The global tax environment is undergoing a significant amount of disruption, as new regulations are transforming how companies conduct business across borders. One major example of this disruption is manifest in the rise of the Base Erosion and Profit Shifting (BEPS) Action Plan set forth by the Organisation for Economic Co-operation and Development (OECD).

BEPS is no longer an impending event, but an immediate reality for those of us in the world of corporate tax. Over the past year, we’ve seen the G20 finance ministers officially provide their endorsement of the OECD’s measures and numerous countries around the world are now enacting legislation in accordance with these guidelines. And the pressures of complying with BEPS means that companies need trusted answers (both technological and human expertise) to navigate a global trade landscape that is more complex and heavily focused on transparency and accuracy.

What is BEPS country-by-country reporting?

As the cornerstone of the OECD’s recommendations, BEPS country-by-country reporting (CbCR), as outlined in BEPS Action 13, requires multinational enterprises to include detailed financial and tax information relating to the global allocation of their income and taxes, among other indicators of economic activity. In practical terms, CbCR better ensures that adequate taxes are paid in the jurisdiction where profits are generated, value is added, and risk is taken. The ultimate goal, of course, is to promote transparency and accuracy in reporting.

Roughly 50 countries are moving forward with BEPS reporting legislation, including the UK, Australia, Spain, Mexico, the Netherlands, Poland, South Korea and China—with many more expected to follow suit. Additionally, about 40 countries have signed the OECD’s Multilateral Competent Authority Agreement on CbCR (known as the “MCAA”), which calls for the automatic exchange of CbCR information among the signatories. The U.S. finalized its CbCR regulations today, June 29, 2016. This will impact U.S. multinational enterprises (MNEs) in ways they may not yet be prepared for – including the IRS requirement of a new reporting form, Form 8975, Country-by-Country Report, with an income tax return.

How global companies are reacting to CbCR legislation

Because the BEPS guidelines will fundamentally change the course of international taxation and transfer pricing for all multinational enterprises (MNEs), Thomson Reuters, in association with TPWeek, recently conducted its second survey of in-house tax and transfer pricing directors across more than two dozen industries to get a pulse on their level of preparedness and organizational response to BEPS reporting and related legislation. For this recent report, 207 tax professionals were surveyed.

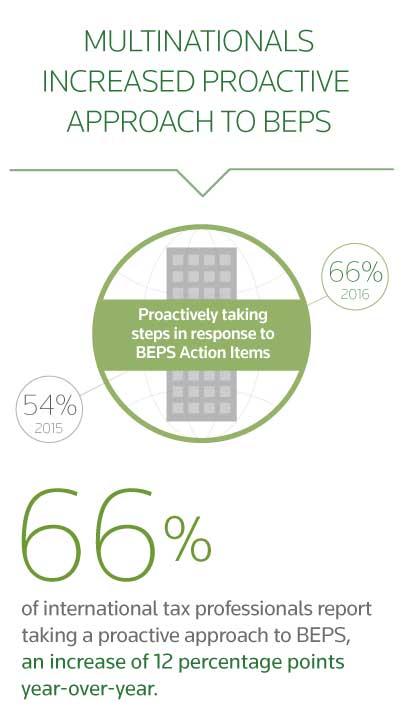

Not surprisingly, the percentage of respondents who are proactively taking steps in response to BEPS has increased by 12 percentage points year-over-year (54% to 66%) among all countries. Similar to last year’s findings, the majority of respondents report that transfer pricing documentation and CbCR are the biggest challenges among all of the BEPS actions.

The majority of respondents from Europe (90%) and Latin America (93%) report the impact they are seeing as a result of BEPS reporting compliance is largely an increase of time spent on the matter. In addition, 33% of all countries report that more staff is needed as a result of BEPS. Interestingly though, many respondents stated that their companies have not yet provided more resources to help their tax departments comply with the demands of BEPS reporting.

Given the intensity with which BEPS reporting legislation is increasing around the world, how can MNEs effectively comply with the demands it places on corporate tax departments? The answer lies in taking a systematic approach that includes a thorough business assessment and proper planning, as well as the use of comprehensive technology and informed guidance.

BEPS reporting and the need for technology and up-to-date research

As countries around the world incorporate the OECD’s recommendations into their domestic legislation to varying degrees, MNEs are challenged to keep pace. For example, CbCR may require companies to file in several jurisdictions—or decide which country to use as the “surrogate reporting entity”. Further, MNEs are faced with the overwhelming challenge of efficiently collecting tax information from multiple data sources within their organization to assemble the CbCR report.

Enter the latest advances in BEPS reporting tax technology. These solutions provide up-to-date research, valuable risk assessments, and intuitive analytics so tax departments can remain current amidst an ever-evolving legislative landscape — and even stay ahead of inquiries from various tax administrations.

With the latest tax technology and research, corporate tax departments gain the ability to track BEPS reporting legislation in each and every jurisdiction worldwide, including effective dates, reporting thresholds, and even nonconformities to OECD guidelines. The technology then automatically applies these rules to the global footprint of an MNE instantaneously, producing a customized report stating exactly which jurisdictions the company needs to file CbCR reports in, how they should file, and by when.

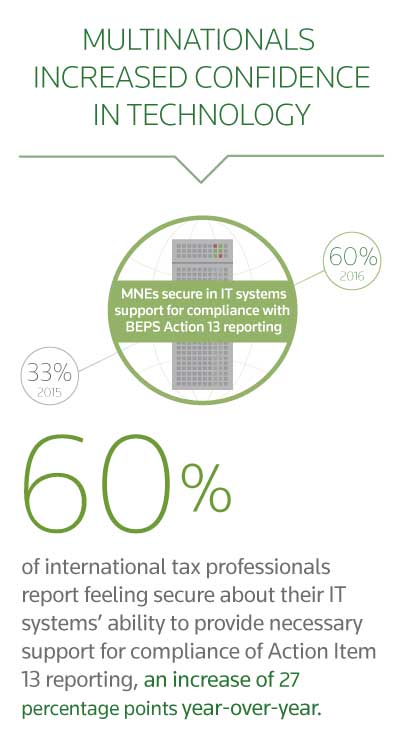

Fortunately, it seems more and more MNEs are understanding this necessity. According to the aforementioned BEPS survey, the percentage of respondents that feel secure about their IT systems’ ability to provide necessary support for compliance with BEPS Action Item 13 increased by a notable 27-percentage points year-over-year (33% to 60%).

So, if you are a part of an MNE corporate tax department and are wondering how to cope with the impact of BEPS reporting, know that having the proper technology is paramount. With it, you can create a standardized and sustainable worldwide tax data collection process enabling you to document and defend your company’s results to taxing authorities around the globe—a necessity in today’s changing global tax environment.

How can Thomson Reuters help you with BEPS Country-by-Country Reporting?

As “The Answer Company,” Thomson Reuters is your global partner for international tax compliance challenges. Our BEPS research and technology solutions address your immediate and ongoing needs for country-by-country reporting and other Action Items, while providing a solid foundation for future impact on your organization.

Checkpoint BEPS Global Currents

With a customizable dashboard of the latest BEPS developments, you can respond proactively to new developments, make strategic plans to minimize impact and ensure you are in compliance with new laws and standards as they are passed.

ONESOURCE BEPS Action Manager

With up-to-date research, valuable risk assessments and intuitive analytics, multinational tax departments can remain current amidst an ever-evolving legislative landscape—and stay ahead of inquiries from various tax administrations.