An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.

Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the US Treasury via their delegation authority to the IRS.

Here are some details:

- Each state was given a list of their low-income census tracks

- Each state could nominate up to 25% of these tracks to be Opportunity Zones

- All nominations had to be submitted by March 21, 2018 — a one-time-only 30-day extension was available upon request with an April 20 end date

- The Treasury Department had to approve these nominations

- Once approved, the designation as an Opportunity Zone will stay in place for 10 years

Intended to increase development and investments in economically struggling areas with Qualified Opportunity Funds (QOFs), taxes on capital gains invested in the funds can be deferred or even partially eliminated.

Interest has increased since the proposed regulations came out, and tax professionals are receiving an influx of inquiries. Everyone is trying to figure out the rules, and investors see it as an area of opportunity and are looking to tax professionals for guidance. So although the Treasury still needs to provide more details, interest in the tax-advantaged zones from potential investors, developers, and property owners has already soared.

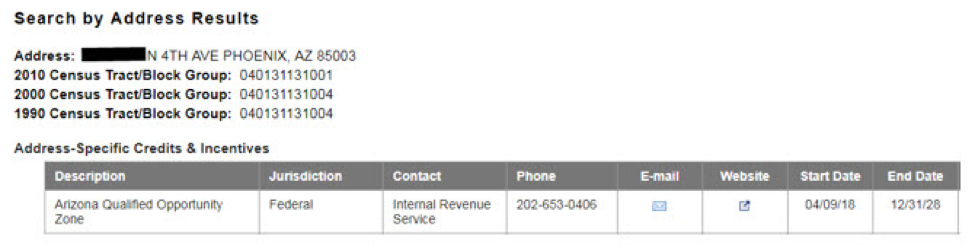

In the Credits and Incentives products from Thomson Reuters, we have added designated areas for all 50 states and the District of Columbia to search by address and process by batch. It’s as easy as entering in an address to see if the location may be in a Qualified Opportunity Zone.

Here’s an example:

Keep an eye out for more information in the future!