Tax and accounting

Tax planning and calculation solutions

Tailor your services and create tax plans for your clients with real-time tax law updates and instant scenario analysis

Open the door to tax advisory operations

From small business tax planning to international tax calculations, empower your staff to better serve clients with innovative tax strategies and advisory services.

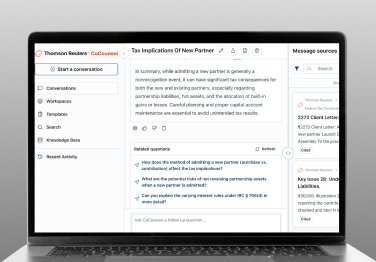

Transform your tax practice with CoCounsel Tax, an AI-powered assistant that combines trustworthy answers, automation, and firm knowledge into one seamless platform. Enhance efficiency, reduce risk, and improve client confidence with CoCounsel Tax.

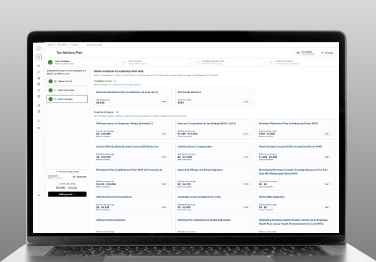

Transform tax compliance work into high-value advisory opportunities with AI-powered strategy identification and guided implementation workflows. Empower staff at all levels to deliver expert tax planning, demonstrate clear value to clients, and create recurring revenue streams.

Simplify your nonresident alien tax compliance process with a powerful software solution. Access the most extensive library for nonresident alien tax issues, including a searchable FAQ database.

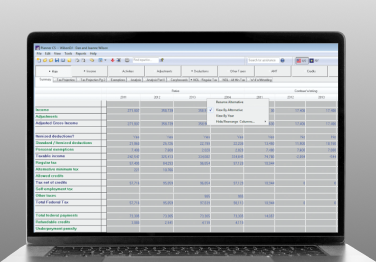

Utilize this comprehensive, long-term tax planning software for accountants to compare different scenarios, provide detailed insight, and create sleek, easy-to-read briefs for clients.

Need help finding the right tax workflow solution for you?

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us