The 2023 State of the Tax Professionals Report sheds light on the current state of the tax industry and how firms are adjusting to meet the demands of an ever-evolving profession. From leveraging artificial intelligence and machine learning to streamlining tax preparation processes, the report explores the innovative approaches that firms are taking to remain competitive in today’s dynamic tax industry.

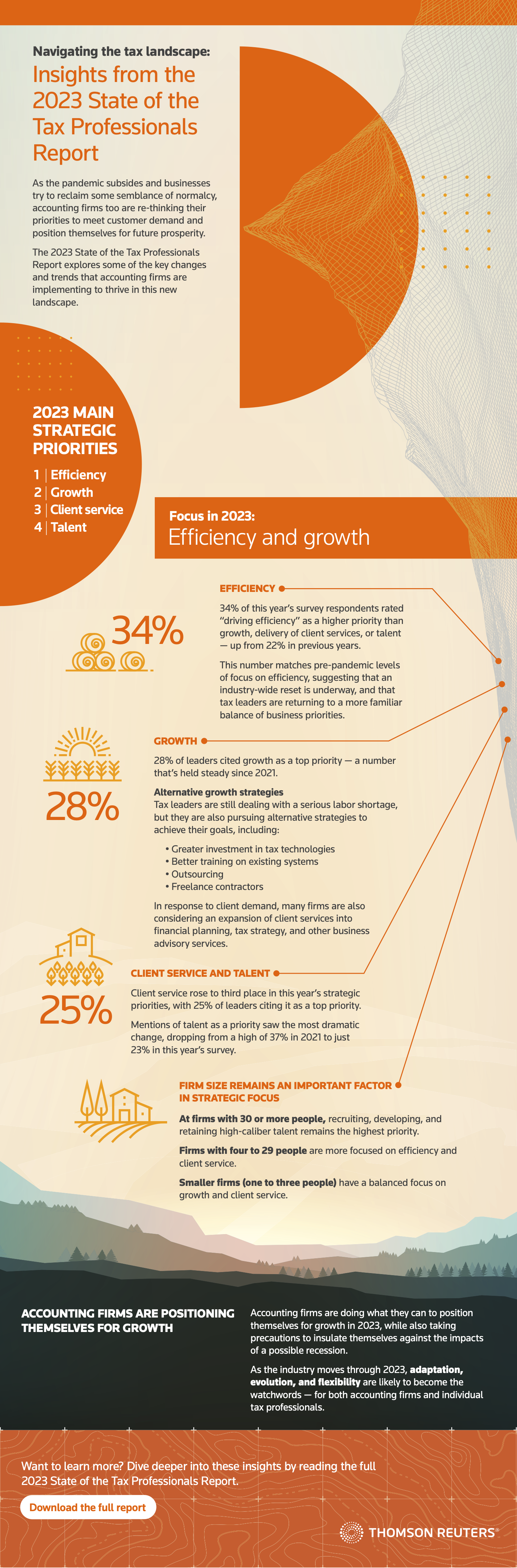

Keep reading to explore the report with our latest infographic, diving into key findings and strategic trends that tax professionals are using to stay ahead of the curve.

The 2023 State of the Tax Professionals Report provides valuable insights into the tax industry and the strategies that firms are using to remain competitive. From focusing on efficiency and growth to expanding client services, it’s clear that firms are taking a variety of approaches to navigate the ever-evolving tax landscape.

By leveraging the findings in this report, tax professionals can gain a better understanding of industry trends and position themselves for future success.