Explore the latest development in sales and use tax automation.

Highlights

- Touchless compliance uses agentic AI to autonomously manage sales tax processes with minimal manual intervention.

- Traditional automation reduces time spent, while touchless compliance fundamentally changes the work tax teams perform.

- Advanced systems enable scalability, real-time visibility, and strategic capacity creation without increasing headcount.

Tax automation has evolved beyond traditional software that simply calculates rates and populates returns. While these tools improved manual processes, tax teams still spend countless hours validating data, investigating anomalies, and reconciling discrepancies.

Touchless compliance represents the next evolution — an end-to-end approach that leverages intelligent automation to manage the entire sales and use tax process with minimal manual intervention.

Jump to ↓

Defining touchless compliance

How touchless compliance works

The human-in-the-loop advantage

Key differences: Traditional automation vs. touchless compliance

What advanced sales tax automation enables

Defining touchless compliance

Touchless compliance combines precise automation with agentic AI capabilities to create workflows that don’t just execute tasks but manage processes autonomously. Some industry practitioners also refer to this as autonomous tax compliance, zero-touch processing, or intelligent compliance automation.

Leading practitioners in the space describe this approach as “touchless by default, manual by exception.” This is a fundamental shift from traditional automation approaches.

Think of it this way: Traditional automation does what you tell it to do. Touchless compliance understands what needs to be done and does it.

This distinction matters because sales tax compliance involves continuously changing rules and regulations, as well as reporting requirements, across thousands of jurisdictions (more than 12,000 in the US alone), complex product taxability rules, exemption certificates, nexus thresholds, and data quality issues that traditional automation cannot handle independently.

How touchless compliance works

At its core, touchless compliance systems leverage agentic AI and machine learning that acts autonomously rather than following predefined rules:

Intelligent data management: Actively validates transaction data, identifies anomalies, and flags quality issues so that users stay in the loop and make the final judgement call based on suggested actions. This includes detecting missing data, identifying outliers, and flagging potential errors before they impact filing accuracy.

Proactive process execution: Monitors filing calendars and continuously prepares returns for each filing period, adding data as it comes in, so that users can review on an ongoing basis and see progress/outcomes in advance.

Autonomous anomaly detection: Uses machine learning to analyze patterns and flag compliance issues before they become problems. The system recognizes unusual transaction patterns, unexpected tax liability changes, and potential audit triggers.

Dynamic stay-current technology: Adapts automatically as tax rates change, new requirements emerge, and jurisdictional rules evolve. This includes monitoring legislative changes, rate updates, and new nexus obligations.

Contextual intelligence: Understands data relationships and recognizes when exemption certificates expire or nexus thresholds are crossed. The system maintains awareness of business context, not just transactional data.

The human-in-the-loop advantage

Touchless compliance keeps humans in control while eliminating tedious manual work. Although touchless compliance dramatically reduces manual intervention, tax professionals remain essential for complex judgement calls, unusual transactions, and strategic oversight. Tax professionals handle exception management, maintain strategic oversight, and make judgement calls while AI handles routine execution. The system learns from human decisions and provides full transparency into automated processes.

Beyond traditional automation

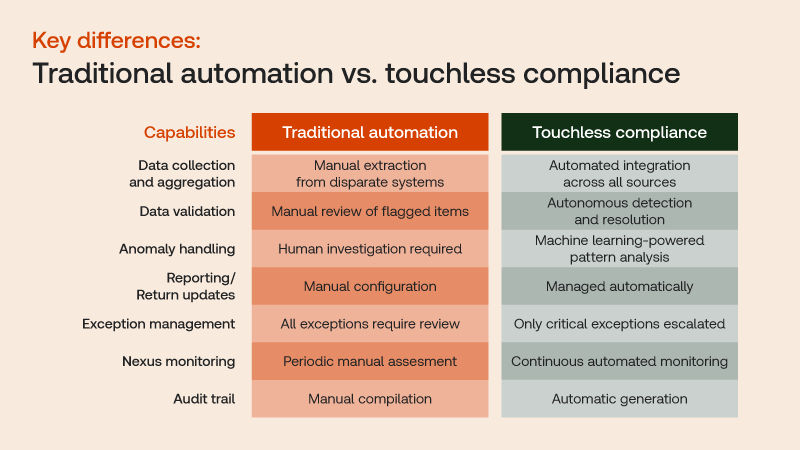

To understand the leap forward touchless compliance represents, consider the differences:

Traditional automation requires you to design the workflow, configure every rule, manually feed data through each step, review outputs for accuracy, and intervene when anything unexpected occurs. It makes existing processes faster but doesn’t fundamentally change how work gets done.

Touchless compliance manages the workflow autonomously, adapts to new situations without reconfiguration, identifies and resolves many issues independently, and focuses your attention only where it’s truly needed. Any changes or decisions made by AI still require final sign-off by a user and are well-documented and fully auditable, ensuring you retain ultimate control. It changes what work you do, not just how quickly you do it.

Traditional automation might reduce a 40-hour compliance process to 25 hours. Touchless compliance might reduce it to 10 hours — and those 10 hours are spent on strategic review and decision-making rather than manual data processing.

Key differences: Traditional automation vs. touchless compliance

What advanced sales tax automation enables

The shift to touchless compliance creates possibilities that traditional automation simply cannot deliver:

Scalability without staffing: Process significantly more returns, often 2-3x the volume, without increasing headcount. For instance, expanding from 5 to 20 states triggers automatic nexus identification, jurisdiction configuration, due date monitoring and return filing — removing weeks of manual work.

Real-time compliance visibility: Instead of discovering issues during return preparation or worse, during audits, you maintain continuous awareness of your compliance position across all jurisdictions.

Proactive risk management: Advanced systems identify potential problems before they materialize, giving you time to address issues rather than react to crises. This includes early detection of nexus exposure, exemption certificate gaps, and unusual liability patterns.

Strategic capacity creation: With significant reduction of manual effort, your tax team gains capacity for the strategic initiatives that drive business value through nexus analysis, planning for business expansion, process optimization, and cross-functional collaboration.

Audit readiness by default: Comprehensive documentation and clear audit trails are generated automatically as part of the compliance process, not assembled after the fact. This includes transaction-level detail, decision logs, and change tracking.

Faster response to business changes: When your company launches new products, enters new markets, opens new locations, or completes acquisitions, compliance systems adapt rapidly rather than requiring weeks of manual setup.

The Thomson Reuters vision

Thomson Reuters ONESOURCE Sales & Use Tax AI embodies the touchless compliance vision, combining deep tax expertise, intelligent automation, transparent AI, and seamless integration.

“At Thomson Reuters, our Corporates vision is clear – compliance should be touchless by default, manual by exception. This isn’t just automation; it’s a fundamental reimagining of the tax function, freeing professionals to drive strategic business advantage,” said Ray Grove, Head of Product, Corporate Tax and Trade, Thomson Reuters. “It’s a testament to our relentless pursuit of innovation, trust, and deep customer understanding.”

The transition ahead

The shift to touchless compliance is inevitable, not optional. Organizations embracing this future of sales tax automation now gain competitive agility, strategic capacity, risk mitigation, and cost efficiency that compounds over time.

The future of sales tax is arriving faster than most organizations realize. Is your organization positioned to make the most of this transition?

This is the first blog in a 4-part series. Stay tuned for Traditional vs. touchless: Compare sales and use tax step by step, Are hidden sales tax risks threatening your business agility, and What if your tax team could focus on strategy instead of spreadsheets.