Resource center

Decoding the Big Beautiful Bill

On July 4, 2025, the most comprehensive tax legislation since the Tax Cuts and Jobs Act (TCJA) officially passed. Our purpose-built resource center can help you navigate these sweeping changes. Are you ready?

Your complete OBBBA planning resource

2025 year-end tax planning guide

Navigate the sweeping changes from the One Big Beautiful Bill Act (OBBBA) and optimize your tax strategy before year-end. This comprehensive guide delivers expert insights on new deductions, credits, enhanced business provisions, and critical compliance requirements to help you maximize savings and avoid costly mistakes in this pivotal tax year.

OBBBA TaxWatch training

Federal tax update: Navigating OBBBA — six CPE credits

With OBBBA, tax practitioners need to have a heightened awareness of the current tax laws to stay compliant. The Thomson Reuters TaxWatch Training Solutions team provides expert guidance covering what laws are in, what laws are out, and what laws are coming down the pipeline so you can stay compliant and effectively plan for clients in this evolving landscape.

Webinar

Navigate the OBBBA: AI research strategies for tax pros

Accurately interpreting tax legislation takes time — until now. Watch our on-demand webinar to discover how AI delivers verified and summarized answers to complex tax questions in seconds, enhancing efficiency and accuracy in your tax research. Access anytime to keep your firm ahead.

SPECIAL REPORT

The One Big Beautiful Bill Act: Complete analysis for tax planning and compliance

The OBBBA has major implications for tax planning and compliance. We've compiled everything tax professionals need to know into one detailed 55-page report. Discover how the SALT cap, standard deduction amounts, tax rates, and more are affected—giving you comprehensive guidance to navigate these sweeping changes with confidence.

White paper

The tax professional's guide to implementing the OBBBA

The One Big Beautiful Bill Act (OBBBA) introduces permanent tax provisions requiring fresh compliance approaches. This comprehensive white paper covers impactful OBBBA provisions, practical compliance strategies, client assessment frameworks, and advisory best practices to help tax professionals thrive in this new era.

Blog

The latest tax news and insights on the OBBBA

Tax changes are moving quickly in the Big Beautiful Bill era, but our tax and accounting blog helps you stay current. Keep your practice in the know with the latest updates and analysis surrounding this new legislation.

Find answers to your Big Beautiful Bill frequently asked questions

Related products

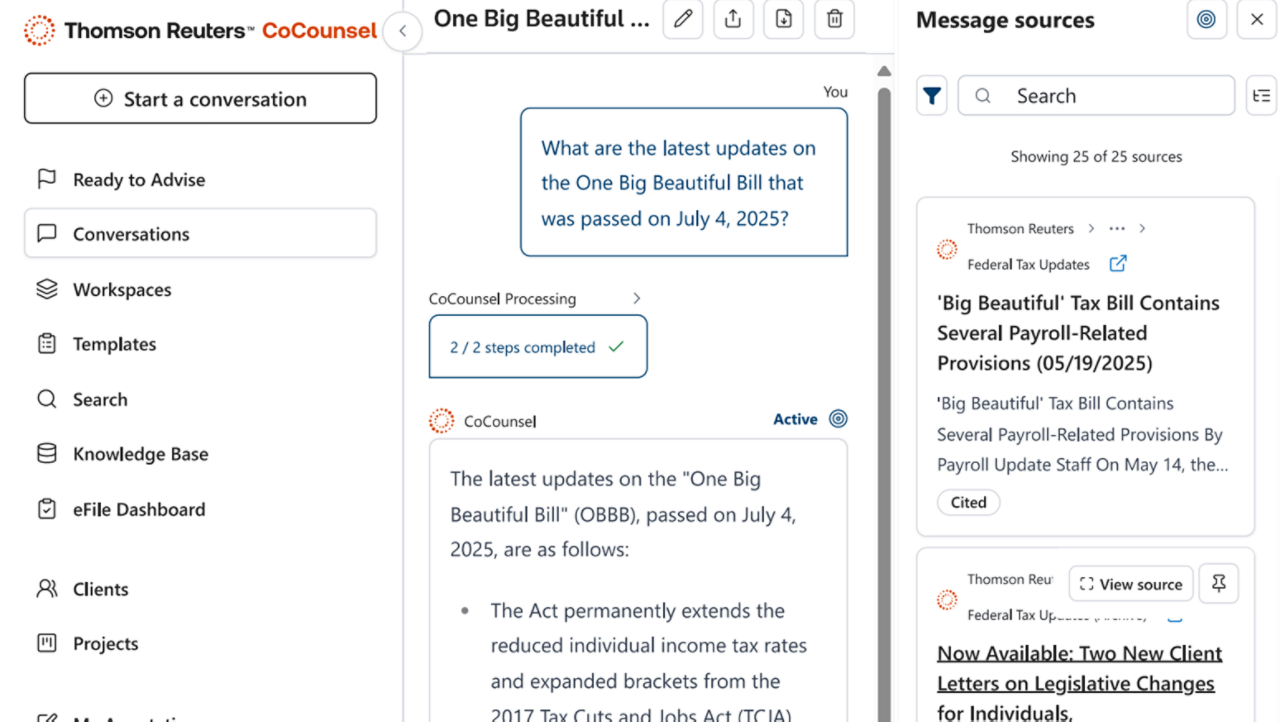

CoCounsel Tax

Stay compliant in rapidly changing regulatory environments with our AI-powered research assistant. Get summarized answers from Checkpoint content, Internal Revenue Code, and internal documents with a single search.

UltraTax CS

Our comprehensive tax software has everything you need to stay efficient, compliant, and confident in your work. With access to broader form coverage, advanced calculation tools, and seamless data population, our users have the support to tackle any client scenario with ease.

GoSystem Tax RS

We designed our cloud-based, highly scalable tax software to make tax returns simple. It helps large and multi-office firms navigate elaborate tax scenarios accurately and efficiently.

SurePrep

Simplify the tax process from start to finish with industry-best 1040 automation. This platform eliminates preparation, reduces review time, and enhances client collaboration so your firm can accomplish more without adding staff.