Jump to:

| What is Schedule K-1? |

| Is Schedule K-1 considered income? |

| Schedule K-2 and K-3 |

| How to process Schedule K-1s efficiently |

Schedule K-1s, which are tax forms used to report a partner’s or shareholder’s income, losses, capital gain, dividends, etc., to the IRS, are sent to more than 40 million U.S. taxpayers each year.

There are several different types of K-1 forms, which we will discuss later, but the K-1 is designed to make it easier to measure the contributions of a shareholder toward the overall performance of a business.

K-1s are sometimes confused with Form 1099s, which are tax information documents for individuals who are not employees, like sole proprietors and freelancers. K-1s, however, are quite different and can come with some complexities for tax and accounting firms.

Let’s take a closer look at K-1s by beginning with the basics.

What is Schedule K-1?

K-1s are tax forms that are used for business partnerships to report to the IRS a partner’s income, losses, capital gain, dividends, etc., from the partnership for the tax year. With the K-1, a partner’s earnings can be taxed at an individual tax rate versus the corporate tax rate.

All pass-through entities, including partnerships, LLCs, and S Corporations must issue K-1s to individual partners and shareholders. The deadline to issue K-1s is March 15th, however, if an extension is filed by the partnership, LLC, or S Corporation, the due date may be extended to September 15th. If September 15th falls on a weekend, the due date is the next business date. When filing their personal tax return to the IRS, individual partners and shareholders will need their K-1 to complete their tax return. Learn more about deadlines and extensions on the IRS website.

There are three different types of K-1 tax forms, which vary depending on the type of business. These are:

- Form 1065 for partnerships: The partnership passes the earnings to the partners who then use the information when filing their individual tax returns to the IRS.

- Form 1120-S for S-corporations: Similar to the 1065, this shows how much each member of the S-corporation earned or lost for the tax year. The IRS looks at the information provided to determine the percent ownership of an individual in an S-corporation.

- Form 1041 for beneficiaries of trusts and estates: This includes the income derived from an estate after the passing of a descendant.

Is Schedule K-1 considered income?

A Schedule K-1 lists taxable income, similar to a W2 or a Form 1099, but only for the particular types of business entities outlined above.

As far as K-1 distributions are concerned, they are generally not considered taxable income.

How does Schedule K-1 affect personal taxes?

In general, a K-1 can affect personal taxes in two ways: either by increasing a partner’s tax liability or by providing them with a tax deduction.

It will likely increase their total tax liability for the year if the K-1 is associated with an income.

On the other hand, if the K-1 represents a loss or expenditure (for example, they are investing in a partnership) then it may result in a tax deduction for the partner and reduce their overall tax liability for the year.

To further illustrate, consider the following example: a partnership records a loss of $40,000 each year for the first two years of operations. In the third year, it makes a profit of $200,000. Therefore, the partnership makes no tax payments on the first two years of losses. For the third year, which is a positive year, the partnership is taxed on $120,000 [$200,000 – ($40,000 x 2)]. The earnings amount is then split between the partners and taxed at their individual income tax brackets.

If a partnership records a loss over the tax year, partners can state the loss on the K-1 and carry the amount forward until a year of profit for a future tax deduction. Furthermore, consecutive years of net losses can accumulate and be used to apply against future income.

Is K-1 income subject to self-employment tax?

As outlined by the IRS, limited partners do not pay self-employment tax on their distributive share of partnership income, but they do pay self-employment tax on guaranteed payments.

General partners, however, are subject to self-employment tax on their distributive shares of income.

W-2s vs. Schedule K-1

Form W-2 is used to report wages paid to employees and the taxes withheld from them. K-1s list taxable income, much like a Form W-2, but partners are not employees and should not be issued a Form W-2.

Schedule K-2 and K-3

Schedule K-2 and K-3 are schedules that pertain to international tax provisions.

As explained by the IRS, Form 1065 Schedule K-2 reports items of international tax relevance and is an extension of the Form 1065, Schedule K.

In general, the Form 1065 Schedule K-3 reports a partner’s distributive share of items of international tax relevance and is an extension of the Form 1065 Schedule K-1.

As of tax years beginning in 2021, pass-through entities with items of international tax relevance must complete the new schedules.

How to process Schedule K-1s efficiently

As noted earlier, K-1 processing can present several complexities for tax and accounting firms. The reasons why K-1 reporting can be challenging include, but are not limited to:

- There is no standard format for K-1s. They can come in a variety of formats and may include free-form text, footnotes, unstructured data, disclosures, and statements. Practitioners must sift through, extract, and process disparate information in a labor-intensive, manual process that takes time and increases the risk of errors.

- The information disclosed on a K-1 may have state, federal, and international tax implications.

- Tiered partnership structures create additional complexity.

Therefore, practitioners must leverage intelligent K-1 software that allows them to extract, review, and aggregate complex K-1 information. With the right solution in place, firms can:

- Minimize risk and costly mistakes associated with manual processing work

- Save time and reduce staff costs associated with K-1 data entry

- Process K-1s with more speed and accuracy than ever before

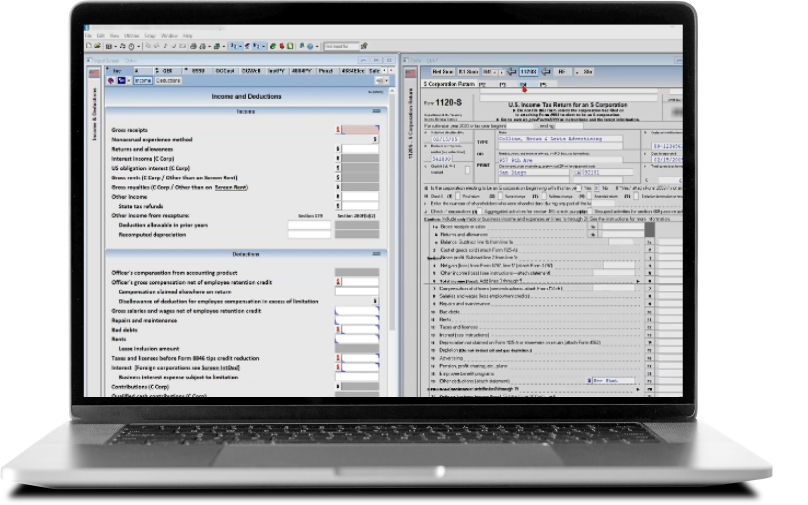

UltraTax CS

Professional tax preparation software to reduce your Schedule K-1 workflow time and increase your productivity

Learn more ↗