The geopolitical terrain is undergoing unforeseen changes, and certain prominent trends that had solidified in past decades are now experiencing a reversal. The regulatory and policy environment is both ramping up and diverging in critical areas. Multinational corporations and small businesses are facing significantly different challenges. And in a high-profile election year in many countries, trade could well feature as a key battleground, as candidates either try to set out their intentions to negotiate better bi- or multi-lateral agreements or conversely, to take a more protectionist stance. With so much at stake, there’s a myriad of issues to be prepared for in 2024.

The state of play in terms of recent developments and what lies ahead from a regulatory, business, organizational, and data perspective, was the subject of discussion at a recent Thomson Reuters webinar. In the view of speaker Marianne Rowden, CEO of the E-Merchants Trade Council (EMTC), “We’re in a period which I call deglobalization. Geopolitics are creating complexity for trade professionals and multinational corporations that have had 30 years of trade liberalization in a golden era where you could trade with any country.”

The impact of evolving trade policies on business

A significant volume of policy developments has taken place in the last year which will likely have a major impact on global trade in 2024. These range from the United States’ surprise retrenchment from global digital trade policies that liberalize data flows between countries, to the growing emphasis on humanitarian considerations in regulations governing the supply chain.

Two of the most notable new and upcoming regulatory regimes are the EU’s Carbon Border Adjustment Mechanism (CBAM) which came into effect in October 2023, and the analogous U.S. Foreign Pollution Fee Bill which has been proposed in the U.S. Both will ultimately impose import fees on ‘carbon-intensive’ products like steel, aluminum, and cement, meaning that trade professionals will be responsible for both reporting on the import of those commodities and paying the taxes or fees associated with them.

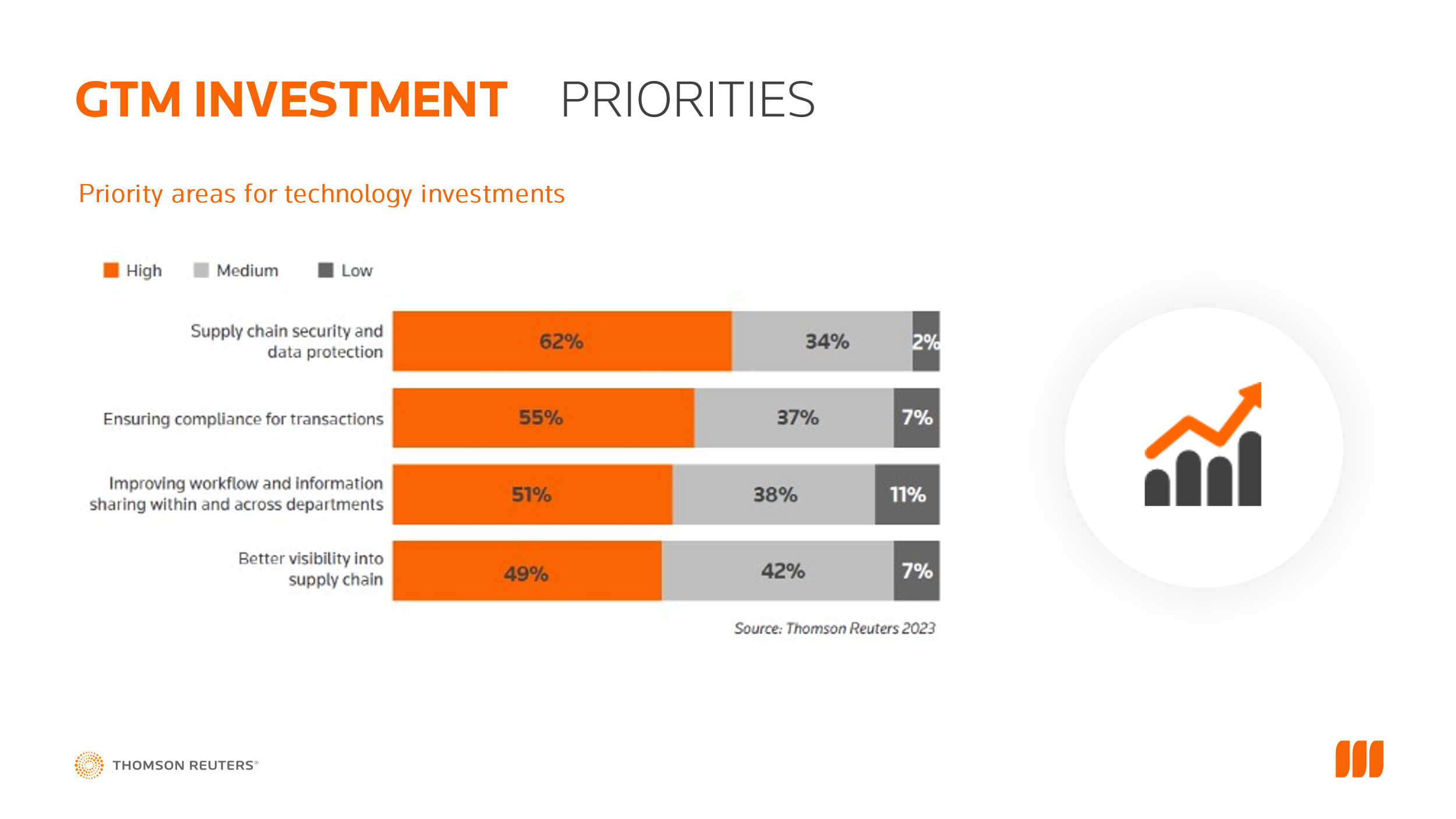

Indeed, the impetus to gather more data, particularly around environmental, social, and governance (ESG) issues, is growing thanks to these and other mandatory disclosure laws, and due to the drive to mitigate rising reputational risk, meet customer and investor expectations – and because it can be profitable to do so. Research by Thomson Reuters – outlined in our 2023 Corporate Global Trade Survey – highlights the importance of all these factors:

Here, technology certainly comes into play to streamline and facilitate data collation, analysis, and reporting. “Due diligence is driving the need for transparency in supply chains and companies such as Thomson Reuters are certainly providing the overview for multinational companies and developing tools,” said Rowden.

The impact of policy divergence between corporates and SMEs

- For Rowden, a divergence in the policy outlook for traditional multinational corporations and emerging e-commerce companies, including small and mid-sized enterprises (SMEs) is becoming noticeable – whilst it’s not specific to the U.S., it is particularly acute in the U.S.

- “The phrase that I use is ‘one country, two systems’,” explained Rowden. “I’ve used this phrase to talk about how the United States has two trading systems emerging, one for traditional multinational corporations and the other system emerging for low-value shipments and e-commerce companies that include many small and medium-sized enterprises.”

- She also touched on the implications of what she called “the blender effect”. This refers to the idea that, on the one hand, major trade policies are being imposed from the top down, which multinational corporations have to integrate into their overall global trade compliance programs. At the same time, there are moves to bring e-commerce companies into the existing legal regime from the ‘bottom-up’, something that has proven difficult to achieve so far. This push-and-pull policy divergence and integration is likely to pose significant challenges to businesses of all sizes as we look ahead.

- Data is another area where corporates and SMEs face different challenges. “There really is a dichotomy here between large companies and small companies,” said Rowden. “For multinationals, they have the data, so it’s a matter of providing governments with the right data at the right time. And the problem I think is there’s too much data being collected by governments and it’s a never-ending cycle.”

- “For small companies, we have a more base issue of what data do you need? Particularly with those with low-value shipments, the question is what data do they need to get their shipments admissible and released from customs’ custody? The problem is that customs has traditionally collected transaction data, from which they construct a risk profile. But…in low-value shipments and e-commerce, you don’t have to [have] that traditional input of record to have that risk profile. However, we do need data to authenticate the parties and the legitimacy of the products being imported.”

|

|

E-commerce is growing in influence on global trade in 2024

E-commerce is becoming an increasingly significant factor in global trade, and with its revenue now surpassing $1 trillion, it is no longer a “fringe” part of the global economy. However, this growth has brought it under the scrutiny of policymakers, leading to more regulations. For example, the European Union’s decision to eliminate ‘de minimis’ provisions for VAT and customs duties is a potential challenge for U.S. e-commerce companies exporting to the EU, particularly SMEs.

On the plus side, at the operational level, today e-commerce has access to advanced technologies that simply weren’t available even five years ago. These can be used as platforms with very little cost to the e-commerce community to manage their trade risks. “This concept of trade as a service, I think, will probably take off over the next couple of years,” believes Rowden.

___________________________________________________________________________________________

There’s much to think about for large multinational corporates and small businesses involved in cross-border trade – particularly e-commerce companies – in the year ahead. Read more in our infographic about the challenges and their impacts on global trade.

_____________________________________________________________________________________________