The Thomson Reuters Institute has released its latest report on generative AI (GenAI), titled 2025 Generative AI in Professional Services. This comprehensive study explores the attitudes, perceptions, and usage of GenAI among professionals in the legal, tax & accounting, risk & fraud, and government sectors. Conducted in early 2025, the survey gathered valuable insights from more than 1,700 respondents across the United States, the United Kingdom, and Canada. Participants included tax professionals within corporations, as well as members of outside tax & accounting firms.

Here we’ll highlight the 2025 report’s most important (and, in some cases, surprising) findings and insights pertaining to tax and accounting professionals.

Jump to ↓

Key findings from the new report

Perceptions of GenAI among tax professionals

Usage of GenAI by tax professionals

Impact of GenAI on client relationships

2025 Generative AI in Professional Services Report

Explore all the latest comprehensive insights into how GenAI is shaping professional services.

Access full report ↗

Key findings from the new report

The report offers a deep dive into the transformative impact of GenAI on tax and accounting professional services.

The report has found that tax professionals are increasingly adopting GenAI tools to automate routine tasks, improve accuracy, and provide innovative solutions. However, the report emphasizes preparing for the necessary strategic integration of GenAI with training and policies in place while also communicating with clients on the usage of GenAI to fully realize its benefits.

Thomson Reuters Institute

Perceptions of GenAI among tax professionals

Professionals have become more positive about this technology, with more than half (55%) expressing excitement and hopefulness about its use. According to the 2025 report, 71% of tax firm professionals and 75% of corporate tax respondents say that it should be applied, compared to 52% and 60%, respectively, in 2024. That represents the biggest year-over-year increase among all professions covered in the report.

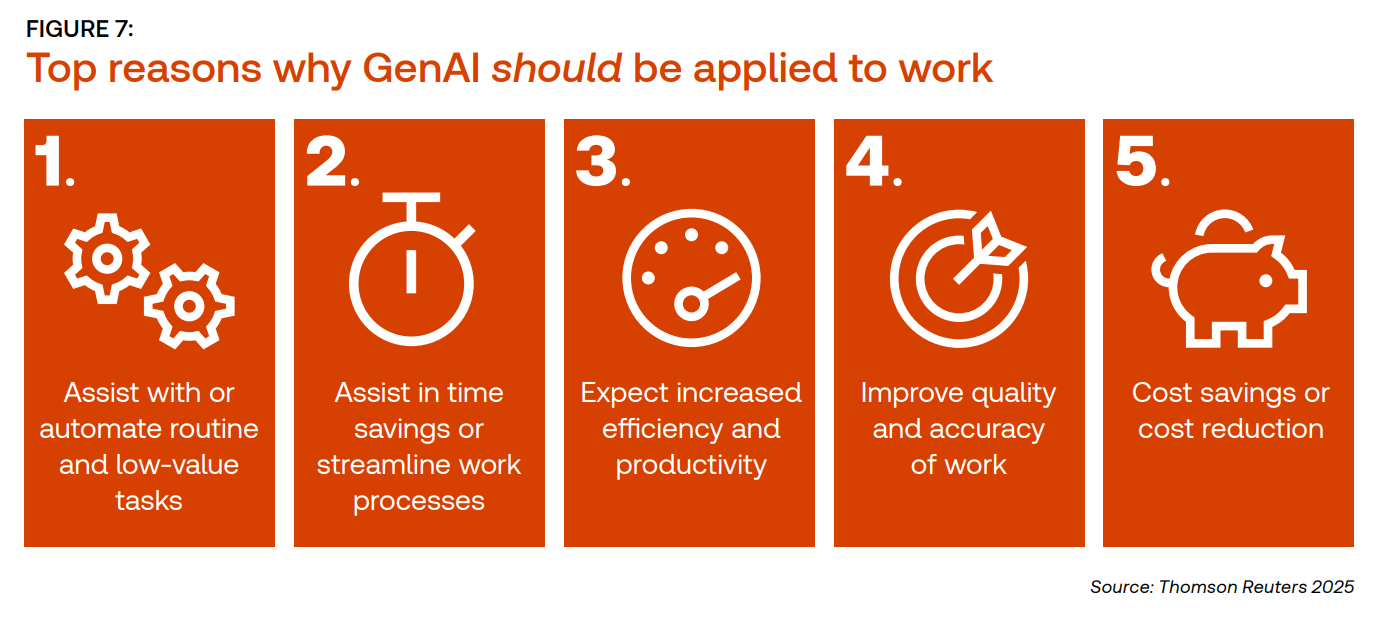

More and more tax, audit & accounting professionals see GenAI as a tool that can help them save time and boost productivity, in large part because well-designed GenAI tools can streamline workflow processes. One of the attributes of a rigorously crafted, professional-grade GenAI tool is its capability to continuously “learn” and improve as it works with more and more data.

Despite these benefits, many tax professionals continue to express reservations about GenAI, specifically on accuracy and reliability of datasets, outputs, and machine learning algorithms, and the need for proprietary systems and tailored AI solutions may slow down adoption of GenAI tools by some organizations.

While concerns persist, sentiment has shifted towards viewing GenAI as a means of augmenting rather than replacing human work. Tax professionals increasingly recognize that GenAI’s ability to process vast amounts of data quickly and accurately offers the promise of improved quality and accuracy of work, enhancing the overall efficiency of tax preparation and helping professionals stay on top of tax laws and regulations. With an ethical framework, tax professionals can make sure they are using GenAI responsibly.

In addition, tax professionals are excited about the technology’s potential to address industry challenges such as talent costs and shortages as well as capacity limitations. That makes it a potentially critical component for maintaining the sustainability of tax, audit & accounting practices.

Usage of GenAI by tax professionals

GenAI usage among tax professionals has increased since the Thomson Reuters Institute’s 2024 report. In the 2025 report, 21% of tax, audit & accounting firms say that they’re using GenAI at an enterprise level, compared to 8% in 2024. In addition, 13% of tax firm professionals surveyed describe GenAI as playing a central part of their workflow, with nearly all industries expecting it to become central within five years.

According to the 2025 report, 89% of tax firm professionals and 92% of corporate tax practitioners believe that GenAI can be applied to their work. GenAI can automate time-consuming repetitive tasks in six primary use cases for tax professionals, allowing them to focus more on higher-value decision-making, forecasting, and advisory work for their clients.

Top six use cases for tax professionals

- Tax research – 77%

- Tax preparation – 63%

- Tax advisory – 62%

- Accounting/bookkeeping – 57%

- Document summarization – 55%

- Document review – 53%

Tax research, advisory, and preparation overtook accounting and bookkeeping as top use cases. Another intriguing point about usage: Among current GenAI users, 73% of tax firms and 69% of corporate tax practices engage with the technology in their work at least weekly. In other words, if you adopt GenAI, you will use it more often than not.

Impact of GenAI on client relationships

While GenAI has impacted tax professionals’ workflows, the impact on organizations needs more discussion to be further realized. The report clearly demonstrates that clients are strongly interested in knowing whether the tax professionals they work with have incorporated GenAI into their operations. According to the report’s data, 77% of corporate tax clients want the firms they work with to use GenAI. What’s more interesting, 59% of tax firm clients don’t know whether their firms use GenAI tools in their work. This suggests that there is a widespread lack of communication between clients and firms concerning this technology’s usage.

This is crucial, because tax professionals need to engage in conversations with clients about GenAI and its impact on value and rates. To be able to conduct these important discussions, tax practices need to clearly understand and then communicate the benefits that GenAI can deliver to their clients. But despite the growing adoption of GenAI tools, there’s a significant strategic gap. Only 20% of all professionals surveyed in the report are measuring the technology’s return-on-investment (ROI). Not evaluating that ROI–using metrics such as internal cost savings and client satisfaction–could hinder a tax practice’s understanding of GenAI’s value.

“I see generative AI as a game-changer in our industry,” said a U.S. corporate tax manager quoted in the report. “It has the potential to streamline complex processes, improve efficiency, and unlock innovative solutions that were previously unimaginable.”

Thomson Reuters Institute

Clarity about that value can help tax professionals better grasp how this technology may cause billing rates to change. Of the tax firms surveyed in the 2025 report, 39% believe the rates they charge their clients will stay the same. However, 43% of tax firms believe that rates will increase somewhat or significantly. This implies that tax professionals are steadily gaining a stronger sense of GenAI’s value to their practices and to their clients.

The future of tax work

GenAI has been in the industry since the public release of ChatGPT more than two years ago, and the technology’s use is only going to continue to expand. Tax, audit & accounting professionals have become aware of AI’s redefining potential to make them more productive and to save them time. 95% of all industry professionals surveyed in the report expect GenAI to become a central part of their organization’s daily workflow within the next five years.

An Australian corporate tax controller called it “inevitable that [GenAI] will form a greater and greater part of professional services as it is trained and refined. Companies seeking to advantage themselves will more and more develop the capabilities, which should improve outcomes in longer term.”

Thomson Reuters Institute

But despite this enthusiasm, the report suggests that in general, professionals aren’t preparing themselves for the GenAI future. Of the tax firms surveyed in the 2025 report, 70% lack policies guiding the use of GenAI in their practices. That’s a higher percentage than any other profession surveyed. In addition, 72% of tax firms don’t offer training in this technology—also the highest percentage among the professional practices polled in the report.

With the rise of agentic AI in tax, professionals will need to further prepare for the future. Agentic AI leverages generative AI and large language models to autonomously plan, reason, and execute multi-step processes. While advanced tax technology and automation are nothing new for most accounting firms, the introduction of agentic AI is redefining what classifies as a “mundane” task.

Preparing for the future

The future of work in the tax industry is bright. But if tax, audit & accounting professionals and firms are committed to successfully incorporating AI and its benefits into their practices, they should be ready to accommodate the changes that it will introduce and find professional-grade GenAI solutions that will enhance their workflows. Organizations that put this off are at risk of being quickly left behind in a competitive market. Preparations should include establishing training programs and governance protocols to ensure ethical and effective use of this ever-evolving technology.

Professional-grade GenAI tools ensure that the datasets and machine learning algorithms are tailored to the tax profession’s specific needs and regulatory requirements. When researching for a professional-grade GenAI solution, you need one that understands professional standards and can deliver reliable results at superhuman speed. And most importantly, it needs to be encrypted end-to-end, so your data—and your customers’—remains private and secure. That is professional-grade generative AI.

By grounding AI responses in this authority, professional-grade GenAI tools like Thomson Reuters CoCounsel help ensure that technology enhances rather than undermines the quality of tax, audit, and accounting services. CoCounsel is the industry-leading GenAI assistant that works alongside you from task to task, from research to analysis and much more—creating a single, seamless workstream.

CoCounsel

One agentic AI assistant for tax, audit, and accounting professionals

Meet your all-in-one assistant ↗