E-invoice reconciliation software

Close the gap between e-invoicing and indirect tax returns with ONESOURCE Reconciliations

Deliver automated, line-level reconciliations across e-invoices, VAT returns, and ERP data to detect and classify differences, accelerate resolution, and reduce risk of penalties

Resolve discrepancies faster with automated reconciliations and built‑in compliance insight

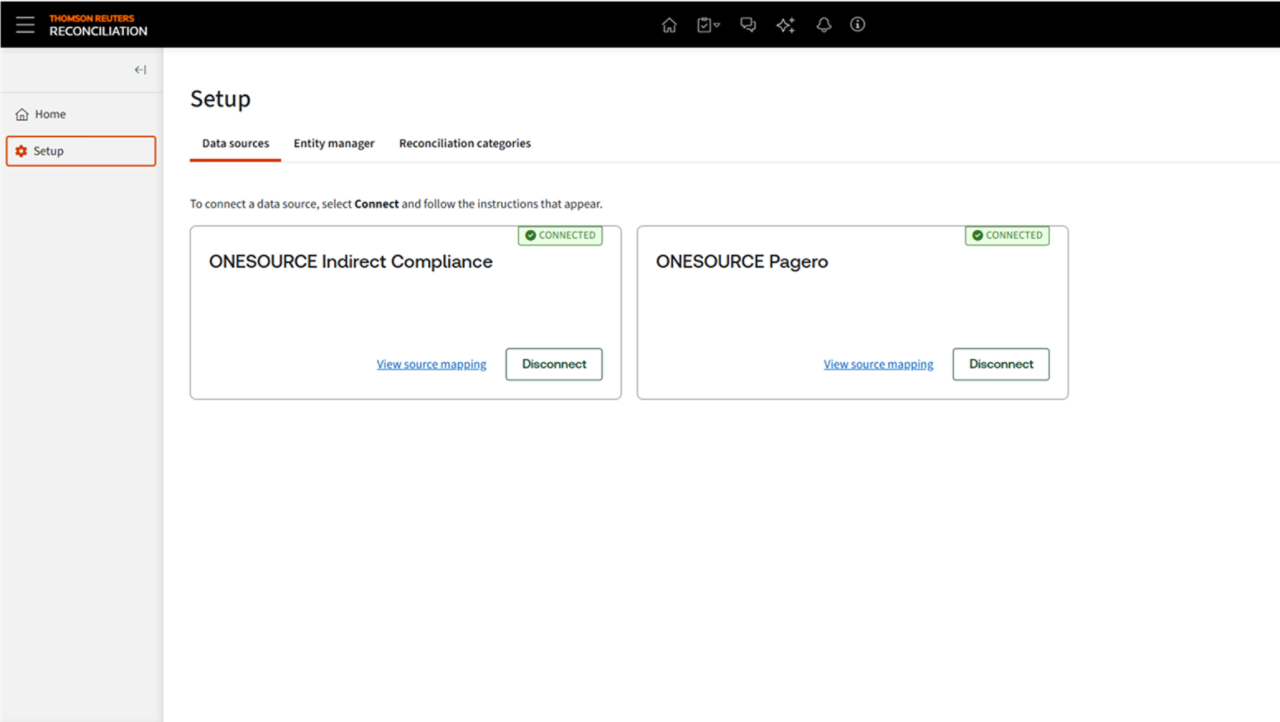

Automated data import

Seamlessly connect your e-invoicing and indirect tax return reporting and be able to identify and explain any differences to tax authorities easily and avoid the risk of penalties.

Explore all features

Have questions?

Contact a representative

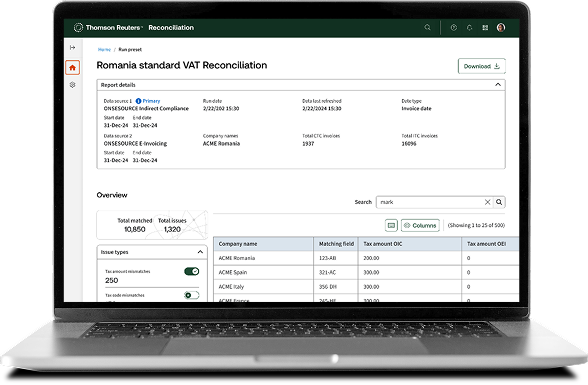

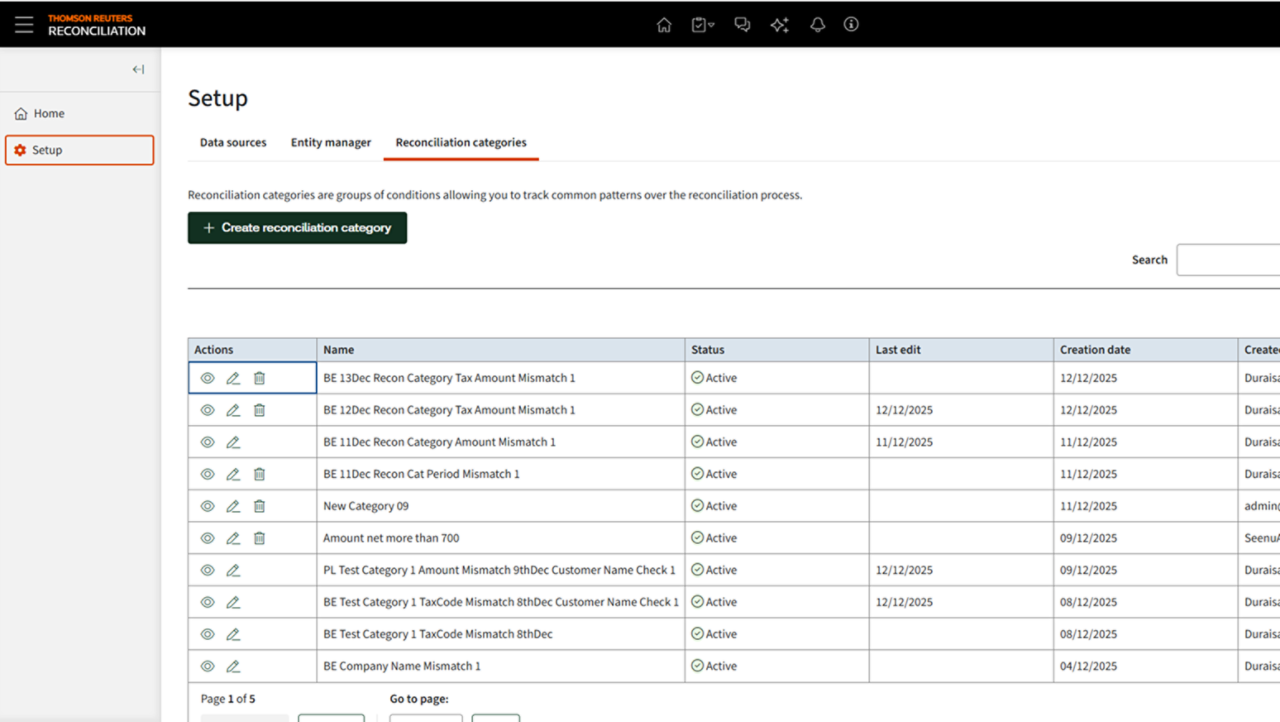

Discrepancy identification and classification

Quickly identify and classify discrepancies between e-invoicing and compliance data. You can minimize the risk of mismatches and ensure timely resolution; it's particularly useful for businesses where accuracy and speed are critical to meeting statutory deadlines.

Explore all features

Have questions?

Contact a representative

Country specific reporting

Have confidence in the accuracy of your indirect tax returns with reconciliation reports created and continuously monitored by our global content team. This feature ensures any regulatory changes impacting e‑invoicing through to indirect tax compliance reporting are reflected.

Explore all features

Have questions?

Contact a representative

The value of ONESOURCE Reconciliations

Automate reconciliations at scale

With ONESOURCE Reconciliations you can import data from any source, identify discrepancies, and resolve them faster, turning days of work into minutes.

Frequently asked questions

It's a content driven reconciliation solution that automates the comparison of e-invoices, VAT/GST returns and ERP transactions. It detects and classifies line-level discrepancies, prioritizes those that impact return boxes, and accelerates investigation and resolution.

Compliance-aware analytics map variances to affected return boxes and highlight items approaching statutory response windows common in prefilled regimes. Teams focus on the issues that change liability, shortening reconciliation cycles and avoiding fines or forced payments.

A flexible taxonomy and country content provide consistency across jurisdictions and adapt as mandates evolve. The platform is built for high-volume, multi-country operations with EU data residency considerations.

Role-based access aligns to product and entity permissions, ensuring appropriate segregation of duties. Standardized reports and variance categories create a defensible audit trail from e-invoice to return.

Yes. You can create your own custom reports and discrepancy categories to suit your business needs and requirements.

Yes. ONESOURCE Reconciliations automatically reconciles data from ONESOURCE Pagero and ONESOURCE Indirect Compliance and it also can import data from other sources, including third party providers.

Questions about ONESOURCE Reconciliations? We're here to support you.

888-885-0206

Call us or submit your email and a sales representative will contact you within one business day.

Contact us