The long-anticipated arrival of IRS employer mandate penalty notices is well underway. Officially known as Letter 226-J, the notices inform employers of a preliminary employer mandate penalty calculation under Section 4980H. In late 2017, the IRS began mailing notices for 2015 – with a reported 30,000 applicable large employers receiving Letter 226-J. Now the IRS has progressed to issuing Letter 226-J for 2016.

The move to issuing 2016 penalty notices is significant because the pool of employers that may be subject to employer mandate penalties is much wider. Only employers with 100 or more full-time employees (and equivalents) in 2014 were subject to the Section 4980H penalties for 2015. For 2016, the employer base expands to include those with 50 or more full-time employees (and equivalents) in 2015. So, employers with 50-99 full-time employees that escaped liability for 2015 penalties may not be so lucky for 2016.

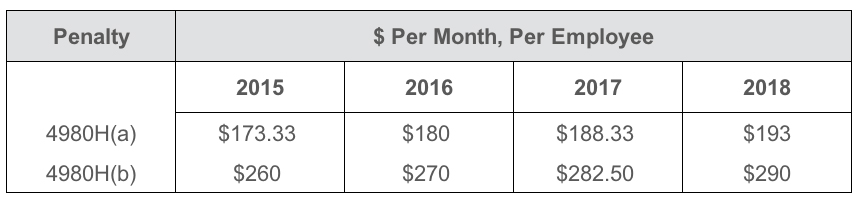

Not only does the number of employers potentially liable for penalties increase, but the penalty amounts for 2016 are higher. In addition, other transition relief available for 2015 isn’t effective for 2016. For instance, employers only had to offer minimum essential coverage to at least 70% of full-time employees for 2015, whereas for 2016 and later years an offer must be made to at least 95% of full-time employees.

Receipt of Letter 226-J will require prompt action. If the notice recipient agrees with the proposed penalty, they simply sign and date the response form and pay the penalty. Otherwise, the response must include an explanation of why there’s disagreement with the proposed penalty and describe changes that need to be made to reported information, such as previously filed Forms 1095-C and 1094-C. Whether the employer agrees or disagrees with the Letter 226-J preliminary assessment, response is required within 30 days from the date of the letter.

Reviewing the preliminary penalty calculations for accuracy could be a time-intensive exercise. Drafting a thorough and complete response to reduce the proposed penalty could prove to be an even more arduous task. With the dollar amount of penalty assessments on the line, it’s essential to get it right. PPC’s Guide to Health Care Reform provides complete coverage of the Section 4980H penalty mechanics and guidance on constructing an effective response to Letter 226-J.