Update: As of April 9, Trump has paused reciprocal tariffs for 90 days on most countries. The 10% baseline tariff on all imports for other countries will remain in place.

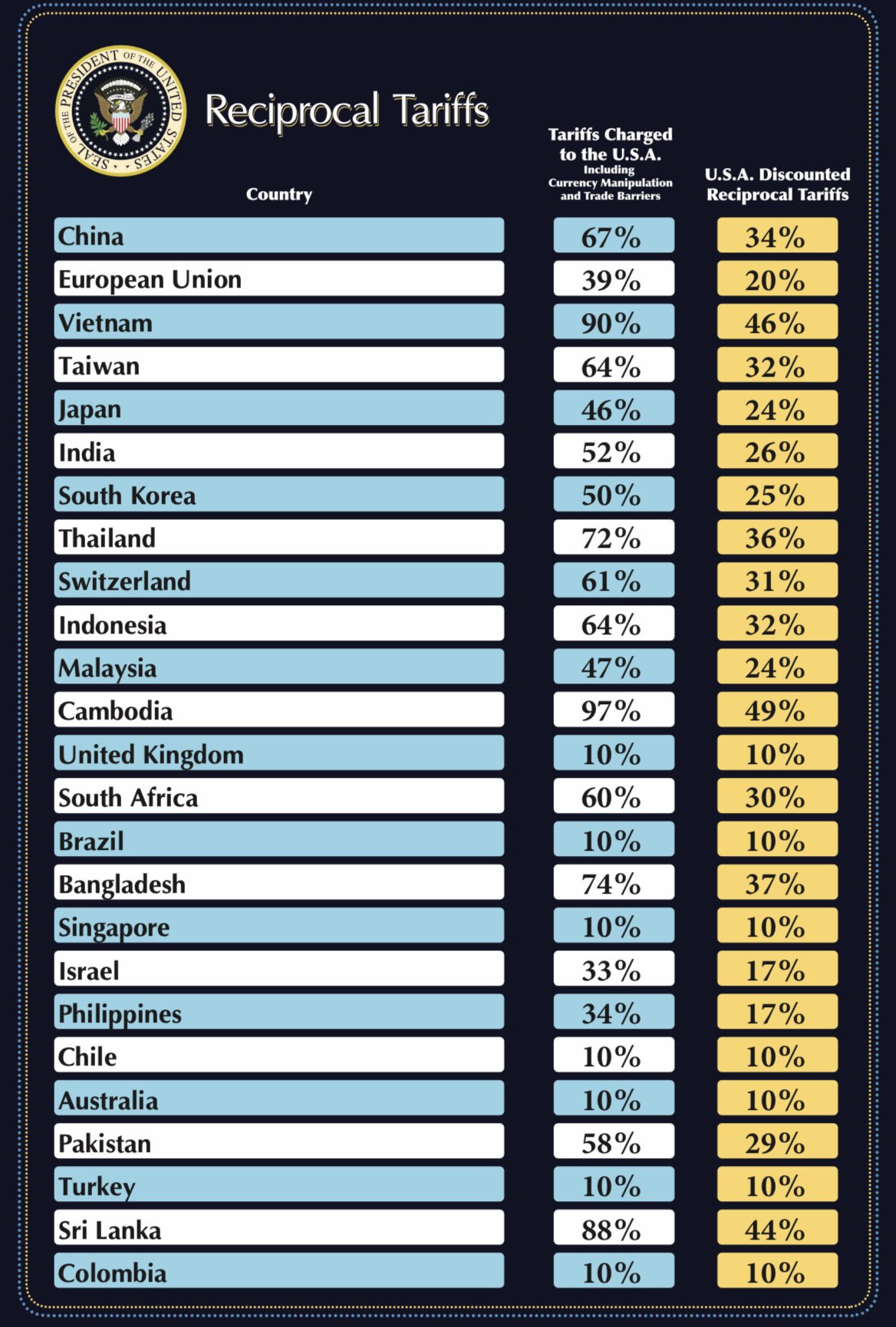

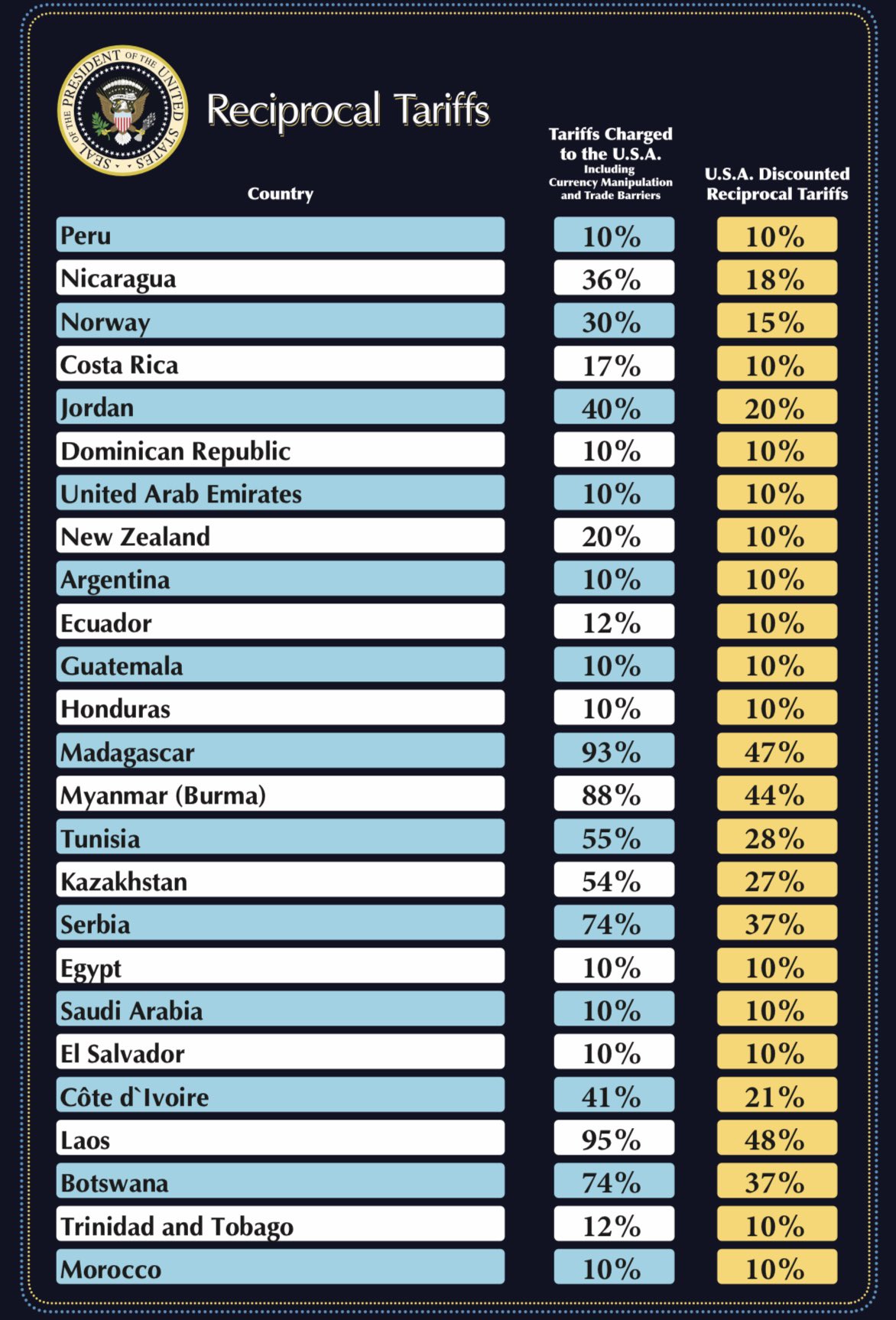

President Trump’s latest tariff announcement on April 2 marks a significant shift in U.S. trade policy. The announcement included a 10% baseline tariff on all imports from any country, set to take effect on April 5. Additionally, a separate set of “reciprocal tariffs” were announced, with the United States imposing higher tariffs, including a 34% tariff on Chinese imports and a 20% tariff on the European Union starting on April 9.

The Executive Order (EO) issued does provide for a number of exemptions including donations, informational materials (50 USC 1702(b)), items under specific Section 232 tariffs (e.g., steel, aluminum, autos), and various sectors such as copper, semiconductors, and pharmaceuticals. There are other important exemptions for Canadian and Mexican USMCA origin/eligible goods. The EO should be referenced for specific details. The tariffs are being implemented, per President Trump, due to “large and persistent trade deficits” with these countries.

Jump to ↓

What countries are impacted by the reciprocal tariffs

Key implications from the tariff announcement

Executive order on the de minimis loophole

Actions for global trade professionals

What countries are impacted by the reciprocal tariffs?

Below is a portion of the list of reciprocal tariffs the United States is imposing on foreign countries. The White House also released an official list from the Executive Order Annex.

The final reciprocal tariff was stated as being determined based on a combination of existing country-specific tariffs as well as non-tariff trade barriers such as “licensing restrictions; customs barriers and shortcomings in trade facilitation; technical barriers to trade (e.g., unnecessarily trade restrictive standards, conformity assessment procedures, or technical regulations); sanitary and phytosanitary measures that unnecessarily restrict trade without furthering safety objectives; inadequate patent, copyright, trade secret, and trademark regimes and inadequate enforcement of intellectual property rights” to name a few. A complete report on trade barriers was published this week by the United States Trade Representative (USTR).

|

|

Key implications from the tariff announcement

Disruption of global supply chains

The new tariffs are likely to disrupt global supply chains, as businesses will need to navigate increased costs and potential delays. Companies that rely heavily on imports from affected countries may face significant operational challenges. For instance, the automotive sector, which is already grappling with a 25% automobile tariff taking effect April 3, may see further disruptions.

Increased costs for businesses

The tariffs will increase the cost of imported goods, which could be passed on to consumers in the form of higher prices. This could lead to reduced consumer spending and a potential slowdown in economic growth. Businesses will need to reassess their pricing strategies and cost structures to remain competitive.

Potential retaliatory measures

Affected countries are likely to respond with their own tariffs, creating a cycle of retaliation that could further destabilize global trade. This could lead to a trade war, which would have far-reaching economic consequences. Global trade professionals should be prepared for a volatile market environment and potential trade disputes.

Market volatility

The announcement has already caused a dip in U.S. stock futures, reflecting investor concerns about the potential impact on the global economy, inflation, and corporate earnings. U.S. stocks have erased nearly $5 trillion of value since February, highlighting the market’s sensitivity to trade policy changes. Investors and businesses should monitor market trends closely and be prepared for further volatility.

Justification and goals

The U.S. Trump administration justifies these tariffs as a response to duties and other non-tariff barriers placed on U.S. goods by other countries. The goal is to level the playing field in trade and bring strategically vital manufacturing capabilities back to the United States. “This is a declaration of economic independence,” Trump said in his announcement speech.

However, many economists and business leaders warn of negative consequences, including higher prices for consumers, reduced competitiveness for U.S. businesses, and a slowdown in global trade.

Selective tariffs

The administration is also considering additional tariffs targeting semiconductors, pharmaceuticals, and potentially critical minerals to address trade issues with China. This selective approach may provide some relief to certain industries but could also create uneven market conditions. Global trade professionals should be aware of these potential changes and their impact on specific sectors.

Managing Tariff series: Minimizing the impact of tariffs using ONESOURCE Free Trade Agreements

Blog

Executive order on the de minimis loophole

On April 2, President Trump also signed an executive order (EO) to close the trade loophole known as “de minimis.” This duty-free treatment covered goods under $800 imported from China and Hong Kong.

This EO is in follow up to previously issued EOs earlier this year that had been temporarily suspended until a process was in place with US Customs and Border Protection to collect the appropriate duties on de minimis shipments. The application of all applicable duties for these shipments will now move forward, effective May 2, 2025. There will be a separate process implemented for de minimis shipment that move specifically by postal carriers.

Actions for global trade professionals

- Monitor the evolving situation: Stay informed about the latest developments in trade policy and their potential impact on your business with newsletters like Reuters Tariff Watch.

- Prepare for supply chain disruptions: Develop contingency plans to mitigate the risks associated with supply chain disruptions, such as diversifying suppliers and building inventory buffers.

- Explore alternative sourcing options: Consider alternative sourcing strategies to reduce dependency on high-tariff countries.

In conclusion, President Trump’s reciprocal tariff announcement has significant implications for global trade. Industry professionals must be proactive in managing the risks and opportunities presented by these new trade barriers. By staying informed and preparing for disruptions, businesses can work through the challenges and uncertainties of the evolving trade landscape.