Ready to Review features

Supercharge your tax prep with agentic AI agents

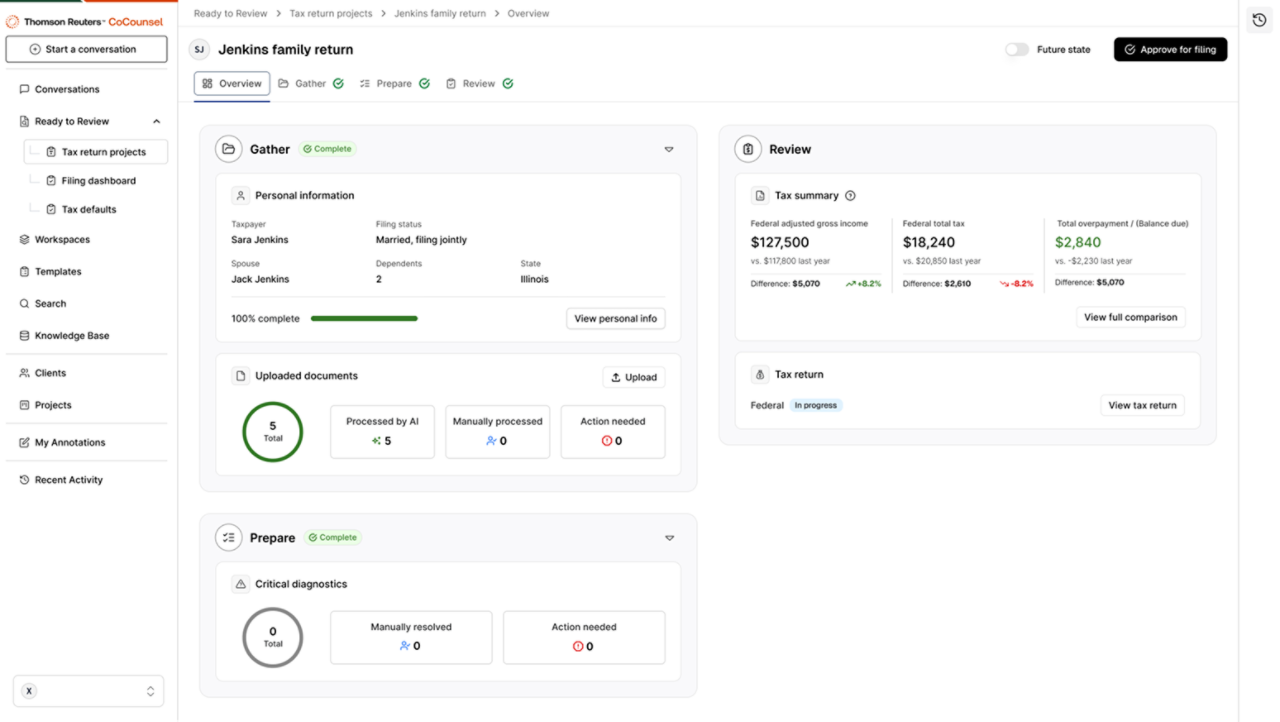

Free your team to focus on valuable advisory services with Ready to Review, a cloud-based tax workflow solution powered by agentic AI that automates the gather-and-prepare steps for simple 1040s

Document processing tools

Use agentic-AI-powered document intelligence to automatically extract, categorize, and verify tax data from source documents — empowering you to manage more returns with less staff.

Gather Agent

Stop spending hours on manual data entry. The Gather Agent uses proprietary document extraction with AI to categorize and verify data from source documents and prior-year returns. This agent doesn't just scan documents — it analyzes the data, identifies missing information, and flags gaps before they become problems, allowing your team to focus on strategy work over time-consuming tasks.

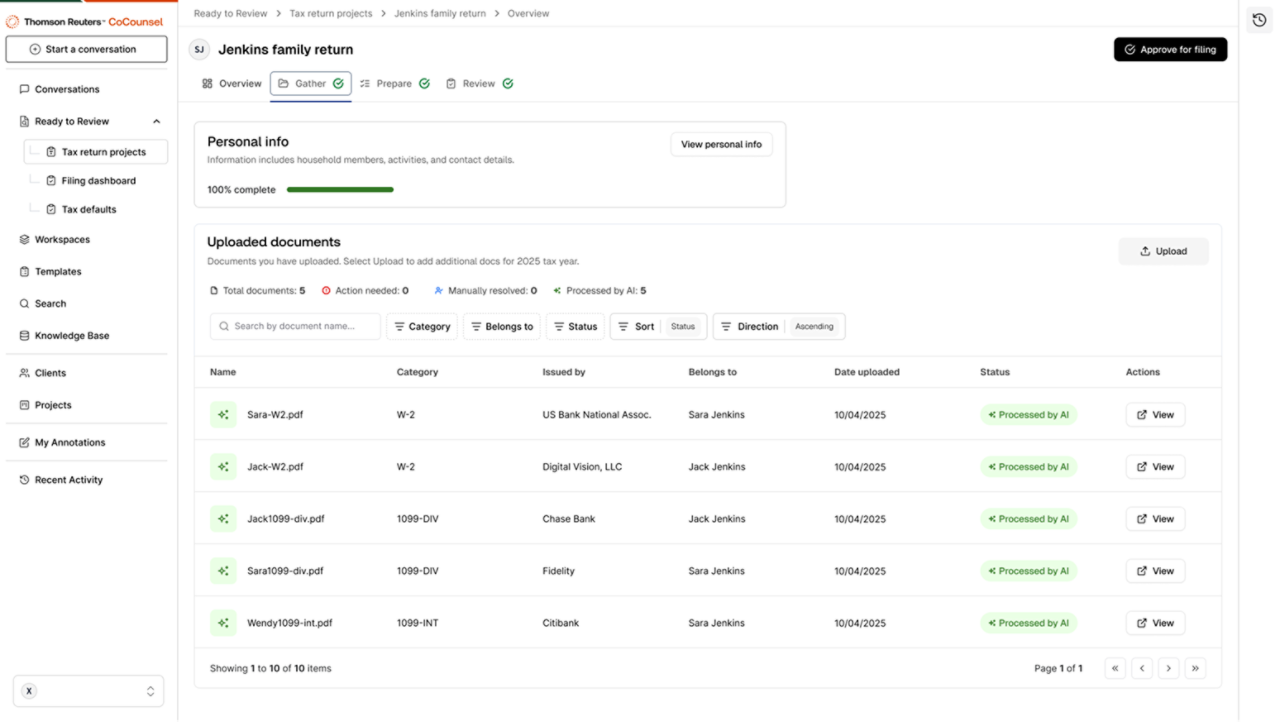

Drag-and-drop document upload

Enjoy effortless document submission with this intuitive interface. Simply upload source documents and previous returns, and the Gather Agent immediately begins processing — no complex file-naming conventions or manual categorization required.

Automated document categorization

Free up preparation time with AI agents that automatically identify and sort W‑2s, 1099‑INTs, 1099‑DIVs, and prior returns — eliminating manual tagging, preventing classification errors, and keeping documents organized for faster processing.

Missing document identification

Proactively identify gaps in client documentation before even beginning preparation. The Gather Agent analyzes uploaded documents against expected requirements and alerts you to missing forms, ensuring complete information gathering upfront.

Autonomous tax preparation and calculation

Prepare tax returns autonomously with AI agents that run through our most powerful tax engine, allowing teams to dramatically expedite their workflows.

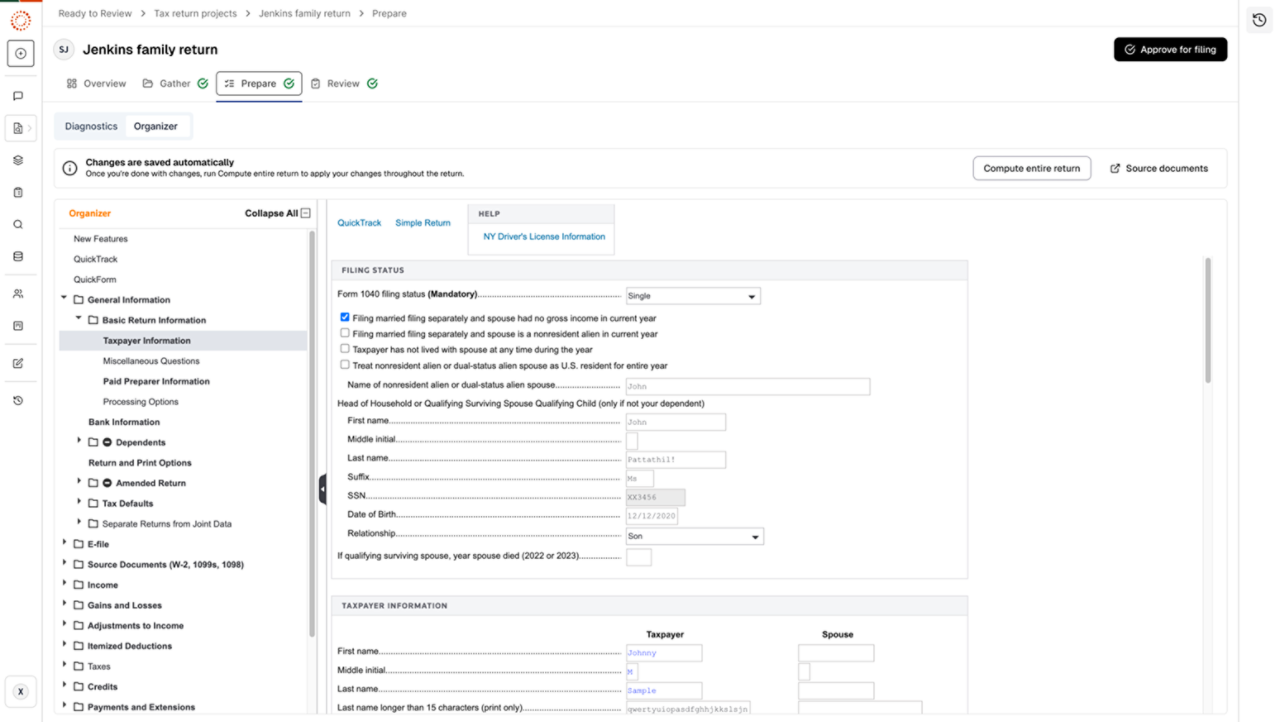

Tax Preparer Agent

Experience true workflow transformation with an AI agent that doesn't just assist — it prepares. The Tax Preparer Agent receives verified data from the Gather Agent and produces a complete draft return, ready for your review. It autonomously creates and resolves routine diagnostics, categorizing issues by priority so you can focus on matters requiring your expertise.

Diagnostics

Reduce hours of routine problem-solving while maintaining accuracy and compliance with a triage system where AI agents handle the routine diagnostics. Diagnostics are organized into clear categories: "Review," "Reviewed," and "Informational," so you can prioritize your time effectively.

Two-year comparison analysis

Catch potential issues before they become problems with built-in two-year comparison functionality. This proactive approach to quality control helps you identify opportunities for tax-planning conversations while ensuring accuracy.

Data transformationand mapping

Seamlessly automate and map extracted data into the correct fields within the tax return using the Tax Preparer Agent. This intelligent mapping eliminates manual data entry errors and ensures information flows accurately from source documents to the final return.

Let AI agents prepare, calculate, and resolve diagnostics so your team can focus on review

Have questions? Contact a representative.

AI-powered platform capabilities

Experience the power of purpose-built agentic AI on a cloud-based platform designed for scalability and efficiency within your existing workflow.

Built on the CoCounsel platform

Increase efficiency throughout the tax workflow with CoCounsel, our agentic AI platform. Backed by 150 years of trusted content and domain expertise, CoCounsel can plan, reason, act, and adapt autonomously, streamlining complex tax-preparation tasks and ensuring accuracy.

Cloud-based scalability

Handle volume spikes during tax season without hardware investments or capacity constraints. Ready to Review's cloud-based architecture scales automatically to meet your needs, whether you're processing dozens or thousands of returns.

Streamlined e-filing

Transmit and file returns directly through Ready to Review or via your preferred delivery portal. Track filing status for all client returns in a centralized e-file dashboard, eliminating the need for multiple systems and clarifying each return’s progress.

Single-platform efficiency

Operate within one purpose-built solution instead of juggling multiple applications and manual steps. Ready to Review consolidates document processing, tax preparation, review, and filing into a unified workflow — reducing complexity and increasing efficiency.

Questions about Ready to Review? We're here to support you.

800-968-0600

Call us or submit your email and a sales representative will contact you within one business day.

Contact us