Case study

How ONESOURCE Determination solved Cisco's tax challenges

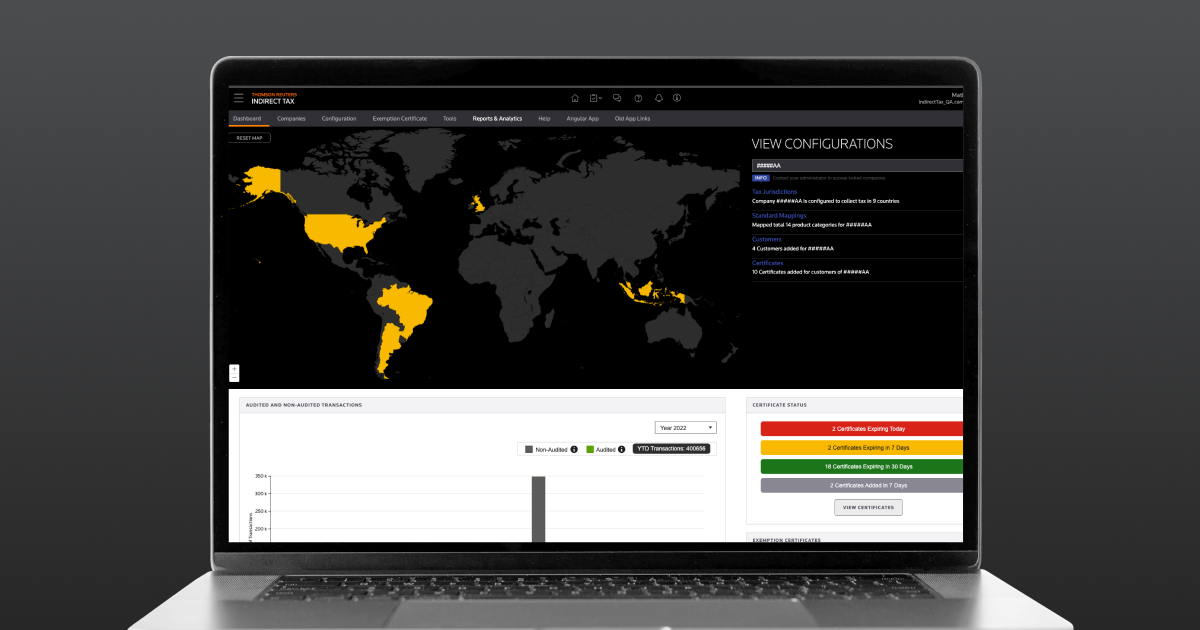

See how Cisco uses ONESOURCE Determination to consolidate global transaction tax, cut compliance risk, and gain real-time visibility across Oracle systems.

Introduction

Cisco Systems, Inc. is the worldwide leader in networking for the internet. It provides the broadest line of solutions for transporting data, voice, and video within buildings, across campuses, and around the world. Cisco’s products and services help customers build their own network infrastructure and enable communication with customers, prospects, business partners, suppliers, and employees. Its IP networking solutions are the foundation of the internet and most corporate, education, and government networks around the world.

Proof points:

- One centralized audit and compliance database of all transactions for reporting, auditing, and compliance requirements.

- Reduction in time required for returns processing, enabling more available time for strategic tax planning and analysis

- Increased responsiveness and reduced system maintenance costs due to elimination of expensive VAT system

Challenge

With tax professionals and systems distributed worldwide, tax consolidation and visibility became a challenge. Due to its rapid expansion into new markets and increased channels of distribution, Cisco needed a central audit and compliance database. Its goal was to find a truly global solution that could address global business practices, providing real-time, global tax determination for each transaction.

Cisco’s technical team required a single, centralized tax solution that could connect to all their systems worldwide with the scalability and performance capabilities necessary to support their significant global transaction business volume. To ensure an effective rollout, Cisco required that the chosen tax solution meet all business and technical requirements of a rigorous pilot test.

A tax solution that provided Cisco’s tax professionals with the ability to respond to and fully support the company’s rapidly changing global business environment was a top priority. They needed a solution that would empower them to quickly and easily implement tax, business, and system changes without requiring substantial support and custom programming by IT.

To be appropriately responsive, Cisco tax professionals in each country wanted access to the tax system so they could manage tax determination for their business units and ensure that they correctly met the requirements of the tax authorities where they did business. They needed a configurable solution that provided real-time control and visibility over all their tax data and changes that affected their areas of responsibility. In addition, their list of requirements included tools to facilitate planning and modeling for strategic decision making, as well as a global exemption certificate and product exception management and application.

The global transaction tax solution needed to seamlessly integrate with their mission critical Oracle 11i E-Business Suite Applications and provide accurate tax determination for all sales and purchase transactions at the line and item level, as well as at the total invoice level.

“ Sabrix* solution has given us the confidence that we will be able to handle the volume of transactions we have, and to streamline compliance on a global basis.”

Glen Rossman

Vice President of Tax

Solution

Cisco is now deploying ONESOURCE Determination globally. Its decision to centralize and automate transaction tax operations was driven by the need to:

- Improve the tax department’s ability to respond rapidly and accurately to business changes. Cisco estimates that with the centralized ONESOURCE Determination solution, it will be able to significantly increase the accuracy and consistency of sales, use, and VAT determination on all sales and purchase transactions worldwide.

- Have global visibility and control. With ONESOURCE Determination, Cisco has real-time visibility and control through the identification of its transaction tax exposures for all transactions worldwide. In addition, Cisco has one centralized audit and compliance database of all transactions for reporting, auditing, and compliance requirements. With ONESOURCE Determination, Cisco is now able to reduce the time required for returns processing, enabling more available time for strategic tax planning and analysis.

- Reduce unnecessary IT and tax costs. With ONESOURCE Determination, Cisco can reduce costs related to system maintenance and increase responsiveness and efficiencies for its global sales and procurement activities. This also enables Cisco to eliminate its highly customized, and expensive-to-maintain VAT system, which would have also significantly complicated their Oracle 11i upgrade.

Outcomes

By automating global transaction tax through ONESOURCE Determination, Cisco will achieve significant reductions in their costs of compliance and tax system maintenance, as well as added business responsiveness, global visibility, control, and seamless integration with its sales and purchasing business processes.

At a glance

Industry

Technology (Networking & Telecommunications)

HQ region

San Jose, California, United States

Year founded

1984

Harness the power of automation with ONESOURCE Indirect Tax Determination

Take the risk out of the equation and automate processes that drive greater efficiency with numbers you can count on with ONESOURCE Indirect Tax Determination.