The DOL will seek public input on Family Medical Leave Act regulations and targets tips and dual jobs, electronic payment of civil penalties, subminimum wage certificates, and fluctuating workweeks, among other issues, for proposed regulations.

The 2019 spring regulatory budget agenda of the Office of Information and Regulatory Affairs, Office of Management and Budget (OMB) includes several Department of Labor (DOL) proposed regulatory changes that may be of interest to payroll professionals. The DOL’s 2019 spring Agency Rule List contains projected dates for further action and long-term actions [OMB Agenda, Spring 2019 Unified Agenda of Regulatory and Deregulatory Actions].

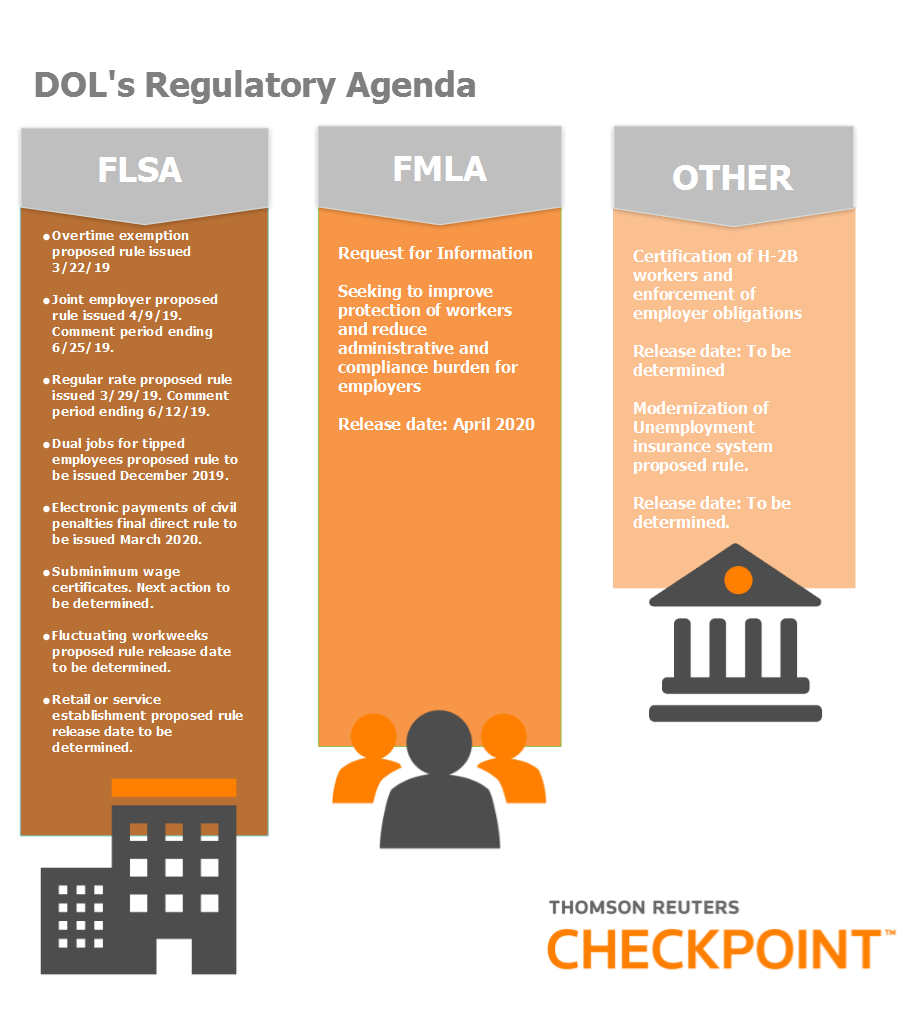

DOL Regulatory Agenda

Projected Dates for Further Action

Family and Medical Leave Act (FMLA).

The DOL will release a Request for Information (RFI) in April 2020 for input regarding how to improve the FMLA regulations to better protect workers and reduce administrative and compliance burdens on employers. The FMLA requires employers with at least 50 employees to provide up to 12 weeks of unpaid job-protected leave in a twelve-month period to employees who meet certain requirements. The leave may be taken for the following events: (1) birth, adoption, or foster care placement of the employee’s child; or (2) a serious health condition affecting the employee, the employee’s spouse, child, or parent. Additionally, the FMLA requires employers to provide up to 26 weeks of FMLA leave for the care of a service member with a serious injury [RIN 1235-AA30].

Overtime Exemption.

On March 7, 2019, the DOL issued the proposed overtime rules. Currently, to qualify for the overtime exemption, bona fide executive administrative, or professional employees generally must: (1) be salaried, meaning that they are paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed (the “salary basis test”); (2) be paid more than a specified salary amount, which is currently $455 per week (the equivalent of $23,660 annually for a full-year employee) in existing regulations (the “salary level test”); and (3) primarily perform executive, administrative, or professional duties, as provided in the DOL’s regulations (the “duties test”). Under the proposed rules, the standard salary level would increase from $455 per week to $679 per week on Jan. 1, 2020. The proposed rules also would increase the highly compensated employee (HCE) total annual compensation level from $100,000 to $147,414 and allow for the inclusion of nondiscretionary bonuses to satisfy a portion of the standard salary level test. The comment period closed on May 21, 2019 [RIN 1235-AA20].

Tips and Dual Jobs.

The 2018 Consolidated Appropriations Act amended the law (29 USC 203(m)) to include a provision which says that employers may not retain tips received by their employees under any circumstances. The DOL had previously issued proposed regulations prior to amendment of the law that would have rescinded restrictions on employers’ use of tip pools when they paid their tipped employees a direct cash wage of at least the full federal minimum wage rate, and did not claim a tip credit against the minimum wage rate. Additionally, the DOL would like to clarify the existing “dual jobs” regulation consistent with a recent Field Assistance Bulletin (FAB). According to the FAB, employers are no longer prohibited from taking a tip credit based on the amount of time an employee spends performing tipped work contemporaneously or within a reasonable period with non-tipped duties. A federal district court recently did not defer to the DOL guidance provided in the FAB and instead applied the “80/20 rule” as established by the courts and provided in WHD Opinion Letter FLSA2018-27, 11/8/18, which states that no tip credit may be taken where the employee is routinely assigned non-tip activities more than 20% of their time. Under 29 CFR 531.56(e), no tip credit may be taken for time spent performing nontipped work. The DOL withdrew the 2017 proposed regulations and will issue a new proposed rule in December 2019 [RIN 1235-AA21].

Exclusion of Certain Items from Regular Rate Calculation.

The Fair Labor Standards Act (FLSA) generally requires overtime pay of at least one and one-half times the regular rate of pay for hours worked more than 40 hours per workweek. Regular rate requirements define what forms of payment employers include and exclude in the “time and one-half” calculation when determining workers’ overtime rates. Currently, additional perks that employers may offer to employees are inadvertently discouraged because it is unclear whether such perks must be included in the regular rate calculation for overtime purposes. The proposed rule would provide clarification that certain items would not need to be included in the regular rate calculation. The comment period was recently extended until June 12, 2019 when stakeholders requested more time [RIN 1235-AA24].

Joint Employer Status.

The DOL’s proposal on joint employer status would ensure employers and joint employers clearly understand their responsibilities to pay at least the federal minimum wage for all hours worked and overtime for all hours worked over 40 in a workweek. The DOL is proposing a four-factor test that would consider whether the potential joint employer exercises the power to: (1) hire or fire the employee; (2) supervise and control the employee’s work schedules or conditions of employment; (3) determine the employee’s rate and method of payment; and (4) maintain the employee’s employment records. The comment period was recently extended to June 25, 2019 due to concerns expressed by law firms, unions, and advocacy organizations, among other stakeholders [RIN 1235-AA26].

Removing the Operation of Patient Lifts from Hazardous Occupations for 16- and 17-Year-Olds.

Generally, current FLSA provisions do not permit 16- and 17-year-old employees to work in nonagricultural jobs that fall under the DOL’s Hazardous Occupations Order (HOs). Particularly, HO 7 prohibits youth from operating a patient lift. The DOL notes in its notice of proposed rulemaking (NPRM) that patient lifts are safer than forklifts and other heavy industrial equipment. The DOL proposes removing power-driven patient lifts from the HO 7 list as per public input and bipartisan congressional requests so that greater opportunities can be provided to young workers in the healthcare field. The proposed rule was released in September 2018 and the final rule is projected to be released in April 2020 [RIN 1235–AA22].

Electronic Payments of Civil Penalties.

The DOL will be issuing a direct final rule in March 2020 that will allow assessed civil penalties from violations administered by the Wage and Hour division to be paid electronically. Currently, employers are required to pay by certified check or money order [RIN 1235-AA28].

Long Term Actions

Updating the Term “Other Facilities” for Wage Purposes.

Under 29 USC 203(m) of the FLSA, the reasonable cost of board, lodging, or other facilities may be included as wages paid to an employee. Under current DOL regulations, an employer may claim a credit against wages for the value of food, housing, or other facilities if the following requirements are met:

- lodging must be “customarily” provided by the employer or similar employers;

- the employee must voluntarily accept the lodging;

- the lodging must be furnished in compliance with applicable federal, state, or local law;

- the lodging must be provided primarily for the benefit of the employee rather than the employer; and

- the employer must maintain accurate records of the costs incurred in furnishing the lodging.

Further, 29 CFR 785.23 allows employers and employees to reach a “reasonable agreement” regarding the number of hours presumptively worked when an employee resides on the employer’s premises. The DOL will issue a proposed rule in November 2020 that will clarify the meaning of “other facilities” for the modern workplace. DOL projects the proposed rule will be released in November 2020 [RIN 1235-AA29].

Special Certificates for Subminimum Wage for Workers with Disabilities.

Under 29 USC 214(c) of the FLSA, the Secretary of Labor is allowed to issue special certificates to employers to pay workers that are either handicapped or have disabilities at a special wage rate (subminimum wage rate) that is lower than the federal minimum wage rate (currently $7.25 per hour). The DOL seeks to revise current regulations to reflect changes in employment laws since the DOL’s last update [RIN 1235-AA14].

Fluctuating Workweeks.

Currently, under employers are permitted to use fluctuating workweeks to pay employees a fixed weekly salary, regardless of the number of hour worked if: (1) the employee’s hours must fluctuate from week to week; (2) the employee must receive a fixed salary that does not vary with the number of hours worked during the week (excluding overtime premiums); (3) the fixed amount must provide compensation every week at a regular rate at least equal to the minimum wage rate; and (4) the employer and employee must share a clear mutual understanding that the employer will pay the fixed salary regardless of the number of hours worked. Recently, a federal appellate court that an employer may not use incentive payments in fluctuating workweek calculations. The DOL will propose regulations that permit different forms of compensation that may be used in fluctuating workweek calculations [RIN 1235-AA31].

Retail or Service Establishment Exemption.

The FLSA provides an exemption from its provisions to certain commissioned retail or service workers under 29 USC 207(i). The DOL seeks to update current regulations on the exemption. The DOL noted that the regulations have not been updated in many years. For example, in August 2018, the DOL issued which clarified that an online payroll software platform’s commissioned sales representative could be exempt from receiving overtime under the retail or service establishment exemption [RIN 1235-AA32].

Temporary Non-Agricultural H-2B Workers.

The Department of Homeland Security (DHS) and the DOL seek to issue a proposed joint rule regarding the certification of H-2B temporary nonagricultural workers and enforcement of employer obligations of H-2B workers. An interim final rulewas issued in April 2015. The interim final rule provided a process for employers to obtain a temporary labor certification from DOL for use in petitioning DHS to employ a nonimmigrant worker in H–2B status [RIN 1205-AB76].

Unemployment Insurance System. The 2020 White House budget proposal noted one of the priorities was modernizing the unemployment insurance program. The DOL has included a long term action in its regulatory agenda that aligns with the goal to combat improper state unemployment payments [RIN 1205-AB97].

Flexible payroll solutions that are as unique as your firm

“Increase profits, strengthen existing client relationships, and attract new clients with our trusted payroll solutions that accommodate in-house, outsourced, or hybrid models.

Or, shop for payroll information solutions designed to help you find trusted answers quickly on our store.”