It's hard to imagine that it has been over a year since the COVID-19 pandemic began. President Biden signed the latest COVID-19 relief on March 11, nearly one year after the first COVID-19 relief bill was passed. The new legislation, known as the American Rescue Plan Act (ARPA), contained several provisions designed to assist employers and employees as the nation slowly gets back to normalcy. This article will highlight the COBRA premium tax credit.

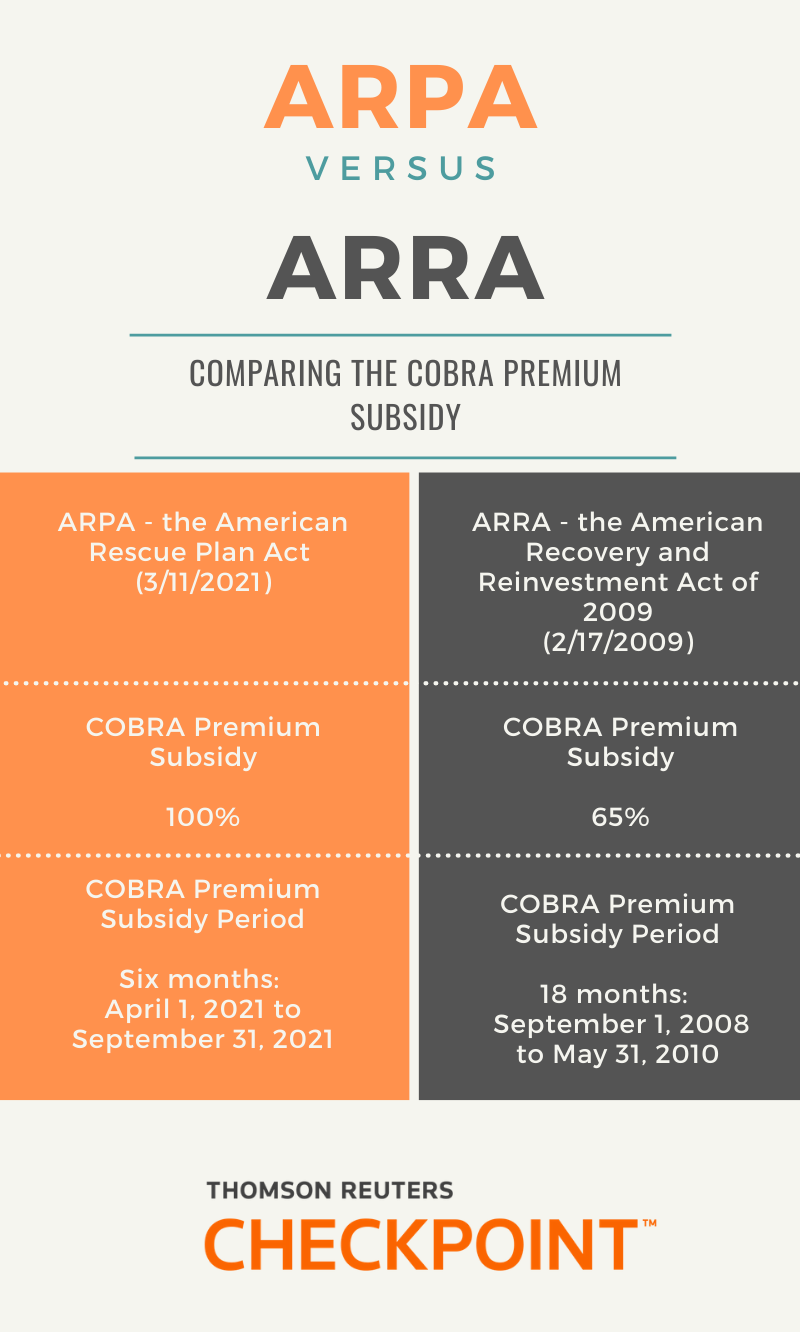

ARPA established a 100% COBRA premium subsidy for continuing health coverage between April 1, 2021 through September 30, 2021.

You may already be familiar with the term COBRA premium subsidy. A similar program was created during the Great Recession from 2007 to 2009 when the unemployment rate soared to over 9%. The American Recovery and Reinvestment Act of 2009 (ARRA) allowed workers who involuntarily terminated to be eligible for health coverage for up to 15 months at a reduced rate through a COBRA premium subsidy. Through ARRA, employees could continue health coverage by paying 35% of the premiums rather than the usual 100% with employers paying the remaining 65%. Employers were reimbursed with a payroll tax credit or a refund if the cost exceeded their tax liability. Credits were claimed through Form 941, the quarterly employment tax return.

Fast forward to 2021, as the COVID-19 crisis continues, the federal unemployment rate held steady at 6.2% in February. Reported state unemployment rates ranged from 2.9% in South Dakota to a high of 9.2% in Hawaii. While most states experienced their highest historical unemployment rates in April and May of 2020, in the initial phase of the pandemic in the U.S., many workers currently remain out of work or must work reduced schedules as virus rates have increased in March 2021.

Unlike ARRA, ARPA provides a 100% COBRA premium subsidy for only a six-month period, from April 1, 2021 to September 30, 2021. The federal government will be funding continuing coverage with employers claiming the reimbursement as a payroll tax credit, much like under ARRA, through Form 941. The credit will be against the employer’s share of Medicare tax. Also, like other COVID-19 related tax credits, such as the COVID-19 paid leave tax credits, this credit may also be advanced, however, we must await IRS guidance regarding this process. The IRS recently confirmed in the IRS payroll industry call, that the advance credit will be claimed through Form 7200 (Advance Payment of Employer Credits Due to COVID-19)) like advanced credits available for wages for the paid leave and employee retention.

Who is eligible?

Beginning April 1, the COBRA premium subsidy must be offered to:

- Your employees who have, beginning April 1, involuntarily terminated or have reduced schedules that make them no longer qualified for health coverage and

- Individuals who are currently enrolled in COBRA coverage.

There is also a special enrollment period that is available for two groups of individuals.

- Group #1: These individuals did not initially elect COBRA coverage but whose COBRA periods have not yet expired. The subsidy is offered for the remaining months of their coverage period. Example: Let’s say an employee was terminated on February 1, 2020 and became eligible for COBRA coverage on March 1, 2020. The 18-month COBRA coverage period would end on August 31, 2021. This means this employee would be eligible for the COBRA premium subsidy from April 1 through August 31, 2021. It does not extend the 18-month coverage period.

- Group #2: Individuals who did elect COBRA coverage, allowed coverage to lapse, but their coverage period has not yet expired. These individuals may have allowed their coverage to lapse because they could no longer afford the COBRA premium payments.

The special enrollment period opens on April 1 and closes after 60 days when notice of the special enrollment period is delivered to the impacted individuals.

What is the COBRA premium subsidy period?

COBRA Premium subsidy coverage period begins April 1, 2021 and lasts until:

- the first month the individual is eligible for Medicare or coverage by another group health plan;

- the end of the maximum COBRA coverage period (usually 18 months); or

- September 30, 2021.

While eligibility is based on a reduction in hours or an involuntary termination, ARPA does not define this term. However, when the COBRA premium subsidy was in play under ARRA, the IRS issued guidance on what constitutes an involuntary termination. We may be seeing similar guidance soon.

What are the new notice requirements for the subsidy?

The ARPA COBRA premium subsidy provisions feature three new notice requirements.

The first notice is required to inform Assistance Eligible Individuals (AEIs) of the availability of the subsidy and of the option to enroll including the option to enroll in different coverage (if permitted by the plan). It must be provided to individuals who become eligible to elect COBRA during the period beginning on April 1, 2021 and ending on September 30, 2021. The notice requirement may be satisfied by amending existing notices or including a separate document along with them.

The second new notice must be sent to individuals and their qualified beneficiaries who elected but discontinued COBRA coverage before April 1, or did not elect COBRA, but whose coverage period has not ended. They must receive notice of the extended election period by May 30, 2021. Generally, if an individual’s qualifying event occurred before October 1, 2019, the individual would not qualify for the subsidy.

The third notice must be provided to AEIs between 45 and 15 days before the date on which an individual’s subsidy will expire, unless the subsidy is expiring because the individual has gained eligibility for coverage under another group health plan or Medicare.

Previously announced COBRA deadline relief does not apply to the notices or the election periods related to COBRA premium assistance available under ARPA.

The DOL has released model notices.

- Model General Notice and COBRA Continuation Coverage Election Notice

- Model Notice in Connection with Extended Election Period

- Model Alternative Notice (coverage subject to state continuation requirements)

- Model Notice of Expiration of Premium Assistance

What about state mini-COBRA laws?

The ARPA COBRA premium subsidy provision also applies to state mini-COBRA laws that require continuing coverage under certain qualifying events. Generally, these state COBRA laws apply to smaller employers – those with fewer than 20 employees. State mini-COBRA laws differ from the federal COBRA law. Corporations operating in multiple states must be aware that state mini-COBRA requirements will vary. Also, we may see states respond with legislation to provide greater access to premium assistance.

The length of state mini-COBRA eligibility varies from as little as 63 days in Oklahoma or up to 36 months in New York. The length may also have exceptions that may provide extensions in certain circumstances.

The following states do not have laws regarding continuing coverage of any kind: Alaska, Idaho, Indiana, Michigan, Montana, and Nevada (repealed). Alabama and Hawaii do not have a mini-COBRA law, but do require continuing coverage based on very specific circumstances.

What’s on the horizon?

Thomson Reuters expects:

- IRS guidance, similar to what was offered for the COBRA premium subsidy under ARRA.

- The IRS to revise Form 941 once again to accommodate claiming the COBRA premium subsidy credit for the new subsidy period. The IRS recently confirmed that a revision to Form 7200 is in the works to allow employers to claim an advance on the subsidy when the cost of premiums exceed payroll tax liability.

- Possible state amendments to existing mini-COBRA laws.

Please consider reaching out to a knowledgeable salesperson at Thomson Reuters Checkpoint to learn more about how a payroll subscription can help your business.

Resources: