Onesource fast sales tax

Sales and use tax rates Real-time tax rates, due dates, and taxability statuses to stay compliant

Why choose Fast Sales Tax

Running a small business is hard. Dealing with indirect tax rates and compliance imposed by state, local, and other tax authorities is even harder. Fast Sales Tax makes it easier, so you can stay compliant and focus on more strategic, value-added activities.

Look up real-time sales and use tax rates for over 1.2 million zip codes across the U.S. and Canada, identify appropriate product taxability statuses, get due dates, and search sourcing rules. From registration to returns, you’ll be backed by the most accurate sales tax database available – the same as those used by Fortune 1000 enterprises. Access everything you need on one platform – accessible via desktop, phone, and Alexa.

What you get with our on-demand sales tax rates and forms

Look up sales and use tax rates by state, county, city or zip code and check whether to calculate sales tax based on origin or destination.

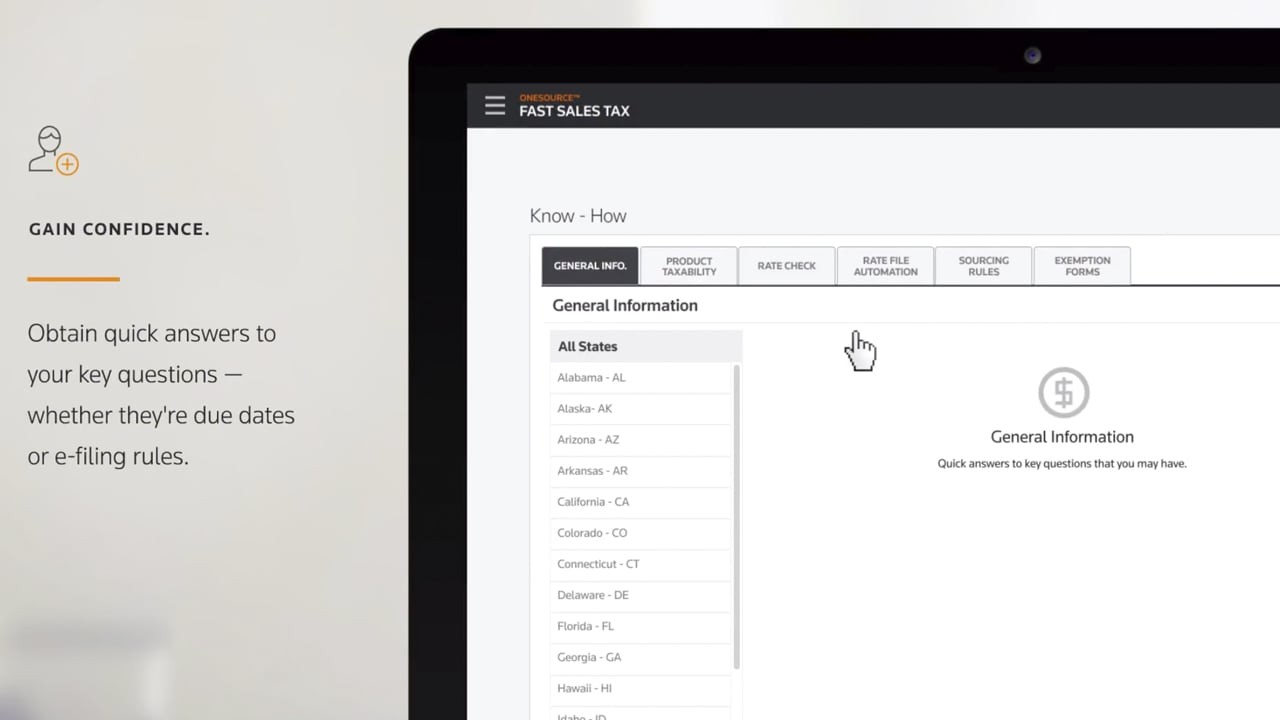

Obtain quick answers to changing sales tax regulations – whether they’re due dates or e-filing requirements.

Our easy-to use-interface provides you with the relevant tax facts you need, in a few simple steps.

Quickly access tax rates, exemption and compliance forms, and taxability statuses for thousands of products and services in every state.

See Fast Sales Tax software in action

Fast Sales Tax: Simple answers to your most complex questions

Not sure where to start when it comes to sales tax rates and compliance? Watch this demo video to learn how Fast Sales Tax provides step-by-step guidance so you get sales tax right.

Get started with Fast Sales Tax

Compare plans, subscribe online, and see how easy it can be to get sales tax right