Highlights

- The One Big Beautiful Bill Act (OBBBA) makes major 2017 tax cuts permanent and introduces new deductions for 2025 returns.

- Key changes include higher SALT caps, expanded credits, new deductions for tips, overtime, and car loan interest, and business expensing relief.

- Stay informed on OBBBA provisions to confidently guide clients through the 2026 tax season and maximize their benefits.

Tax season 2026 brings significant changes for your clients. The One Big Beautiful Bill Act (OBBBA) made many 2017 tax cuts permanent and introduced valuable new deductions for tips, overtime, charitable giving, and more — some affecting the 2025 returns you’re filing now.

Your clients have questions about these changes. From higher SALT caps to new tax breaks for service workers, understanding these provisions will help you deliver confident guidance. Below are the most common tax season questions clients are asking in early 2026, with clear answers you can share.

Jump to ↓

| How is the Earned Income Tax Credit (EITC) changing |

| What’s happening with the Child Tax Credit? |

| Can I deduct more of my state and local taxes this year? |

| Are there new tax breaks for tips and overtime? |

| Can I deduct the interest on my car loan now? |

| Can I deduct charitable donations without itemizing? |

| What are these new “Trump Accounts” for kids? |

| Is Social Security income now tax-free? |

| Did the IRS change the $600 rule for payment apps (1099-K)? |

| Can businesses still fully expense equipment purchases? |

| Do we still have to amortize R&D costs, or did that change? |

| What’s the latest on the Employee Retention Credit (ERC)? |

How is the Earned Income Tax Credit (EITC) changing?

For 2025 tax returns (filed in 2026), the EITC amounts have increased due to inflation adjustments:

-

- No children: Maximum credit of approximately $640-$650

- One child: Maximum credit of approximately $4,300

- Two children: Maximum credit of approximately $7,100

- Three or more children: Maximum credit of approximately $8,000

These higher limits mean eligible clients could see larger refunds this season. The EITC continues with its normal inflation-adjusted parameters, providing consistent treatment compared to prior years.

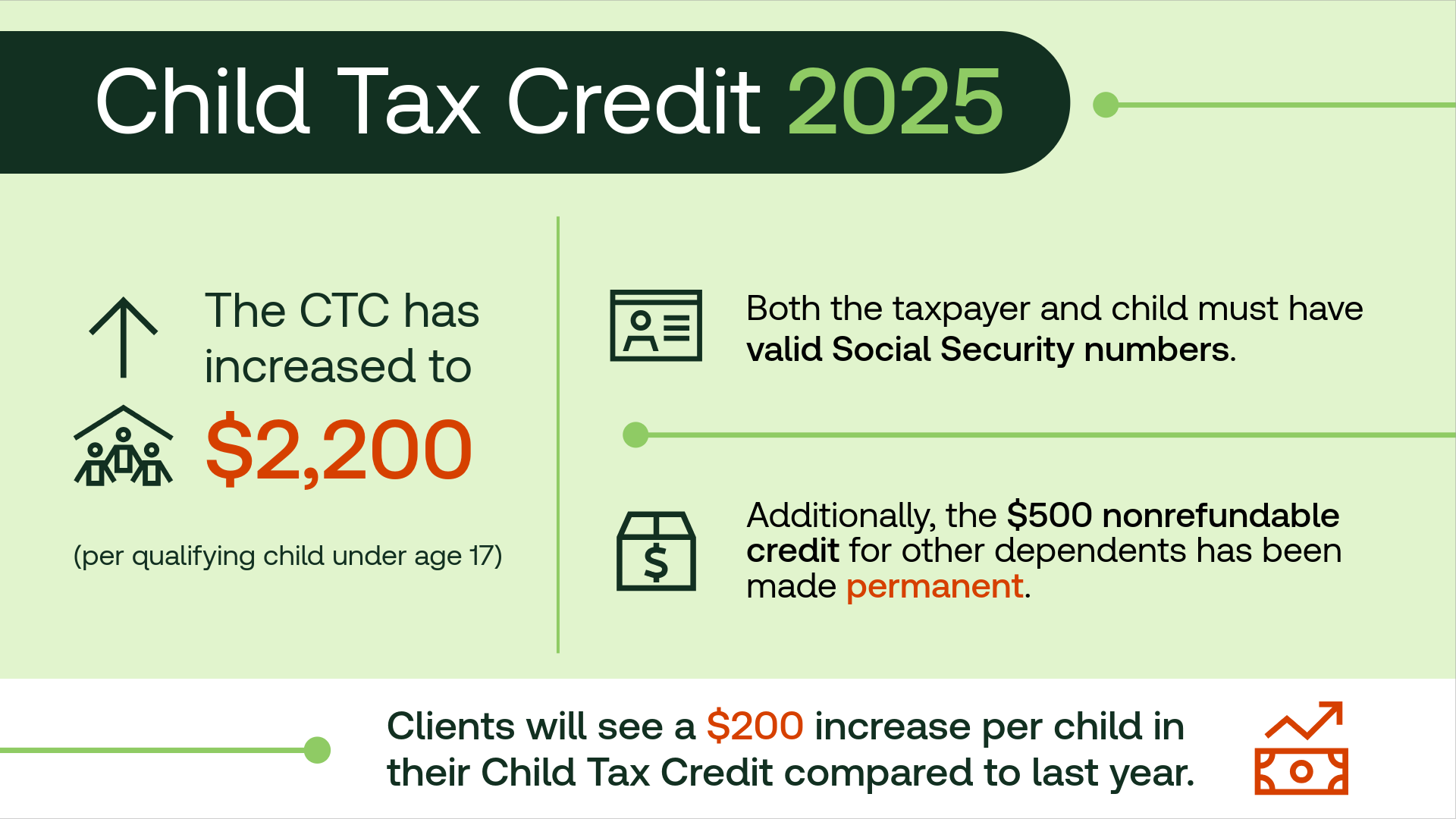

What’s happening with the Child Tax Credit?

On 2025 returns, the Child Tax Credit has increased to $2,200 per qualifying child under age 17, up from $2,000 in prior years. This enhancement is now indexed for inflation going forward.

The OBBBA also tightened identification requirements — both the taxpayer and child must have valid Social Security numbers. Additionally, the $500 nonrefundable credit for other dependents has been made permanent.

Clients will see a $200 increase per child in their child tax credit compared to last year.

Can I deduct more of my state and local taxes this year?

The SALT cap has jumped to $40,000 for 2025 tax returns ($20,000 for married filing separately). This substantial increase from the previous $10,000 cap provides significant relief for taxpayers with high property taxes or state income taxes.

This higher limit especially helps clients in states like California, New York, New Jersey, and Illinois. Note that there’s a phase-out at very high income levels (typically above $400,000 for single filers), so top earners may not receive the full benefit.

This expanded cap continues through 2029 but is scheduled to revert to $10,000 in 2030.

Are there new tax breaks for tips and overtime?

Yes. Congress enacted two valuable provisions in effect for 2025 tax returns:

Tips deduction: Individuals in occupations where tipping is customary can exclude up to $25,000 of tip income earned in 2025. This means the first $25,000 in tips received can be tax-free. The benefit is available whether or not you itemize and decreases for higher earners.

Overtime pay exclusion: Individuals can deduct up to $12,500 of qualified overtime pay they earned in 2025. This effectively makes the first $12,500 of overtime earnings tax-free. This also applies regardless of itemizing status.

Clients need proper documentation to support these claims.

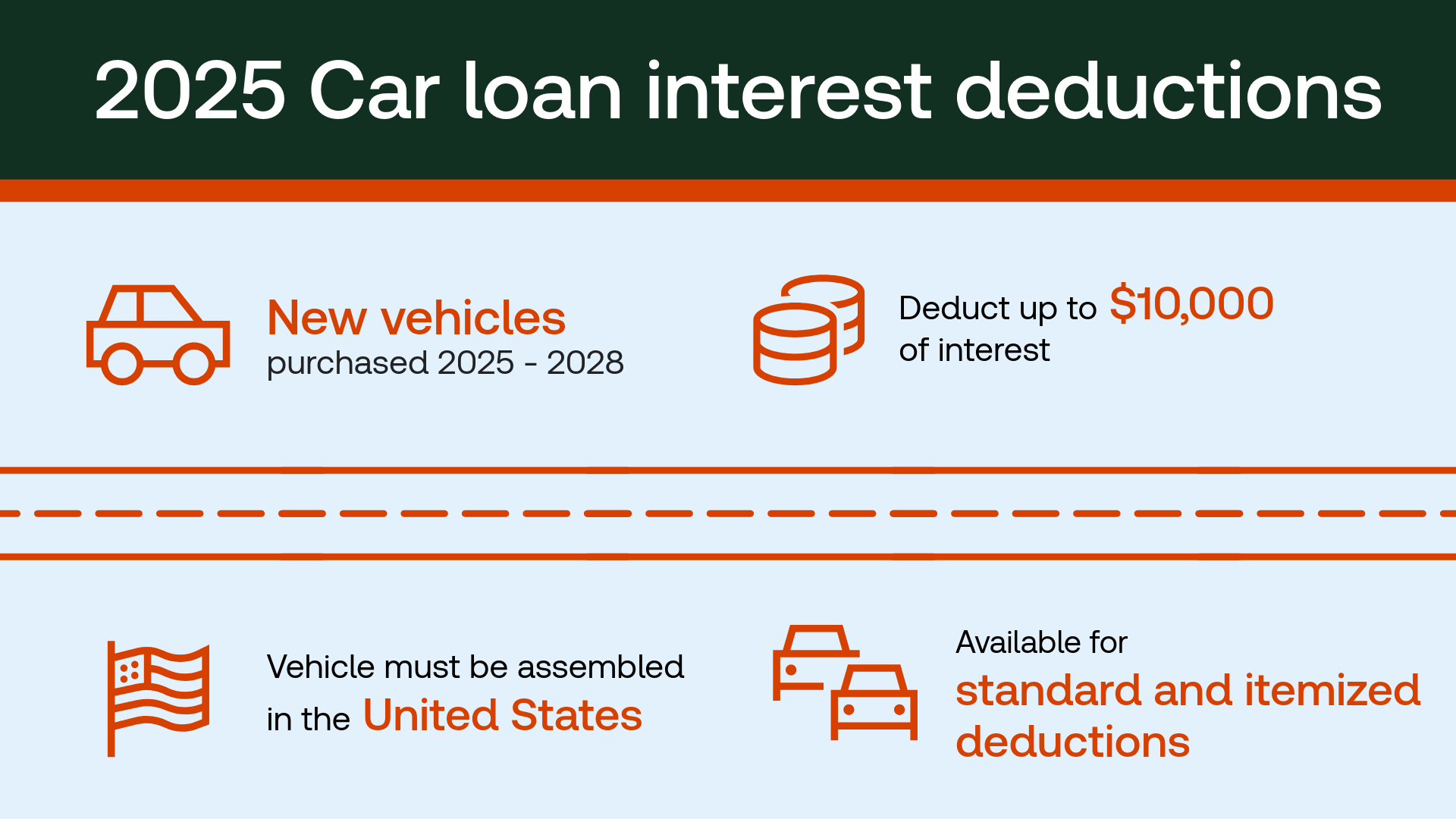

Can I deduct the interest on my car loan now?

Yes. The OBBBA introduces a deduction for interest on qualifying new car loans:

Key requirements:

-

- Applies to new vehicles purchased between 2025 and 2028

- Vehicle must be assembled in the United States

- Deduct up to $10,000 of interest annually on qualifying loans

- Income restrictions apply for high earners

This is an above-the-line benefit, available regardless of itemizing status. Clients who purchased a qualifying vehicle in 2025 can deduct the interest they paid during the year.

Can I deduct charitable donations without itemizing?

Yes. On 2025 returns, taxpayers can deduct up to $1,000 of charitable donations ($2,000 for joint filers) even if they claim the standard deduction. There’s a 0.5% of AGI floor, meaning donations must exceed 0.5% of adjusted gross income to start counting.

For itemizers, the law maintains the generous 60% of AGI limit for cash donations. Clients need proper documentation for all charitable contributions they’re claiming.

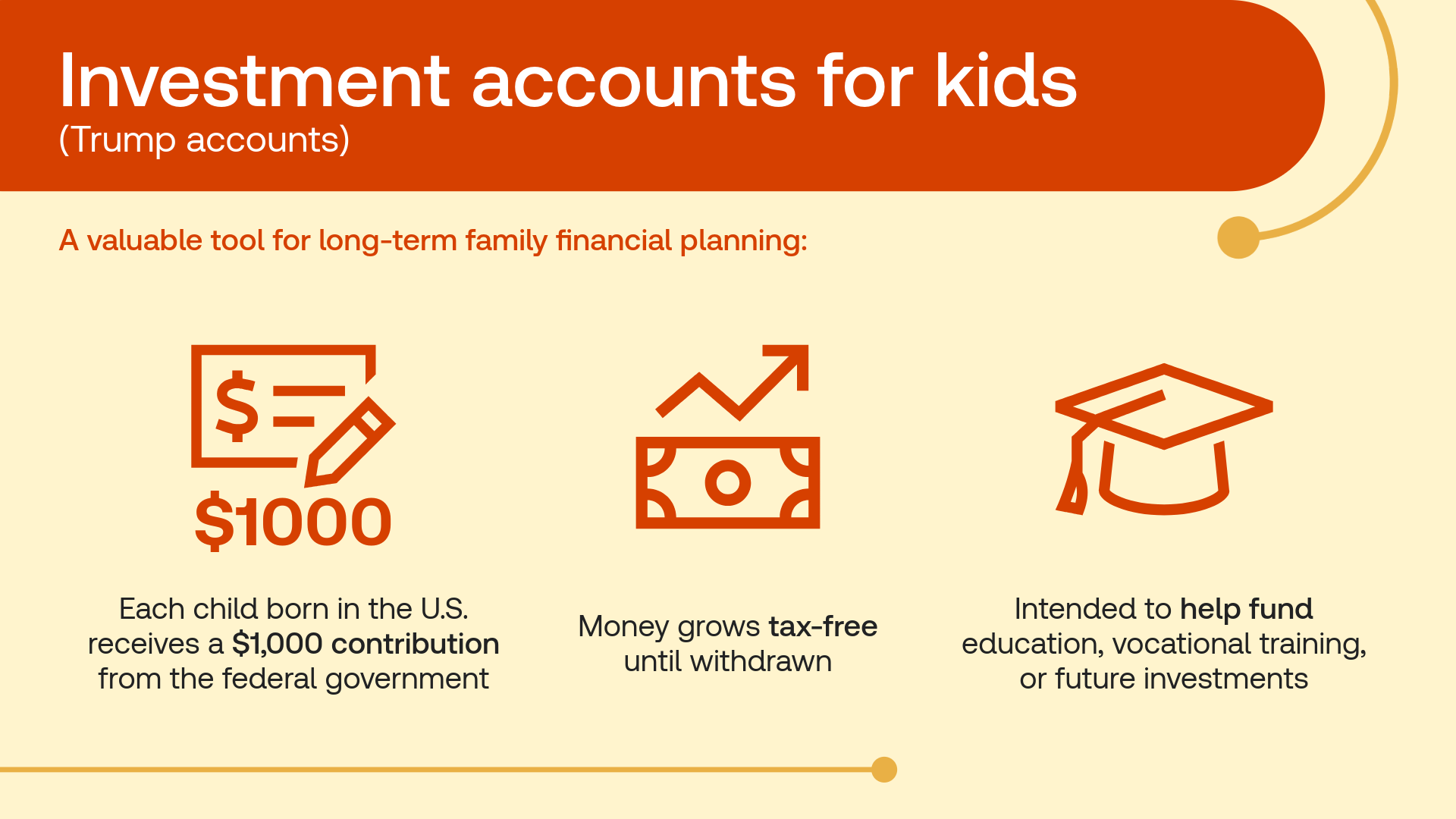

What are these new “Trump Accounts” for kids?

These tax-advantaged accounts, sometimes called “Trump Accounts,” work similarly to 529 plans:

-

- Federal seed money: Each child born in the U.S. during this program’s window receives a $1,000 contribution from the federal government

- Tax-deferred growth: Money grows tax-free until withdrawn

- Flexible use: Intended to help fund education, vocational training, or future investments

For clients with babies born in 2025, they should receive information about establishing these accounts — a valuable tool for long-term family financial planning. Detailed regulations are still forthcoming from the IRS.

Is Social Security income now tax-free?

No, but there’s a significant new deduction. Effective for 2025 through 2028, individuals who are age 65 and older may claim an additional deduction of $6,000, in addition to the current additional standard deduction for seniors under existing law.

Important clarifications:

-

- This is not a repeal of Social Security taxation; it’s an enhanced deduction designed to benefit older taxpayers.

- To qualify for the additional deduction, a taxpayer must attain age 65 on or before the last day of the taxable year. The deduction is available for both itemizing and non-itemizing taxpayers.

- Taxpayers must include the Social Security Number of the qualifying individual(s) on the return and file jointly if married to claim the deduction.

- Clients ages 65 and older can qualify for the deduction regardless of whether they’re currently claiming Social Security retirement benefits.

Did the IRS change the $600 rule for payment apps (1099-K)?

Yes. Congress restored the 1099-K threshold to $20,000 and 200 transactions permanently. The stricter $600 rule has been overturned.

This means when filing 2025 returns, most clients will not receive 1099-Ks for small amounts of income.

Critical reminder: Just because they didn’t receive a 1099-K doesn’t mean income is non-taxable. All income from side jobs, gig work, or online sales must still be reported.

The law also raised thresholds for Forms 1099-MISC and 1099-NEC from $600 to $2,000, effective in 2026.

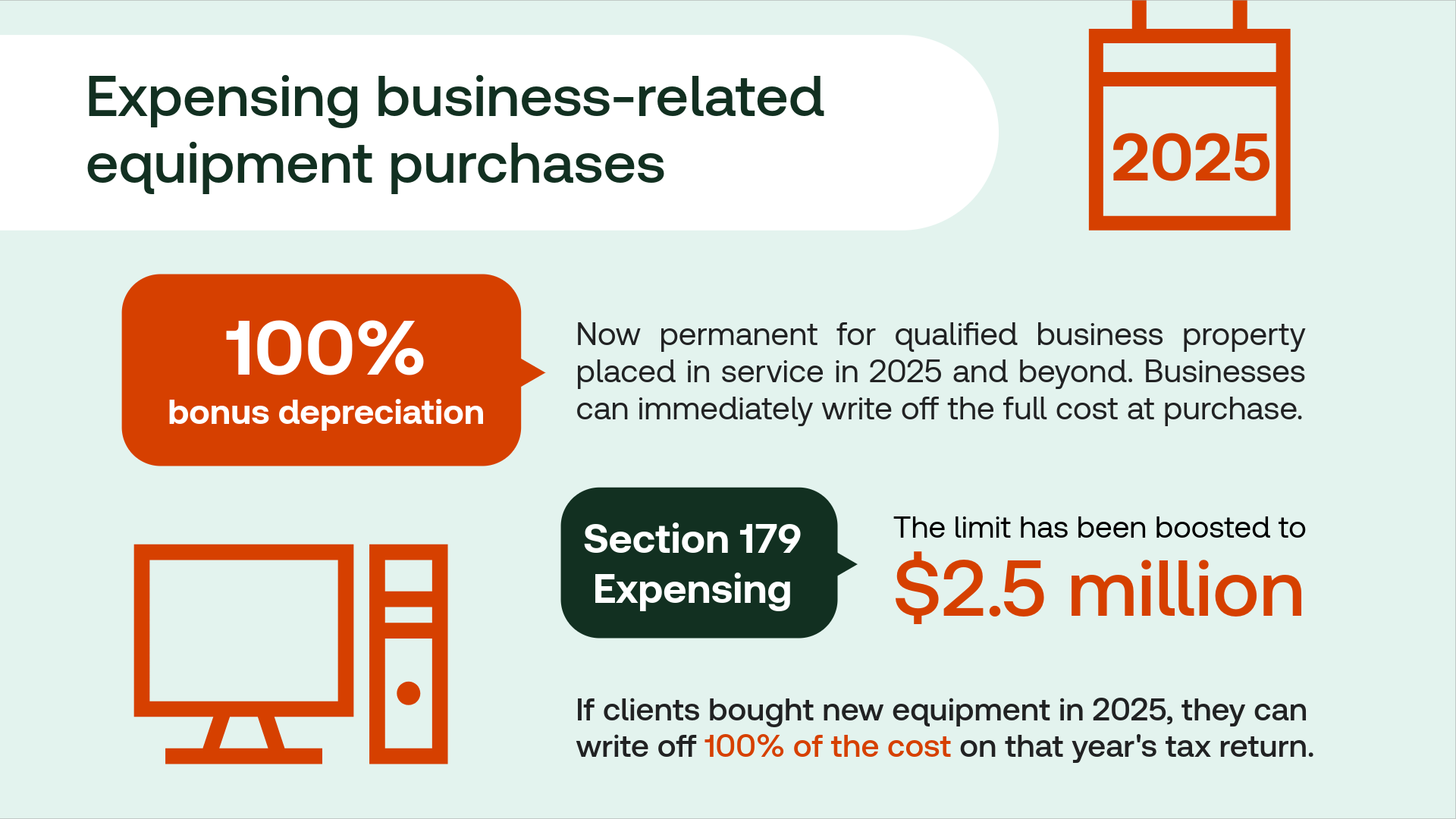

Can businesses still fully expense equipment purchases?

Yes. The OBBBA provided permanent and expanded relief:

100% bonus depreciation: Now permanent for qualified business property placed in service in 2025 and beyond. Businesses can immediately write off the full cost at purchase.

Section 179 expensing: The limit for 2025 has been boosted to $2.5 million (with phase-out starting at $4 million), indexed for inflation and effectively permanent.

If clients bought new equipment or other depreciable business property in 2025, they can write off 100% of the cost on their 2025 tax return.

Do we still have to amortize R&D costs, or did that change?

R&D expensing is back. Congress permanently restored immediate expensing for qualified R&D expenditures starting with 2025 tax returns. Companies can once again expense their domestic research and experimentation costs in the year incurred.

Foreign research must still be amortized over 15 years. Small businesses have an option to retroactively apply these rules to 2022–2024 and amend returns if beneficial.

For 2025 returns being filed now, R&D costs can be fully expensed(a significant win for businesses investing in innovation).

What’s the latest on the Employee Retention Credit (ERC)?

The OBBBA officially barred any new ERC filings after January 31, 2024. The opportunity to file new claims is permanently closed.

The statute of limitations for IRS audits has been extended from 3 years to 5 years for ERC claims, with stiff penalties for promoters who made improper claims.

Action for clients who claimed ERC: Review eligibility carefully. If they suspect an erroneous claim, consider the IRS withdrawal or settlement programs. The IRS prefers voluntary correction over audit enforcement.

Navigate tax season 2026 with confidence

Tax season 2026 offers significant opportunities to reduce your clients’ tax burdens. By staying informed about these OBBBA changes, you can provide confident guidance and demonstrate your value as a trusted advisor.

Stay ahead of complex tax changes

Serve your clients more effectively with these resources:

-

- OBBBA Resource Center — Access detailed analysis, planning strategies, and client communication templates for all One Big Beautiful Bill Act provisions

- CPA firm Resource Center — Stay up to date with current trends and best practices this tax season in our resource library.

- CoCounsel Tax — Get instant AI-powered answers to complex tax questions, cutting research time by up to 70% so you can focus on high-value client advisory work

With the right tools and trusted information, you can turn complexity into opportunity this tax season.

Disclaimer: This information reflects tax law as of December 2025 for tax year 2025 returns (filed in early 2026). The IRS continues to issue guidance on certain provisions of the One Big Beautiful Bill Act, particularly regarding tips and overtime deductions, vehicle interest deductions, and children’s investment accounts. Taxpayers should consult with a qualified tax professional and check IRS.gov for the latest updates and specific eligibility requirements.

CoCounsel Tax

Get straightforward, expert-backed answers to your most complex tax questions in record time

I'm ready ↗