TAX WORKFLOW

Future of Accounting

Top industry trends to pay attention to

59:52

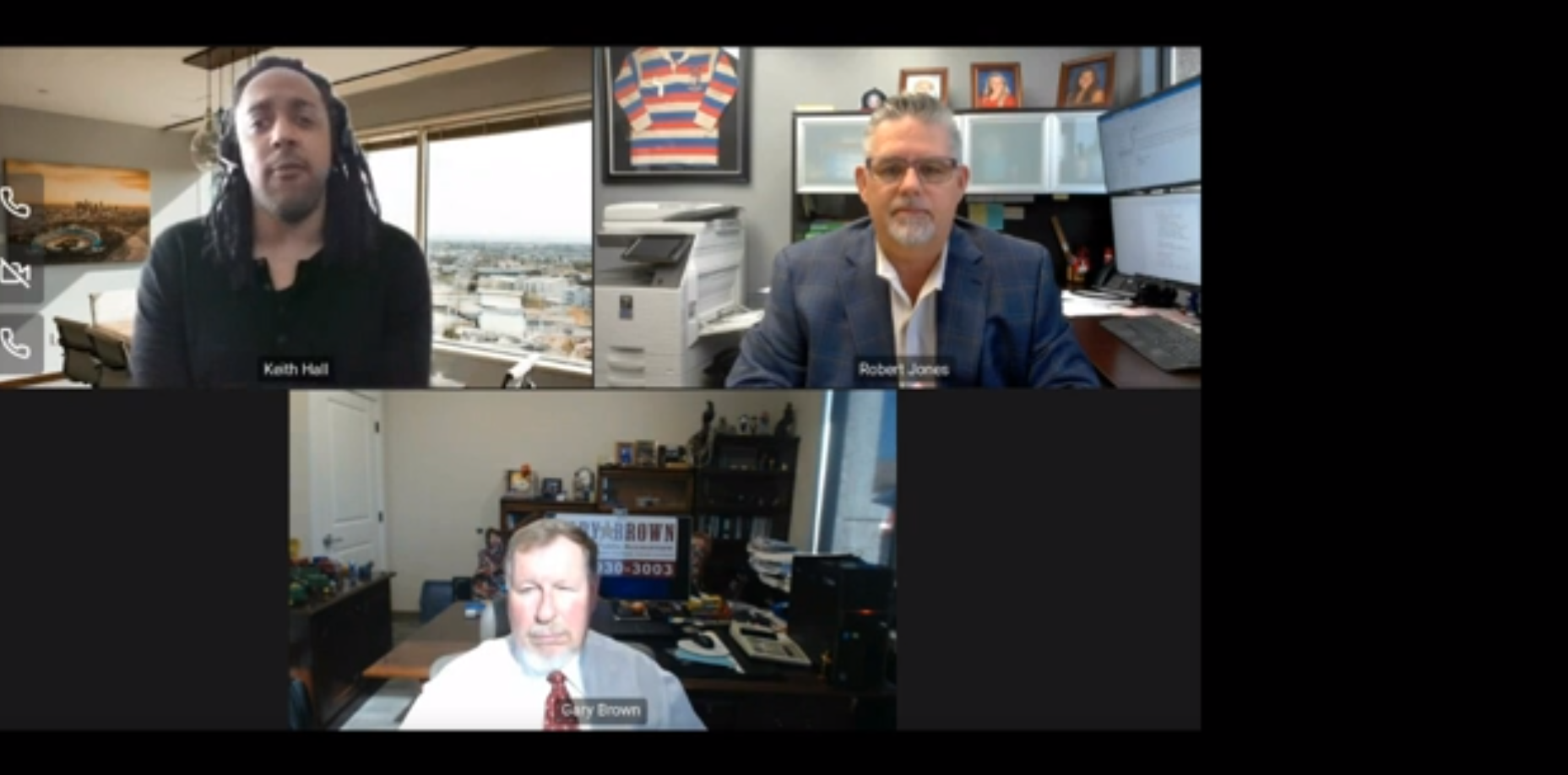

Speakers

Keith Hall

Senior Solutions Consultant

Robert Jones

President and Founder of RC Jones and Associates Inc

Gary Brown

Managing Director of a boutique Georgetown

Join us to discover how to stay ahead of industry trends and ensure your firm is well-positioned to meet future challenges.

The tax and accounting profession is rapidly transforming, driven by technological innovation, regulatory changes, and evolving client expectations. How can you ensure your firm is ready to adapt and thrive in this dynamic environment? What are the best practices and strategies to achieve growth, efficiency, and client satisfaction?

In this on-demand webcast, hear from our panel of industry experts who have navigated these challenges and share their tips on how to:

- Optimize your workflows, leverage technology and automation, and expand your service offerings to meet the needs of your clients and grow your firm

- Identify and deliver value-added services to enhance your client relationships and generate new revenue streams

- Embrace the digital transformation and leverage technology to streamline processes, improve accuracy, and increase productivity

Better tax software with UltraTax CS

Professional tax software for tax preparers and accountants to optimize workflow and increase profitability