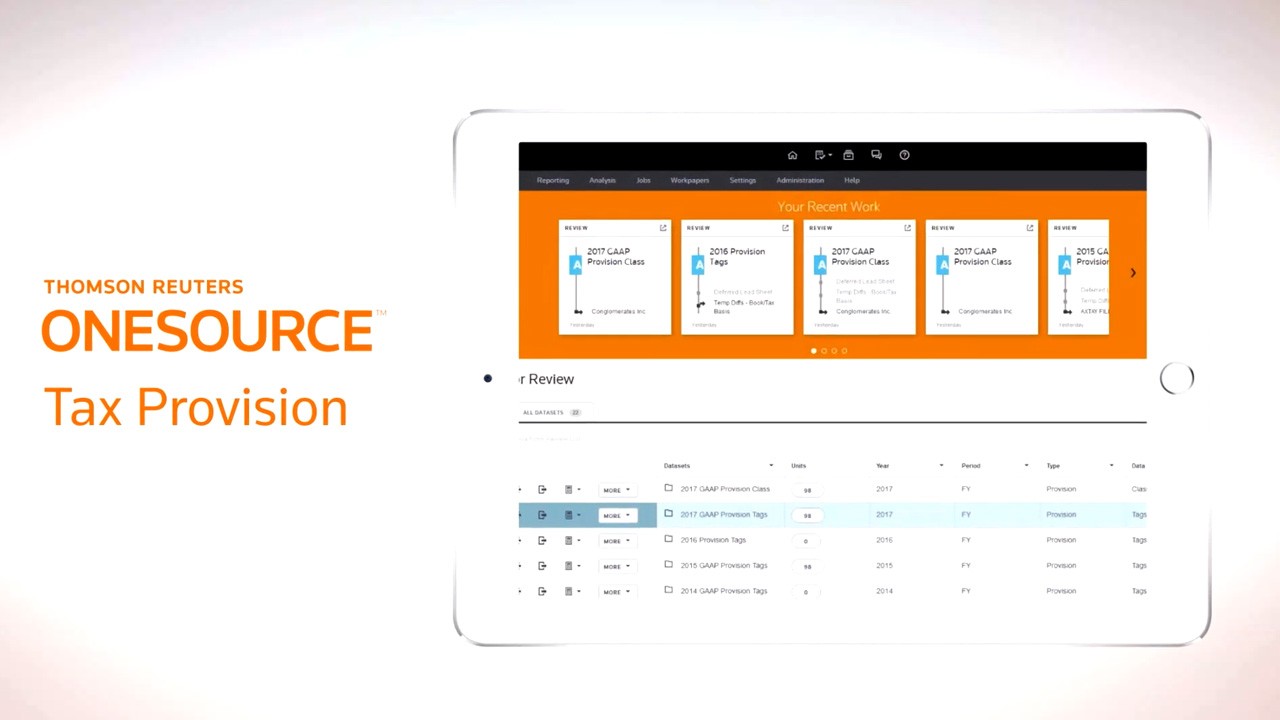

Filter data to focus on relevant subsets and drill down from consolidated amounts to the lowest level in just two clicks.

See all tax provision results on the dashboard to see a flow from calculated values to the entries that drive them.

Access all applications in one central location and eliminate duplicate work with the ONESOURCE platform.

Embeds custom calculations and Excel workpapers directly into your tax provision software.

Integrates with Income Tax and Tax Provision software to pull the data you need to forecast tax impacts on your global operations.

Integrates with Tax Provision software to help you analyze and report tax treatment of open positions under ASC 740-10-50 and IAS 37.

Integrations and connections

The power of connected tax

Pre-built tax provision dashboards

ONESOURCE offers pre-built tax provision dashboards compatible with Microsoft Power BI, enabling a seamless transition from disjointed data to analysis and insights.