New survey data shows why technology investment is becoming the foundation of sustainable firm growth.

Highlights

- Accounting firm budgets are shifting toward technology as staffing shortages intensify.

- Larger firms are pulling ahead by investing heavily in AI initiatives.

- Modern tax automation unlocks the bandwidth for higher‑value advisory services

Tax and accounting work is undergoing more change now than it has at any other point in our lifetimes. While staffing availability has continued to shrink, AI advancements are helping firms automate and streamline areas of the tax workflow that once seemed impossible. With that in mind, why is your firm still budgeting like it’s 2016?

Let’s take a look at new accounting firm budget trends and what they could mean for your practice.

Jump to ↓

Where accounting firm budgets are trending

Large firms are leading the way

What’s driving the push toward technology?

Gauging the impact of modern automation

Thomson Reuters: Tax technology for all firm sizes

Planning a modern accounting firm budget

Where accounting firm budgets are trending

Traditionally, the vast bulk of accounting firm budgets have gone toward human capital, with technology receiving minimal allocation. Today, forward-thinking firms are changing this model. According to Accounting Today’s 2025 Year Ahead survey, technology now makes up 21% of accounting firm budgets, and over 60% of firms plan to increase their IT spending in 2025. This reallocation stems from an understanding that the right technological infrastructure can dramatically enhance productivity, accuracy, and client satisfaction while reducing long-term operational costs.

Large firms are leading the way

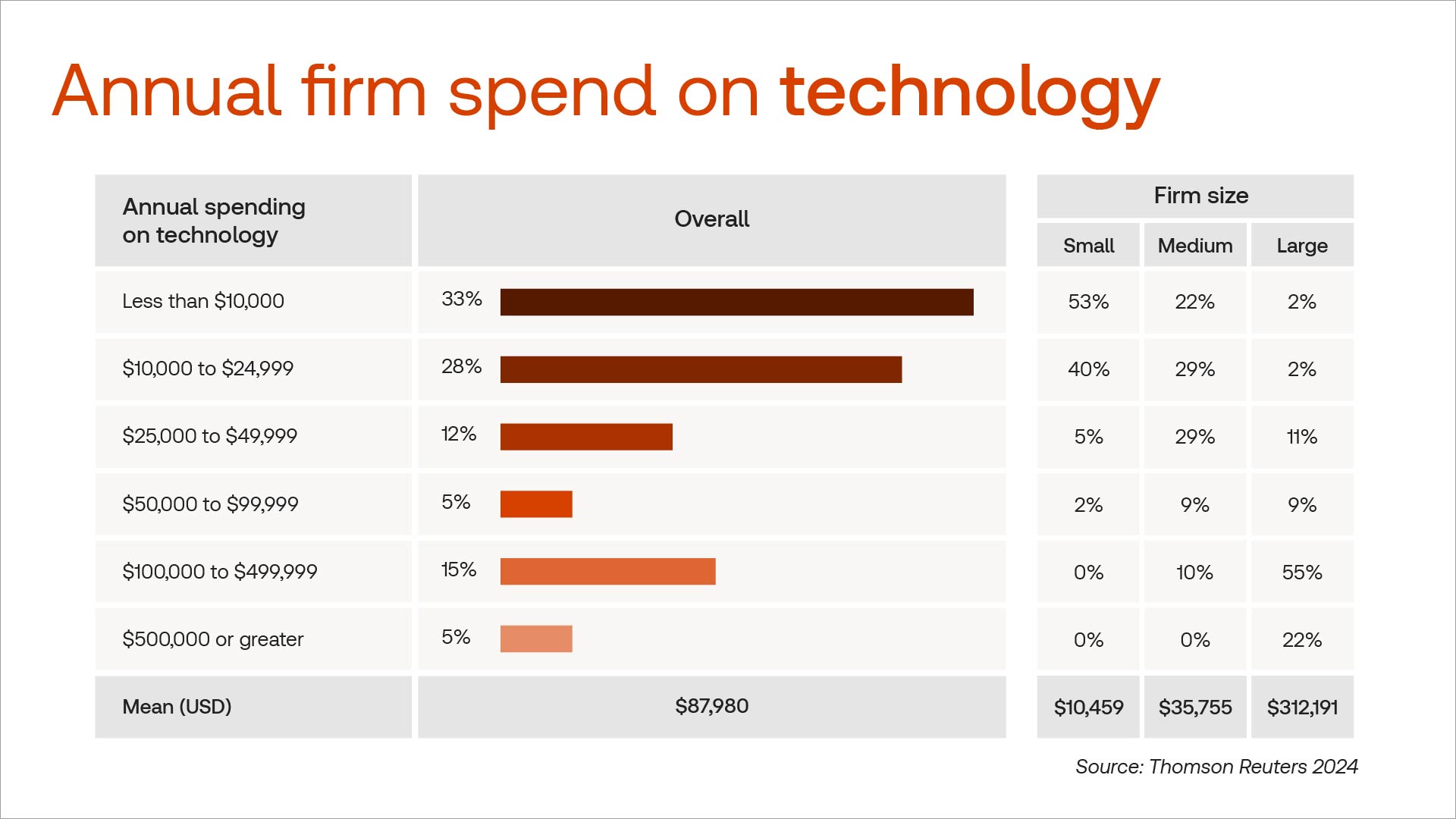

Based on survey findings from the Thomson Reuters 2024 Tax Firm Technology Report, accounting firm budgets for large practices allocate an average of 30 times what small firms spend on technology. Even mid-sized firms had less than 1/9 the technology budget of their large counterparts even though the average differential in staffing size was much closer.

So what does this mean? Large firms may see an advantage to increased technology spending that the rest of the industry isn’t privy to. The Big 4 alone have collectively invested billions into AI initiatives so far this decade. Here are some reasons why the top accounting practices are all in on new tech.

What’s driving the push toward technology?

Our 2025 State of Tax Professionals Report found that hiring and retaining talent was the number one issue keeping respondents up at night. This data shouldn’t come as a surprise. The number of U.S. accounting graduates hit a 20-year low in 2024 according to a trends report by AICPA. These dwindling numbers have left the accounting profession with a disproportionately older staffing pool, many of whom are already management-level or even approaching retirement.

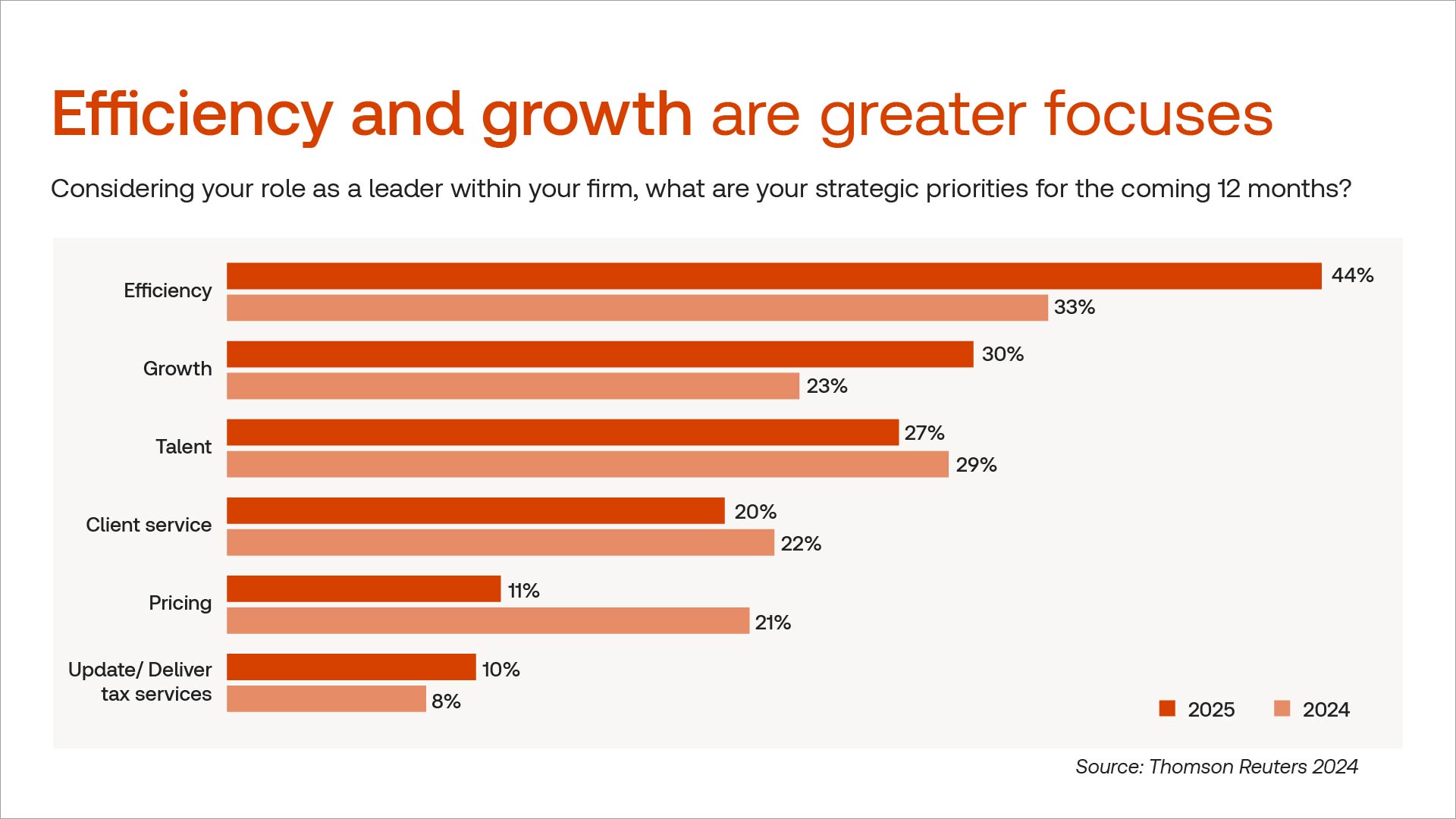

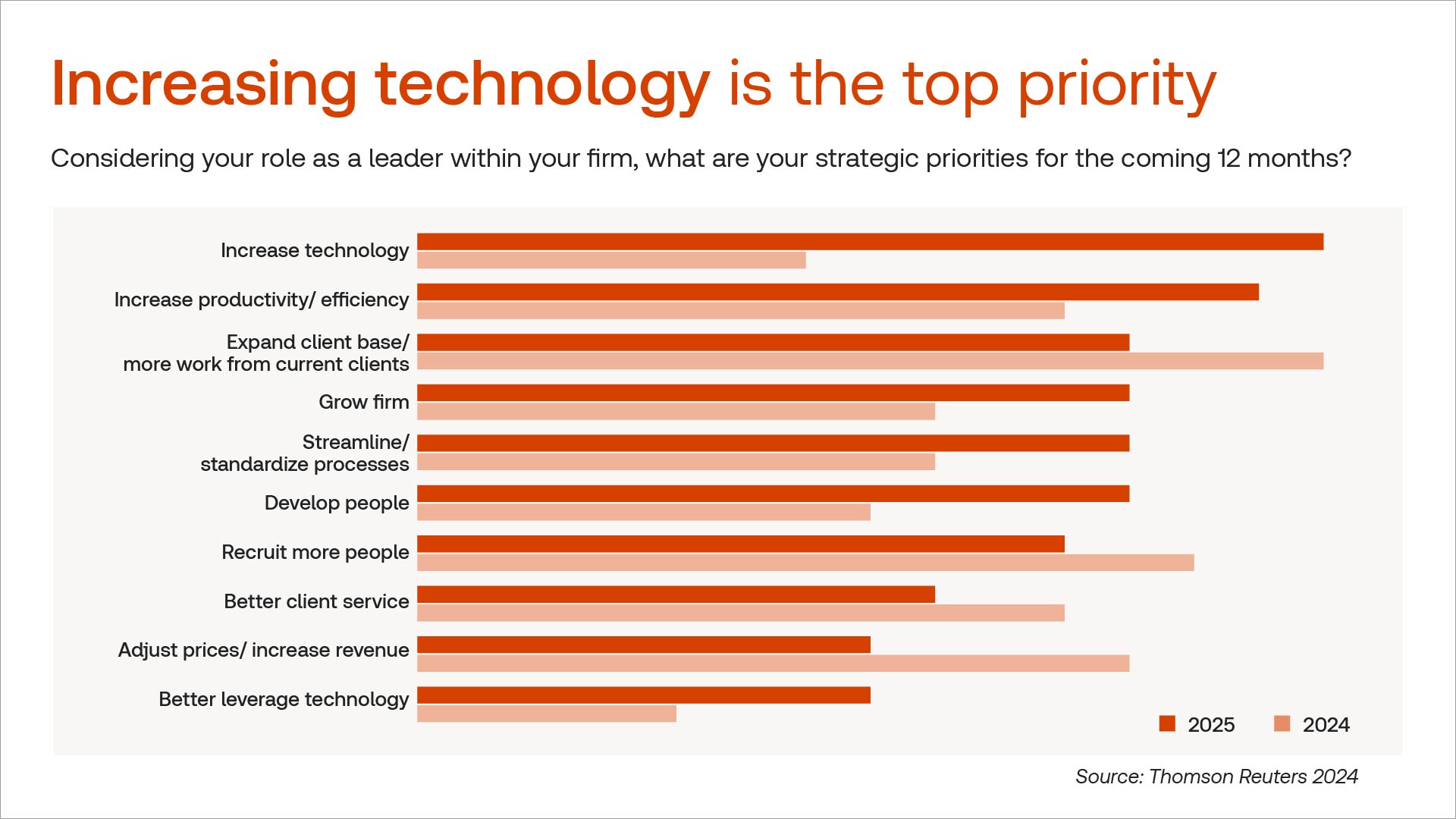

Firms appear to be looking for relief amid the ongoing staffing squeeze. According to 2025 Thomson Reuters survey data, efficiency and increasing technology were the top two strategic priorities for tax firms, a respective 11% and 8% jump from our 2024 survey. Yet only 39% of respondents say they have a clearly defined strategy for growth.

Gauging the impact of modern automation

Consistency and reliability are everything in the tax profession, so it’s no wonder why the gap between desire for tech adoption and action remains wide. But proactive firms that have taken the initiative to upgrade their tech stack are already seeing the benefit.

On average, tax professionals still spend more than half of their time on repetitive, manual work. But survey data from CPA.com shows some firms reporting over 80% automation of the tax preparation process, while large language model-based research tools help reduce document analysis time by 50% or more. What previously consumed hundreds of billable hours per tax season can now be accomplished in minutes, freeing professionals to focus on strategic advisory services that command premium fees.

Thomson Reuters: Tax technology for all firm sizes

Because small and mid-sized firms have less spending flexibility, some firm leaders think that disqualifies them from receiving cutting-edge automation. In reality, accounting firm budgets of all sizes have found space for industry-leading solutions from Thomson Reuters. Here are some examples:

SurePrep 1040SCAN addresses the manual transcription bottleneck by automating individual return data entry. The tool eliminates the hours junior staff traditionally spend transcribing W-2s, 1099s, and supporting documents, allowing firms to process more returns with existing headcount.

SPbinder organizes source documents and workpapers into consistent structures, reducing the time professionals spend hunting for information during return preparation and review. When every engagement follows the same document organization pattern, staff can navigate client files efficiently regardless of which team member initiated the work.

SafeSend streamlines the final delivery process by managing client signatures, payment collection, and document delivery through a single portal. This consolidation eliminates the email chains and manual follow-ups that traditionally extend the completion process by days or weeks.

CoCounsel Tax provides AI-powered research capabilities that compress complex code analysis into minutes rather than hours. The tool helps professionals explore planning strategies they might otherwise skip due to research time constraints.

The common thread: each solution targets a specific operational bottleneck that affects every client engagement. Rather than broad-platform investments, firms can deploy specialized tools where they’ll generate concrete efficiency gains for years to come.

Planning a modern accounting firm budget

The technology spending patterns documented here paint a clear picture. Accounting firm budget that would have gone to seasonal staff in the past is now being put toward tangible, year-round automation wins. Data entry that used to stretch late into the night can now be finished in the early afternoon. During your accounting firm’s next budget planning meeting, remember to weigh what you’re saving now against what you could be missing out on in three years.

Want to learn more? Check out our webinar: “Defining ROI: How tax firms are justifying AI investments” for more insights, stats, and hands-on guidance from software experts. Register today to see how your practice can maximize its future tech spending.