Discover how to overcome resistance to AI adoption, build a compelling case, and lead your team into a smarter, more efficient future with a proven checklist that turns vision into action.

Picture yourself as a young, tech-savvy manager at a tax and accounting firm. You’re passionate about innovation and see AI as the key to unlocking new efficiencies. But every time you bring up AI in meetings, you’re met with hesitation: “It’s too expensive.” “It’s too complicated.” “We’ve always done it this way.”

You’re not alone. Across the industry, professionals like you are stepping up as AI champions determined to drive change from within. Here’s how your journey might unfold, and the checklist that will guide you.

Jump to ↓

| Understanding the AI landscape in tax and accounting |

| Building the case for AI adoption |

| Communicating with stakeholders |

| Overcoming resistance |

| Implementing AI solutions |

Understanding the AI landscape in tax and accounting

Your story begins with curiosity. You notice how leading firms are using AI to automate workflows, analyze documents, and deliver precise answers. You read about tools like CoCounsel Tax, an industry-trusted AI-powered tax assistant, which help professionals work smarter and faster.

Benefits of AI:

-

- Automates repetitive workflows

- Analyzes complex documents in seconds

- Delivers instant, accurate answers to client queries

Real-world success stories:

You realize that AI isn’t just a buzzword—it’s a practical solution that’s already transforming the industry.

Building the case for AI adoption

You decide to build your case. You gather key metrics and stories to share with leadership:

Checklist for building your case:

-

- Quantify efficiency gains (e.g., hours saved per week)

- Highlight accuracy improvements (e.g., reduction in errors)

- Demonstrate cost savings over time

- Share case studies from firms who’ve succeeded with AI

With data and empathy, you’re ready to answer every concern.

Communicating with stakeholders

The pivotal moment arrives: presenting your vision to leadership. You know that numbers matter, but so does the story. You frame AI adoption as a way to align with the firm’s goals; growth, efficiency, and client service.

You’re not just pitching technology; you’re inviting your team to join a journey of innovation.

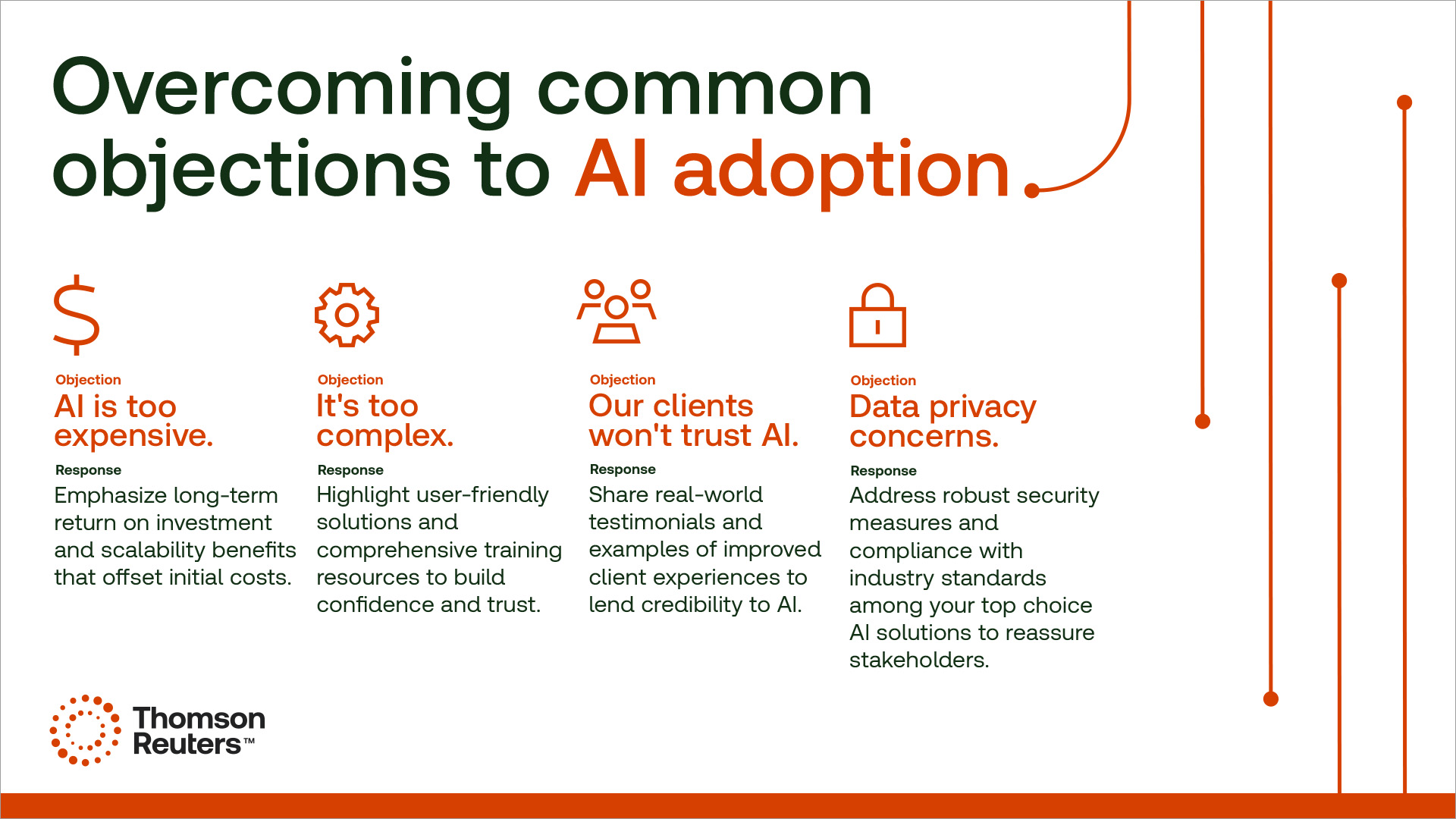

Overcoming resistance

Change is hard. Some colleagues worry about job security, and others are skeptical of new technology. You recognize these fears and address them head-on.

Checklist for overcoming resistance:

-

- Identify sources of resistance (fear, skepticism, lack of understanding)

- Involve colleagues early in the process

- Offer training and support resources

- Celebrate small wins and share success stories

- Communicate regularly and transparently

Gradually, trust grows. Resistance fades. The firm begins to see AI not as a threat, but as an opportunity.

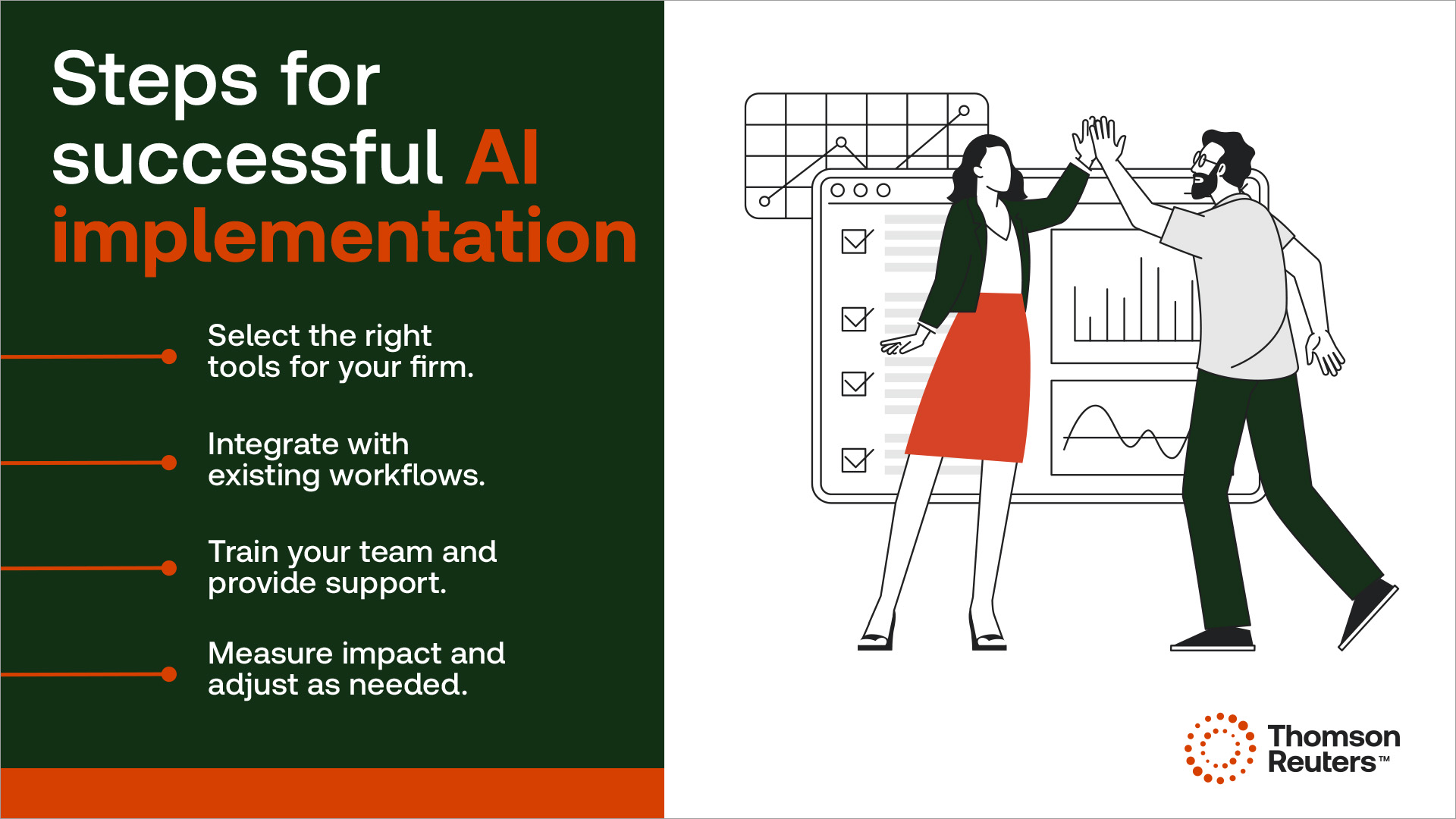

Implementing AI solutions

With buy-in secured, you lead the charge. You research and select the right AI tools, ensuring they fit your firm’s needs. You integrate them into existing workflows and provide ongoing support. Now, transformation is underway and you’re at the helm.

Start championing AI in your tax and accounting firm today

Your journey as an AI champion is more than a series of tasks. It’s a story of leadership, vision, and perseverance.

Using the steps outlined here, start your journey as an AI champion today and help your firm unlock the full potential of artificial intelligence.

Ready to lead the change? Learn more about CoCounsel Tax today.

|

|