Unlock the true financial impact of tax automation with practical, measurable methods for accurate ROI calculation.

Highlights

- Firms that invest in cutting edge automation see better efficiency, accuracy, and scalability.

- Consistent tracking of ROI metrics strengthens ROI accuracy.

- SurePrep significantly cuts down on preparation and review time.

Every software vendor loves to boast about their cutting-edge AI and top-of-the-line efficiency. But when it’s time to justify that investment to your CFO or build a business case for your board, vague promises don’t cut it.

If you’re a decision maker at your firm, you’re probably looking for concrete figures to justify your investment. Here’s how to cut through the vendor marketing-speak and project real ROI quantification when assessing technology performance.

Jump to ↓

Quantifying ROI for tax automation

Financial benefits you can measure

3 critical factors for accurate ROI quantification

Common ROI quantification pitfalls to avoid

How SurePrep drives tax and accounting firm ROI

The bottom line on tax automation ROI

Quantifying ROI for tax automation

In the context of tax and accounting, ROI measures the financial, operational, and strategic benefits of a software or solution compared to its purchase and implementation costs. In addition to calculating profit, you’ll also have to factor in time savings, reduced errors, new revenue opportunities, and potentially more.

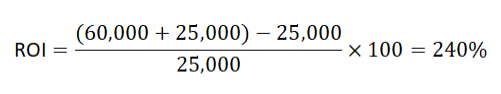

Here’s one way to break it down:

- Annual labor and rework savings: $60,000

- New advisory revenue: $25,000

- Annual automation cost: $25,000

ROI Formula:

In this scenario, the firm ends up gaining $2.40 for every $1 spent.

Financial benefits you can measure

Despite the example above, ROI quantification still trips firm up because their overall productivity can’t be measured with three simple metrics. To get a holistic assessment of your technology performance, you’ll need to account for the full extent of its impact. Here are some additional factors to consider:

Cost reduction through efficiency

Manual tax workflows burn billable hours on repetitive tasks. Automation eliminates much of this waste by handling data collection, categorization, and extraction automatically.

Track these measurable savings:

- Labor cost reduction: Document the hours saved per return and multiply by fully loaded hourly rates

- Administrative expense elimination: Calculate savings from reduced paper, postage, storage, and manual filing costs

- Overtime reduction: Measure decreased peak-season overtime expenses

Error reduction

Manual data entry is naturally prone to some degree of human error. Each mistake triggers rework cycles, delayed filings, and potential compliance risks. Here are some error-related savings your team can track:

- Rework elimination: Track time spent correcting mistakes and multiply by hourly costs

- Compliance risk mitigation: Estimate potential penalty avoidance

- Quality assurance efficiency: Measure reduced review time when automation handles initial accuracy

Scalability

Automation lets existing teams handle increased workloads without proportional staff increases. This scalability provides measurable financial advantages, especially when skilled tax professionals are difficult to hire.

Talent retention and productivity

Automation reduces the repetitive work that drives tax professional burnout. Better job satisfaction translates into the following measurable financial benefits:

- Reduced turnover costs: Replacement costs can range from 50-200% of annual salary

- Productivity improvements: Engaged and employees tend to deliver higher productivity

- Training cost reduction: Lower turnover means less frequent onboarding expenses

3 critical factors for accurate ROI quantification

#1: Baseline documentation

You can’t determine ROI quantification without knowing your starting point. Before implementing new technology, it might make sense to begin tracking the following metrics in order to provide a point of comparison.

- Time spent on specific tax processes

- Error rates and rework frequency

- Administrative costs and resource allocation

- Client service delivery timelines

#2: Consistent measurement methodology

Establish standardized measurement approaches that remain consistent throughout your evaluation period. This enables accurate trend analysis and helps to avoid faulty data.

#3: Multiple stakeholder perspectives

Different roles see different benefits. CFOs focus on cost reduction, partners care about client service enhancements, and staff concentrate on day-to-day efficiency. Capturing value from all relevant perspectives can help you gain a holistic picture.

Common ROI quantification pitfalls to avoid

Don’t inflate benefits by double-counting savings or including speculative future gains. Stick to measurable, attributable improvements. Avoid underestimating implementation costs. Include training time, system integration expenses, and change management resources in your calculations.

While intangible benefits can’t be entirely ignored, it’s important to separate them from hard ROI calculations. Improved employee morale and client satisfaction have real value, even if they’re harder to quantify.

How SurePrep drives tax and accounting firm ROI

Not all tax technology delivers the same ROI impact. By recognizing a greater volume of source documents and fields than the competition, SurePrep 1040SCAN and SPbinder have a measurable impact on your bottom line.

1040SCAN delivers immediate value by extracting data from 4-7x as many documents as alternative products, dramatically reducing time spent on data entry and workpaper indexing. This automated lift gives preparers the flexibility to process more returns in less time or shift their concentration toward advisory engagements.

When paired with SPbinder’s electronic workpaper and review capabilities, the combined solution creates compounding efficiency gains. SPbinder streamlines the entire review process through digital collaboration tools, automated workpaper creation, and centralized document management.

Together, these solutions deliver a 39% reduction in preparation time and 29% reduction in review time based on internal studies. The end result: Firms saved an average of $293 per 1040 return.

The bottom line on tax automation ROI

The first step to achieving organization success is ensuring that the right measures are being taken to track that success. Effective ROI quantification transforms technology investment from a gamble to a near guarantee.

When you can demonstrate clear financial returns, measurable operational improvements, and strategic advantages, you build the foundation for sustained automation success in your tax firm.

Want to learn more? Check out our webinar: “Defining ROI: How tax firms are justifying AI investments” for more insights, stats, and hands-on guidance from software experts. Register today to see how your practice can maximize its future tech spending.