During his remarks on the one-year anniversary of the funding provided to the IRS by legislation from last year, Commissioner Daniel Werfel indicated that the electronic filing of the form used to make adjustments and corrections to previously filed employment tax returns is coming soon.

New IRS funding and plan

The Inflation Reduction Act of 2022 (P.L. 117-169) was signed into law by President Joseph Biden on August 16, 2022, with a provision that allocates nearly $80 billion in funding over a 10-year period to the IRS. Although the Fiscal Responsibility Act of 2023 (P.L. 118-5) clawed back some of the IRS’s funding during federal government debt ceiling negotiations, the Service has continued with the plans in its Strategic Operating Plan for 2023 through 2031.

Adding more electronic filing

The numerous plans the IRS has for the funding include modernizing operations by adding more electronic filing options for many more forms that are submitted to the Service. This includes employment tax returns. A May 4, 2022 report from the Treasury Inspector General for Tax Administration (TIGTA) said that employment tax returns continue to provide the most significant opportunity for growth in business e-filing. TIGTA recommended the IRS develop a Service-wide strategy to prioritize and incorporate all forms for e-filing.

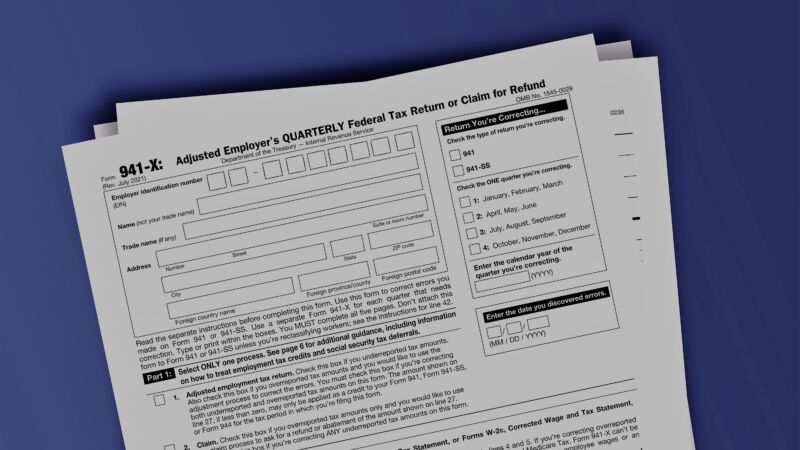

Backlog of adjusted employment tax returns

During the COVID-19 pandemic, the IRS accumulated a large backlog of submitted forms, which includes employment tax returns such as Form 941 (Employer’s Quarterly Federal Tax Return) and Form 941-X, (Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund). Throughout the nation’s health emergency and currently, the IRS has recorded the backlog of several forms, including Forms 941 and 941-X. As of August 10, 2023, the IRS has 1.8 million unprocessed Forms 941 and 505,000 unprocessed Forms 941-X, as of August 9, 2023.

The IRS explains that these tax returns are processed in the order they are received and that some of the Forms 941-X cannot be processed until the related Forms 941 have been managed. The Service also indicates that although not all of the backlogged returns involve a COVID-19 tax credit, the inventory is being worked on at two sites (Cincinnati and Ogden) with trained staff to work on any possible tax credits related to the pandemic.

Employee retention credit causing issues

The employee retention credit (ERC) is among the number of tax credits enacted by federal legislation aimed at helping employers and employees during the COVID-19 health emergency. Only certain employers may qualify for the ERC on qualified wages paid between March 13, 2020, and December 31, 2021, and the IRS has spent a significant amount of time warning employers about ERC scams and frauds – even including ERC claims on its annual “Dirty Dozen” list of tax scams.

Credit can still be claimed

Although the eligibility time period for the ERC has passed, eligible employers can still claim the tax credit on an amended employment tax return. In general, the deadline for filing a Form 941-X to claim the ERC is April 15, 2024, for 2020 tax periods and April 15, 2025, for 2021 tax periods. However, currently, Form 941-X can only be filed on paper. There is no electronic filing option.

Calls for eliminating form and credit backlogs

In its mid-year objectives report to Congress this June, the National Taxpayer Advocate (NTA) said that a large portion of the delay in processing Forms 941-X is due to ERC claims and added that the Service must “eliminate the word ‘backlog’ from its vocabulary in 2024 by modernizing the processing and scanning of paper returns, focusing on suspended returns, issuing all pending refunds before the close of the year, and starting filing season 2024 fresh.”

IRS says valid ERC backlog cleared

On July 26, 2023, an IRS press release included a statement by Commissioner Werfel that the IRS shifted efforts after successfully clearing the backlog of valid ERC claims and the Service adjusted its focus toward intensifying compliance work and putting in place additional procedures to deal with fraud in the program.

Form scanning initiative

Commenting on one year into its modernization efforts under the Inflation Reduction Act, Commissioner Werfel said that the IRS has made significant progress toward its goals and reached new milestones in its Paperless Processing Initiative. Specifically, the IRS has scanned about 849,000 forms in 2023, including about 304,000 Forms 941.

E-filing Form 941-X in the future

In an early release draft of Form 8879-EMP, E-file Authorization for Employment Tax Returns, the IRS states that sometime in 2024, the IRS expects to make filing an amended employment tax return on Form 941-X available as part of its Modernized e-File.

Commissioner confirms

In response to a question from Thomson Reuters during the question and answer portion of the Treasury Department’s press call regarding the Inflation Reduction Act’s one-year report card, Commissioner Werfel said, “That is the ambition that we have,” regarding the ability to e-file Forms 941-X, among others.

“In 2024, the upcoming filing season, the goal is that if you’re a taxpayer who chooses to do all of your work with the IRS electronically, you will have that option,” Werfel stated. He added that the IRS will continue to accept paper for employment tax returns as there is no e-filing requirement and said the IRS aims “to meet taxpayers where they are.”

The 50th IRS Commissioner further explained that even if the IRS continues to get a significant volume of Forms 941-X by paper since e-filing is not required, the IRS expects to be able to handle that volume with digital scanning. “By 2025, every piece of paper that comes through the IRS’s front door will be digitized,” Werfel noted. He continued to say digitizing forms allows the IRS to store forms more efficiently and to process them quicker.

Stay up to date with changing regulations in the tax and accounting industry with Thomson Reuters accounting solutions.