Analyze features

Streamline transaction analysis for greater productivity

Free up more time for high-value tasks and improve overall audit efficiency with the automated risk-assessment capabilities of Audit Intelligence Analyze

Enhanced audit quality

Gain a deeper understanding of population segment risks with advanced AI technology that analyzes transactions, flags unusual items, provides documentation, and catches items normally missed by humans.

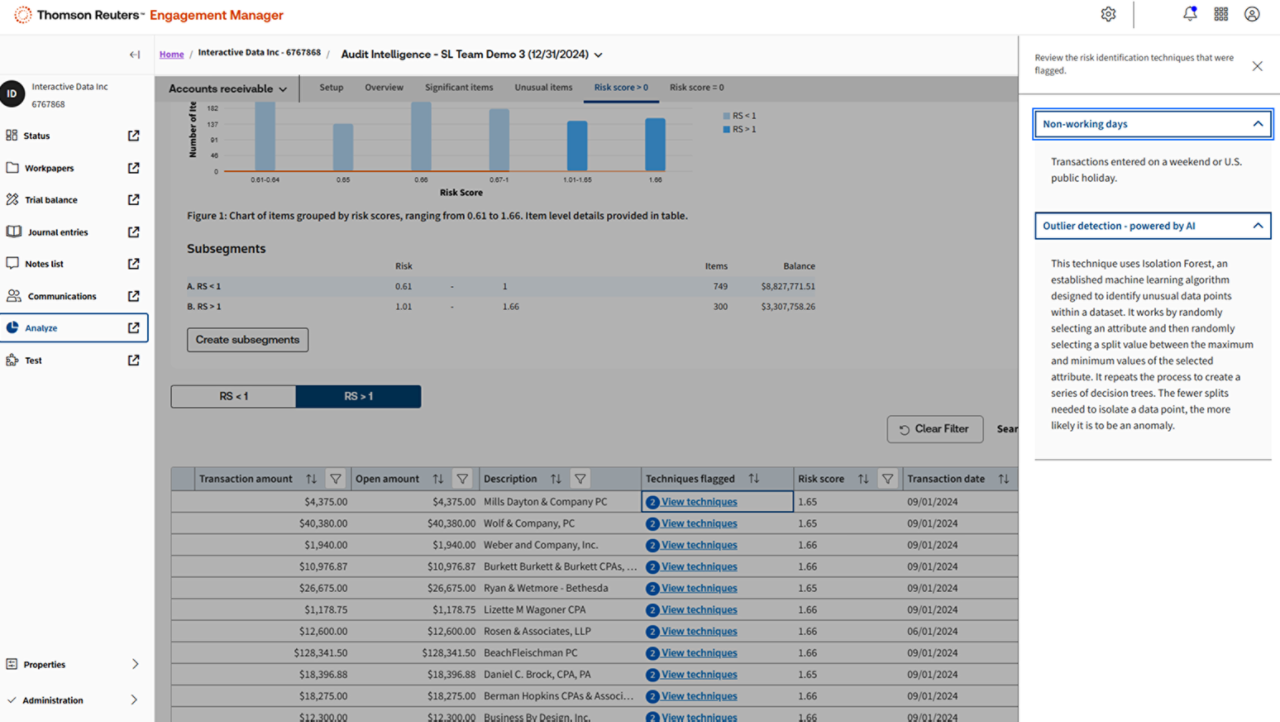

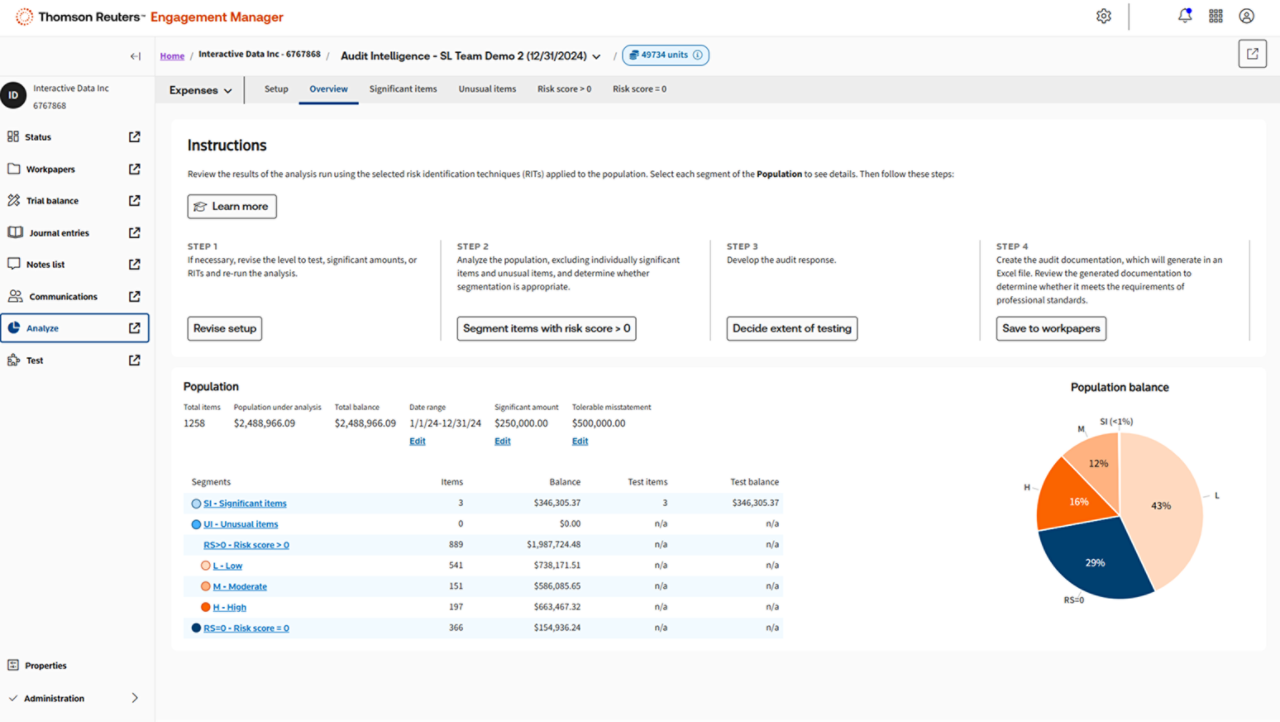

AI-driven risk analysis

Use AI to analyze data across accounts receivable, revenue, cash, expenses, fixed assets, accounts payable, inventory, and journal entries to deliver deeper audit insights. Our solution flags unusual, significant, or duplicate transactions for a prioritized view of high‑risk items with clear rationale to focus on high-risk areas and cut low‑risk testing and oversampling.

Customizable rules

Configure risk rules, thresholds, and filters per engagement to reflect industry, materiality, and client specifics. Control what’s flagged and why with transparent, documented logic. You'll experience fewer false positives and less oversampling — with analyses aligned to your firm's methodology.

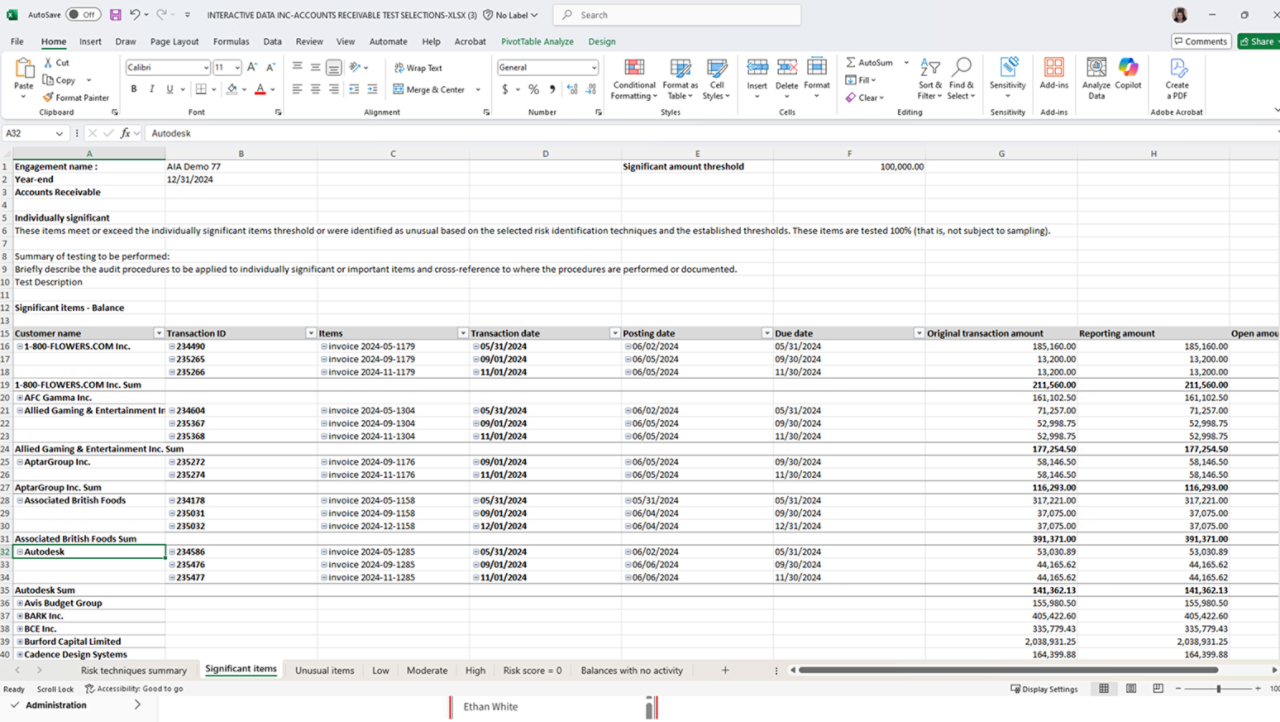

Built‑in audit documentation

Generate work-paper‑ready documentation that explains why each item was selected, key risk drivers, and suggested procedures. Receive transparent, defensible rationale that speeds reviews, reduces rework, aids training, and satisfies client and regulator inquiries.

Increased workflow efficiency

Enhance audit efficiency with a seamless, automated workflow. Easily request and receive client data, organize and analyze it within your engagement, and save results as a work paper with one click.

Flexible integration

Adopt the latest technology and transform your efficiency without having to replace your current audit workflow. Work directly from Engagement Manager or the software of your choice to avoid learning a new way to audit.

Optimized sample selection

Save time by focusing on the high-risk population segments. Within minutes, Analyze automatically selects samples to test and identifies odd transactions — significantly reducing the sample size and cutting the time spent on evaluating test results and documenting the sample selection.

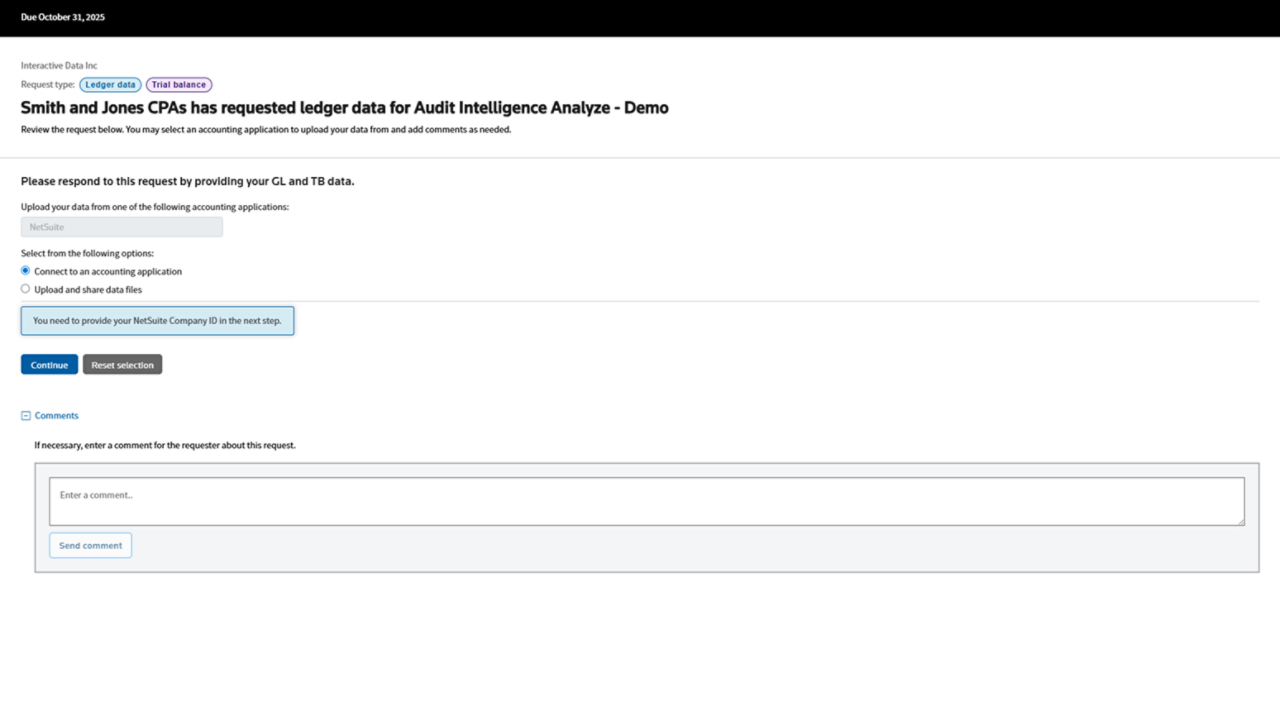

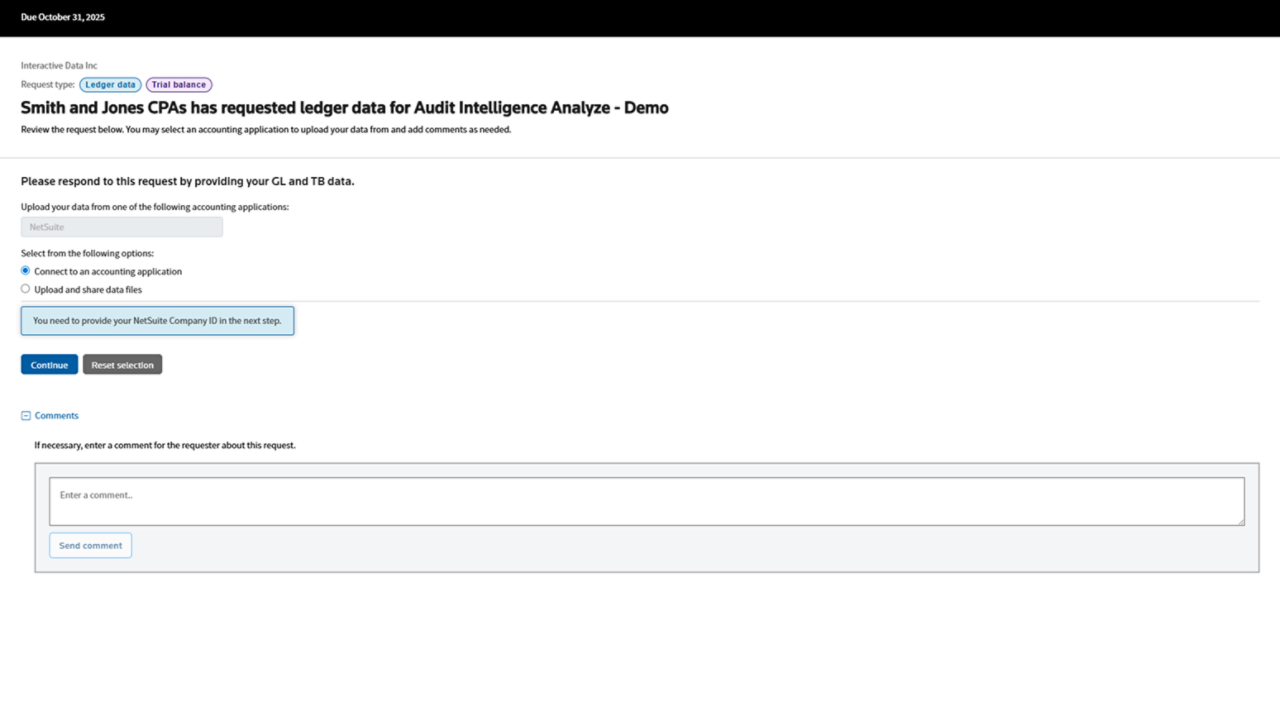

Seamless data requests

Integrate client requests and one‑click import for general ledger, subledger, and trial balance data with minimal cleanup and automatic validation. Using Analyze, you’ll spend less time chasing files and fixing formats — and start your analysis sooner.

Superior client experience

Save your clients hours with a fast, easy, and secure way to provide accounting data. Partnering with Validis — leaders in secure financial data handling — ensures client data uploads take only minutes.

Automated data sharing

Avoid having to download, email, or print information that may get lost or stolen. Clients can quickly and securely share general ledger, subledger, and trial balance data from supported accounting packages.

Supported accounting packages

Our partner, Validis, supports the most common accounting packages to increase client efficiency. Direct login offers the most benefits, including time savings, reduced errors, and automated cash validation using Audit Intelligence Test. The new Upload and Share feature makes any accounting system compatible.

Superior data security

Run your ledger report through Validis, which transfers the data to Analyze for use by the auditor. No changes are made to your accounting data and Validis does not retain it. Thomson Reuters and Validis ensure the highest level of security through comprehensive policies, standards, and practices.

Questions about Analyze? We're here to support you.

800-968-8900

Call us or submit your email and a sales representative will contact you within one business day.

Contact us