Unlock the power of effective prompting to enhance your tax and accounting research.

Jump to ↓

| What is the CREATE method? |

| Breaking down your prompt using the CREATE method |

| How the CREATE prompting method can help tax and accounting professionals |

| Transform your firm with the CREATE prompting method |

As a tax and accounting professional, you’re no stranger to the importance of accurate and efficient research. With the rise of GenAI research assistants, you now have the power to streamline your workflow and unlock new levels of productivity.

But to get the most out of these tools, you need to craft effective prompts that yield precise and relevant results. This is where the CREATE method comes in — a structured approach to prompt-crafting that will save you time, improve accuracy, and enhance your tax research outcomes.

Click image to expand

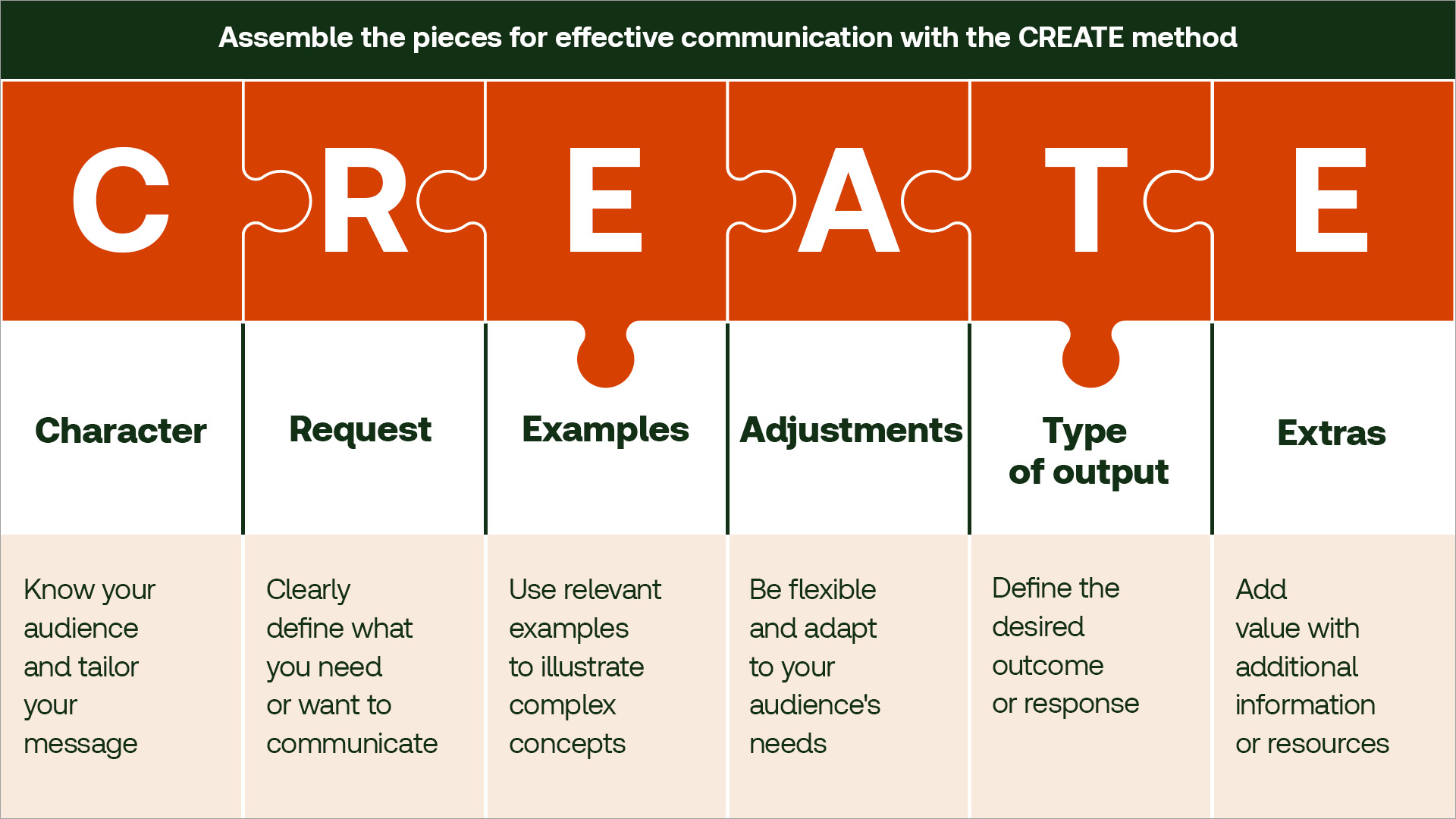

What is the CREATE method?

CREATE is an acronym that stands for Character, Request, Examples, Adjustments, Type of output, and Extras. By breaking down your prompt into these six components, you’ll be able to create clear, concise, and targeted requests that your GenAI tax research assistant can understand and respond to effectively.

Breaking down your prompt using the CREATE method

C = Character: Define the context and character of your request. Who is the subject of your research? What is the specific topic or industry?

R = Request: Clearly state what you’re asking for. What information do you need to find, or what problem do you want to solve?

E = Examples: Provide relevant examples or references to help your GenAI tax research assistant understand the scope and tone of your request.

A = Adjustments: Specify any adjustments or nuances that might affect the outcome of your research. This could include specific dates, locations, or regulatory requirements.

T = Type of output: Define the type of output you’re looking for. Do you need a summary, a list, or a detailed analysis?

E = Extras: Add any additional information that might be relevant to your research, such as specific keywords, formulas, or data points.

How the CREATE prompting method can help tax and accounting professionals

By using the CREATE method, you’ll be able to:

-

- Save time by crafting clear and concise prompts that reduce the need for follow-up questions and clarifications

- Improve accuracy by providing specific context and examples that help your GenAI tax research assistant understand your needs

- Enhance your research outcomes by specifying the type of output you need and providing relevant adjustments and extras

Real-world examples:

To illustrate the effectiveness of the CREATE method, let’s look at two real-world examples where tax and accounting professionals use this structured approach to enhance their research and client consultations.

Example 1: A tax professional needs to research the tax implications of a specific business transaction. They use the CREATE method to craft a precise prompt for their GenAI research assistant:

-

- Character: Define the context and character of the request. In this case, the subject is a company merger in the tech industry.

- Request: Clearly state what information is needed. The tax professional asks for the tax implications of the merger.

- Examples: Provide relevant examples or references. They mention the tech industry to help the assistant understand the scope.

- Adjustments: Specify any adjustments or nuances. They focus on the state of California.

- Type of output: Define the type of output needed. They request information on capital gains tax.

- Extras: Add any additional information. They include relevant case law.

The prompt might look like this: “I need to know the tax implications (R) of a company merger (C) in the tech industry (E) in the state of California (A) with a focus on capital gains tax (T) and including any relevant case law (E).”

Example 2: An accountant is preparing for a consultation with a small business client to discuss their business strategy. They use the CREATE method to craft a detailed prompt for their GenAI research assistant:

-

- Character: Define the context and character of the request. The subject is a small business in the retail industry.

- Request: Clearly state what information is needed. The accountant asks for advice on improving the client’s business strategy.

- Examples: Provide relevant examples or references. They mention the retail industry to help the assistant understand the scope.

- Adjustments: Specify any adjustments or nuances. They focus on the client’s recent performance and market trends.

- Type of output: Define the type of output needed. They request a strategic plan.

- Extras: Add any additional information. They include relevant industry benchmarks and best practices.

The prompt might look like this: “I need advice on improving the business strategy (R) of a small business (C) in the retail industry (E) based on their recent performance and market trends (A) with a focus on creating a strategic plan (T) and including relevant industry benchmarks and best practices (E).”

These examples demonstrate how the CREATE method can be effectively utilized by tax and accounting professionals to enhance their research and client consultations.

By crafting clear and targeted prompts, professionals can leverage their GenAI research assistants to achieve more accurate and efficient outcomes.

Transform your firm with the CREATE prompting method

The CREATE method offers tax and accounting professionals a structured approach to leveraging GenAI research assistants effectively. By focusing on crafting clear and concise prompts and utilizing the six components—Character, Request, Examples, Adjustments, Type of output, and Extras—professionals can save time, improve accuracy, and enhance their research outcomes.

Embracing this method can significantly streamline workflows and keep practitioners ahead in the rapidly evolving field of tax and accounting.

Discover how your firm can embrace AI-powered technologies and enhance your tax research processes with effective prompting methods by exploring below ↓

|

|