Tax software for accountants and tax practitioners

Increase productivity by streamlining and automating tax workflow with authoritative research tools and real-time updates to tax code changes

Find the right solutions

How our IRS-approved tax software helps tax preparers serve clients

Simplify your workflow with Thomson Reuters tax solutions

“UltraTax CS is really the only tax preparation software I truly know. I've used others and I quickly abandoned them because they end up segregated from everything else. So having the integrations like automatic data flow between returns and even other software makes UltraTax (CS) the top of the line product.”

Chris Papin

Papin CPA

Tax preparation software

Work smarter with tax solutions that accelerate return preparation, ensure accuracy, and maintain vigilance over your compliance calendar.

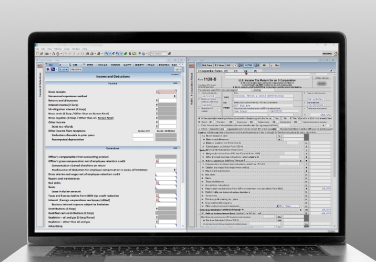

UltraTax CS

Professional tax software for tax preparers and accountants, including a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

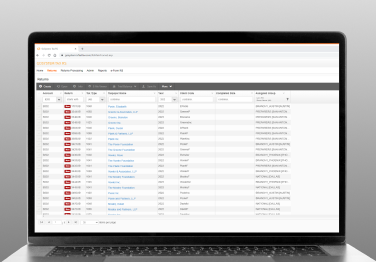

GoSystem Tax RS

Handle the workflow no matter the size of your firm with industry-leading professional income tax software. Pay less in maintenance costs, face fewer storage issues, and rest easy with business continuance under this online platform.

1040SCAN

Eliminate data entry with our industry-leading scan-and-populate tax solution, which automates 4 to 7 times as many documents as the alternatives and exports data directly to your tax preparation software.

Tax workflow management software

Transform your accounting firm with integrated document storage, online teamwork capabilities, and protected client access points — all working together to modernize your practice.

SafeSend One

Automate your firm’s delivery and e-signing process with this powerful accounting solution. Provide a seamless client experience while reducing errors, saving time, and streamlining your workflow.

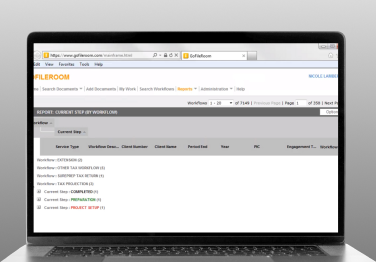

GoFileRoom

Create a truly paperless workflow with our premier document management and storage. This cloud-based system standardizes and organizes volumes of documents and integrates with other solutions for a seamless process.

Tax research tools

Find the right answers faster with comprehensive coverage and expert analysis on various tax topics and challenges.

CoCounsel Tax

Transform your tax practice with CoCounsel Tax, an AI-powered assistant that combines trustworthy answers, automation, and firm knowledge into one seamless platform. Enhance efficiency, reduce risk, and improve client confidence with CoCounsel Tax.

Checkpoint Catalyst

Adapt to a changing business landscape with powerful web-based tax research tools. Make informed decisions based on expert guidance and use decision trees and what-if scenarios to analyze your situation.

Explore all Thomson Reuters tax and accounting solutions

Frequently asked questions

When selecting tax preparation software for your tax and accounting practice, consider these key factors:

First, assess your firm's specific needs by identifying workflow challenges and pain points that need addressing. Look for software with strong integration capabilities like UltraTax CS that seamlessly connects tax preparation, research, planning, and client collaboration tools in one system.

Choose scalable solutions that can grow with your practice and accommodate expanding client bases. The most effective tax software combines automated preparation tools (such as GoSystem Tax RS for complex business returns), efficiency-enhancing technologies like 1040SCAN for document automation, up-to-date research resources, planning capabilities, secure client portals, and workflow automation.

Before committing, test the software's usability through free trials of products like UltraTax CS to ensure it fits your team's workflow. Review feedback from similar-sized firms using these solutions and check industry recognition to gauge reliability.

While professional-grade solutions like GoSystem Tax RS and UltraTax CS may have higher upfront costs, they typically offer greater security, accuracy, and time-saving features (especially when paired with 1040SCAN technology) that provide better long-term value.

The right tax software is an investment that enhances efficiency and allows your firm to focus more on advisory services rather than routine compliance work. For more tips, please see our article, “The best tax software for tax preparers: A buyer’s guide.”

The best Thomson Reuters tax return software for your firm depends on your specific needs, size, and client base:

For small to mid-sized firms seeking a comprehensive, integrated solution, UltraTax CS offers an ideal balance of power and usability. It handles individual and business returns with automation features that streamline preparation and review processes. When paired with 1040SCAN technology, it significantly reduces data entry time by automatically extracting information from client documents.

For larger firms or those with complex business clients, GoSystem Tax RS provides enterprise-level capabilities designed to manage high-volume, sophisticated tax scenarios. Its web-based platform enables seamless collaboration across multiple office locations and supports complex corporate, partnership, and international tax requirements.

For firms transitioning to advisory services, consider how these tax solutions integrate with other Thomson Reuters products like CoCounsel Tax for research and Planner CS for strategic tax planning.

Key factors to consider:

- Firm size and growth trajectory

- Types of returns you typically prepare (individual vs. business)

- Need for remote access and multi-user collaboration

- Integration requirements with existing systems

- Budget constraints and ROI expectations

Many firms find value in scheduling a personalized consultation with Thomson Reuters to evaluate which solution aligns best with their specific workflow and client service goals. Or find more advice our article, “Tax software for accountants: What do CPAs use for tax returns?”

Yes, Thomson Reuters offers artificial intelligence capabilities with CoCounsel Tax, our genAI assistant that is trained by industry experts and backed by authoritative content.

CoCounsel Tax is designed specifically for tax research, including:

- Enabling tax professionals to quickly interpret vast amounts of primary source data

- Processing complex information from legislation, IRS guidance, and case law

- Translating technical tax language into everyday, understandable terms

- Helping professionals confidently answer complex tax questions

- Enhancing research efficiency and accuracy

CoCounsel represents Thomson Reuters' commitment to incorporating artificial intelligence into our tax solutions portfolio, which includes other products like UltraTax CS, SurePrep, GoSystem Tax RS, and SafeSend.

By leveraging AI for tax research, Thomson Reuters is addressing one of the most time-consuming and complex aspects of tax preparation: staying current with and correctly interpreting constantly evolving tax regulations.

Yes, Thomson Reuters offers comprehensive tax workflow automation through an integrated suite of products designed to streamline the entire tax preparation process. Their automation solutions address key pain points for tax professionals by eliminating repetitive tasks, reducing errors, and creating standardized processes across teams.

SurePrep stands at the forefront of its automation offerings, using advanced AI-driven OCR technology to transform document handling. The 1040SCAN component automatically extracts data from client tax documents and populates tax forms without manual entry. This automation creates standardized digital workpapers and significantly reduces preparation time.

UltraTax CS complements these capabilities with robust automation features that create a seamless flow of data between accounting and tax preparation systems. Its customizable workflows adapt to each firm's unique processes, while real-time data sharing with other Thomson Reuters products like Workpapers CS and Accounting CS ensures consistency across platforms.

For the final stages of tax preparation, SafeSend automates the assembly, delivery, and e-signing of returns, providing clients with an intuitive interface for reviewing and approving documents. The system tracks return statuses in real time, giving both accountants and clients complete visibility into the process. By implementing these automation solutions, tax professionals can scale their operations more effectively, particularly during busy seasons, while shifting their focus from administrative tasks to higher-value advisory services that better serve their clients.

Yes, our primary audit management platform is Guided Assurance, a cloud-based system that provides AI-powered risk assessments and a guided engagement process to ensure compliance with professional standards.

They also offer specialized workpaper management tools including Workpapers CS and ONESOURCE Workpapers, which enable real-time collaboration and data management. For verification purposes, Thomson Reuters Confirmation provides secure financial data verification through a validated global network. Our audit software ecosystem is complemented by ONESOURCE Statutory Reporting for financial statement preparation and AuditWatch University for professional development.

These integrated solutions help accounting professionals deliver higher-quality audits with improved efficiency, compliance, and profitability through AI-assisted workflows and collaborative tools.

It will vary based on which product you’re interested in adopting for your team. Many products, like UltraTax CS and SafeSend, will offer a free demonstration where product representatives will walk you through the software to see all its capabilities and what to expect in terms of benefits.

Other products, like TaxCaddy and GoSystem Tax RS, may offer other forms of testing or discounts for customers. To get specific details on pricing or demonstrations, please contact a sales representative directly or contact us.