Tax and accounting

Estate tax planning solutions

Optimize your federal estate and trust tax management process with tools designed for estate tax planning and accelerated tax filings

Powerful trust and estate planning software with ONESOURCE

Overcome complexity in managing diverse estate and trust tax laws, save time with automated filings, and reduce the risk of errors in your estate and trust tax calculations.

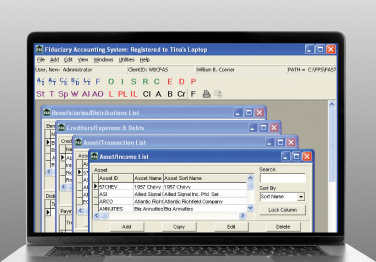

Take advantage of this comprehensive fiduciary accounting software that saves time and prevents errors. Find everything you need for your trust and estate accounting needs in one centralized place.

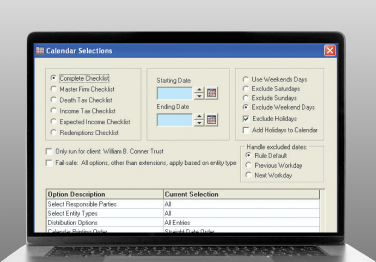

Stay on top of your clients’ needs with an automated fiduciary calendar. View task lists, set reminders, and calculate due dates 1040, 1041, 706, 709, state inventory, and trust and estate deadlines.

Create, analyze, and present estate-planning strategies for your clients with this trust and estate planning software. Clearly communicate the most complex ideas and calculate the effects of different scenarios.

Discover more about our estate planning solutions

Questions about our products and services? We’re here to support you.

Contact our team to learn more about our tax and accounting solutions.

Contact us