Here are some tips to help you process 1099s more efficiently this tax season.

Before you process your 1099s:

- Register with FIRE, the IRS e-filing program. For more information on the FIRE program, visit

https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire. - Set up your vendors. Choose Setup > Vendors and enter each vendor’s name, TIN, address, city, state, and ZIP code. Select “1099 Recipient” as the vendor type and select the 1099 form type and boxes on the 1099 Properties tab.

- Verify each vendor’s TIN information. You’ll find details on TIN verification in our Help & How-To Center.

- Generate a 1099 Activity report to verify that each vendor’s 1099 information and year-to-date totals are correct.

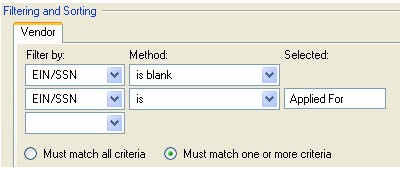

- Generate a Vendor List report to identify missing TIN information. Set the Filtering and Sorting section as shown:

- Verify your firm and staff information. Your firm’s EIN/SSN must be entered in the Setup > Firm Information > Firm screen, and the ID, name, and Social Security number for at least one staff member must be entered in the Setup > Firm Information > Staff screen.

- Set up each client for electronic 1099 processing by following these steps:

- Choose Setup > Clients. On the Main tab click the Ellipsis (…) button in the Additional Contacts section. Enter the contact information for the 1099s and mark the Payroll form signer checkbox.

- Click the Payroll Taxes tab.

- In the Federal 1099 grid in the Forms section, select Internet as the filing method for Copy A/1096.

- Click Enter to save the changes.

When you’re ready to process your 1099s:

-

- Choose Actions > Process Payroll Tax Forms.

- Select 1099 from the Form type drop-down list, select the 1099 type, select the year to process, and click the Refresh button.

- In the Form Selection section, specify the form types to print.

- Click the Process Selected button.

- Choose Actions > Process Internet > Magnetic Files. Click the Transmitter Information button and then select the File contact and enter the transmitter control code you received from the IRS when you registered with the FIRE program.

- Select the 1099 file and click the Create Files button to send the file to the location displayed in the File location field.

- Browse to the IRS FIRE website and upload the newly created file.

Note: You can enter vendor totals into the application in one of two ways for 1099-only clients.

- In the Actions > Enter Transactions screen, you can enter year-to-date totals as checks for vendors.

- In the Actions > Edit Payroll Tax Forms screen, you can enter the totals as override amounts by entering vendor year-to-date information in the Recipient Data tab with 1099 selected as the form type.