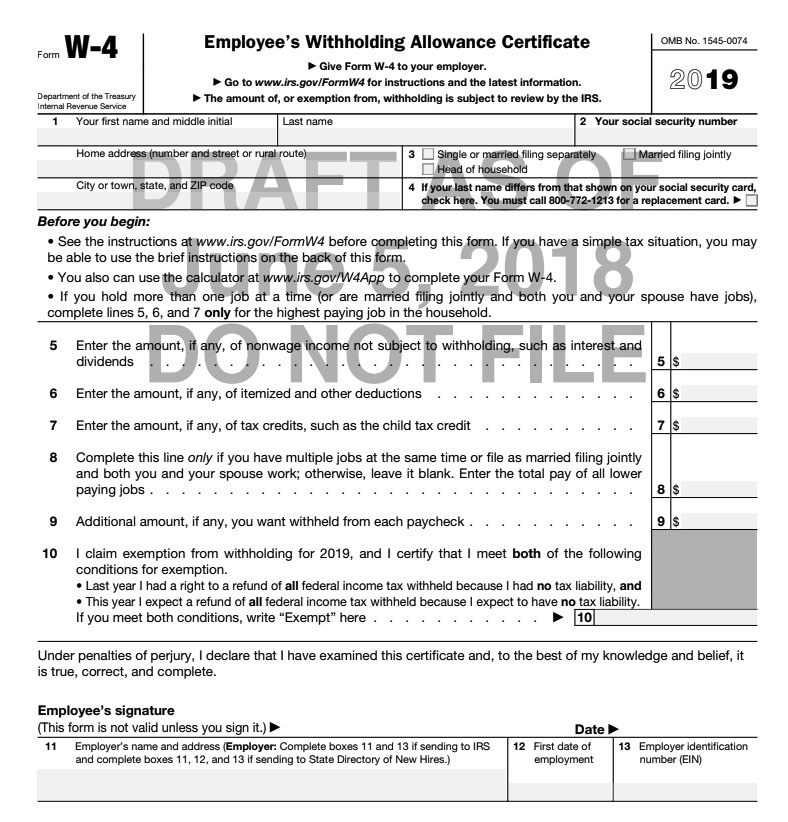

The pre-draft 2019 W-4 has been released, and it’s a major change from previous versions of the W-4.

The new W-4 doesn’t have a way to number allowances — instead, four new boxes that instruct the taxpayer to predict income and deductions replace the old exemption numbers.

The lines are as follows:

Filing status: Line 3 is used to indicate the employee’s tax filing status. The draft 2019 Form W-4 has checkboxes to indicate that the filer is single or married filing separately, married filing jointly, or head of household. The number of default allowances will be calculated automatically in single tables based on the filing status that is checked — 2 if single or married filing separately, and 3 if married filing jointly or head of household.

Lines 5-8. Lines 5-8 are new and completely optional to the taxpayer. These lines mimic a 1040 filing and the IRS indicates that completing them will provide more accurate withholding information.

- Line 5 is for nonwage income not subject to withholding

- Line 6 is for itemized and other deductions (other than the standard deduction)

- Line 7 is for applicable tax credits

- Line 8 is for the total pay of lower paying jobs and is only used when employees have more than one job or are married filing jointly and both spouses work

Completing these lines requires information that employees may not want to share. To avoid completing all lines individually, the IRS recommends using the IRS Withholding Calculator or IRS Publication 505, Tax Withholding and Estimated Tax.

Also, line 9 has additional withholding per paycheck.

The IRS has two draft instructions for calculating withholding — a short instruction with the 2019 W-4 for simple filers and an 11-page instruction guide for more complicated returns (i.e. stock ownership, dividend, and self-employment income). The IRS has indicated that they will advise employers to make the 11-page W-4 instruction booklet available to all employees.

Note: Several states have not adopted the new TCJA rules — the current list is below.

| State | Itemized Deductions | Comments |

| AK | N/A | N/A |

| AL | Yes | N/A |

| AR | Yes | N/A |

| AZ | Yes | Subject to the limitations prescribed by IRC §§ 67, 68, and 274 |

| CA | Yes | N/A |

| CO | No | N/A |

| CT | No | N/A |

| DC | Yes | If taxpayer itemized deductions federally |

| DE | Yes | N/A |

| FL | N/A | N/A |

| GA | Yes | Only if taxpayer also itemized deductions in federal return; Federal Schedule A must be attached |

| HI | Yes | N/A |

| IA | Yes | N/A |

| ID | Yes | N/A |

| IL | No | N/A |

| IN | No | N/A |

| KS | No | For the tax year beginning on and after January 1, 2018 and ending before January 1, 2019, Kansas only allows itemized deductions for 100% of charitable contributions allowable under IRC § 170, 50% of expenses for medical care allowable under IRC § 213, 50% of qualified residence interest provided in IRC § 163(h), and 50% of taxes on real and personal property provided in IRC § 164(a). For the tax year beginning on and after January 1, 2019 and ending before January 1, 2020, Kansas itemized deductions are 100% of charitable contributions allowable under IRC § 170, 75% of expenses for medical care allowable under IRC § 213, 75% of qualified residence interest provided in IRC § 163(h), and 75% of taxes on real and personal property provided in IRC § 164(a). For the tax year beginning on and after January 1, 2020, Kansas itemized deductions are 100% of charitable contributions allowable under IRC § 170, 100% of expenses for medical care allowable under IRC § 213, 100% of qualified residence interest provided in IRC § 163(h), and 100% of taxes on real and personal property provided in IRC § 164(a). |

| KY | No | Effective for taxable years beginning on or after January 1, 2018, Kentucky has eliminated most itemized deductions except for Social Security income, mortgage income, and charitable giving — prior to January 1, 2018, Kentucky allowed most federal itemized deductions |

| LA | No | State does not allow itemized deductions; state allows a deduction for the amount of excess federal itemized personal deductions |

| MA | No | Massachusetts allows certain deductions and exemptions that are part of federal itemized deductions, and Massachusetts does not have a standard deduction |

| MD | Yes | N/A |

| ME | Yes | N/A |

| MI | No | Michigan does not allow itemized deductions (or “below-the-line” deductions) since it adopts FAGI as a starting point for computing Michigan income tax |

| MN | Yes | State starts with federal taxable income so adopts itemized deductions made by taxpayer for federal purposes with certain modifications |

| MO | Yes | N/A |

| MS | Yes | N/A |

| MT | N/A | For 2013, the American Taxpayer Relief Act of 2012 reinstated a limitation on itemized deductions for individuals with incomes above certain thresholds, commonly referred to as the “Pease Limitation”; a limitation on itemized deductions applies to taxpayers whose AGI is more than $300,000 ($275,000 if filing as head of household; $250,000 if filing as single; and $150,000 if married filing separately) |

| NC | No | For tax years after 2013, no itemized deductions included on federal Form 1040, Schedule A are allowed as North Carolina itemized deductions except qualified home mortgage interest, real estate property taxes, charitable contributions, and claim of right repayments; for tax years after 2014, medical and dental expenses are allowed as itemized deductions |

| ND | Yes | N/A |

| NE | Yes | N/A |

| NH | No | N/A |

| NJ | No | N/A |

| NM | Yes | N/A |

| NV | N/A | N/A |

| NY | Yes | Phaseout for taxpayers with AGI exceeding $100,000 |

| OH | No | Ohio does not allow federal itemized or standard deductions |

| OK | Yes | For tax years beginning on or after January 1, 2018, there is a cap of $17,000 on itemized deductions; charitable contributions and medical expenses are exempt from this cap |

| OR | Yes | N/A |

| PA | No | Pennsylvania law has no provisions for standard or itemized deductions |

| RI | N/A | Taxpayers do not have the option to itemize deductions; only the Rhode Island standard deduction is allowed |

| SC | Yes | However, South Carolina does not conform to IRC § 68, relating to the reduction of itemized deductions for certain taxpayers |

| SD | N/A | N/A |

| TN | N/A | N/A |

| TX | N/A | Effective 2008 and after, a limited tax credit is allowed for federal itemized deductions, as limited for state tax purposes |

| UT | Yes | N/A |

| VA | Yes | For tax years after 2017, Vermont uses federal adjusted gross income (previously federal taxable income) as the starting point for calculating Vermont personal tax liability, so the federal standard and itemized deductions are used in calculating Vermont income tax liability |

| VT | Yes | N/A |

| WA | N/A | Wisconsin allows an itemized deduction credit for taxpayers whose federal itemized deductions exceed the Wisconsin standard deduction, and therefore do not conform to the changes made by the 2017 Tax Cuts and Jobs Act |

| WI | No | State does not allow itemized deductions |

| WV | No | N/A |

| WY | N/A | N/A |

Last run 6/18/2018

© 2018 Thomson Reuters/Tax & Accounting. All Rights Reserved.

Furthermore, many states allow taxpayers to use the federal W-4 for state withholding. It’s expected that this will no longer work for 2019 W-4s and most states (exception: PA) will need to come up with their own state version for withholding. Look for an update on this later in the year.

The federal government will allow taxpayers to continue to use their old W-4 status with no need to file a new W-4 — however, the federal government is suggesting all taxpayers review their withholding and see if they need to file a new 2019 W-4 (when it becomes available) for 2019 wages. All new employees hired as of January 1, 2019, and all employees that want to make W-4 changes after January 1, 2019 will be required to use the 2019 W-4.

A second draft is expected sometime around August 2018 with a final version later this year. We will be watching for updates and potential changes.