Co-authored by Fateh Maouche

“Dubai Customs requires all free zone companies to have or develop an Inventory System by not later than 01/01/2019.”

Dubai Customs recently shared the announcement above about Jebel Ali Free Zone (JAFZA) based companies. According to Dubai Customs procedures for the Free Zones, JAFZA entities are contractually expected to be able to trace product arrivals, removals, transformations and disposals into, from and within the free zone environment with an automated stock accounting and control systems.

Regulatory requirement:

The essential technological related customs accounting requirement specified for all licensed operators in Jebel Ali Free Zone (JAFZ) is as follows:

“All free zone companies have to maintain a fully computerized, thoroughly auditable and accountable inventory control system based on free zone or internal transfer Customs approved bills of entries against the goods imported from overseas or purchased from Free Zone clients and the subsequent deliveries to their clients on ex-FZ bills (FZ Transit Out) by referring those free zone/transfer bills of entries. These inventories should be produced to customs on request for inventory reconciliation with customs records.”

In other words:

- The physical location of any goods entered into JAFZA should be traceable;

- The quantity and weight of goods entered into JAFZA should equal the quantity and weight of goods exited from JAFZA;

- The value of the exits should be equal to or exceed the value of the entries.

Tracking and tracing of (Transits-In) and Inverse traceability of (Transits-Out):

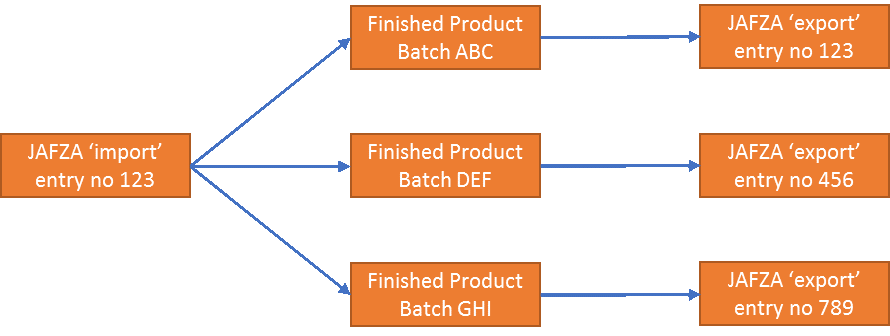

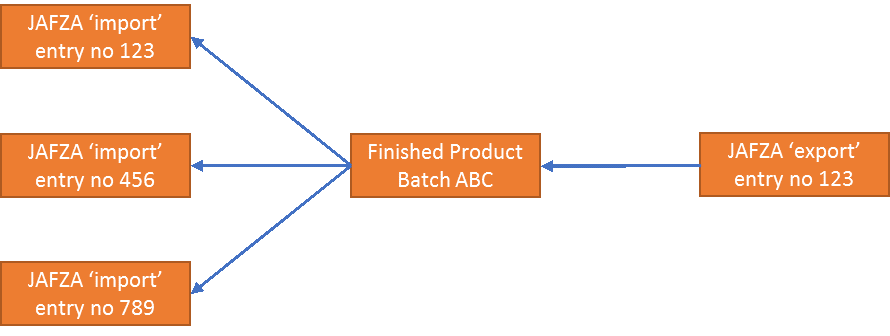

It is essential that each product arrival (‘import’) into JAFZA can be tracked and traced via the inventory control system through to its ultimate disposal and removal (‘export’) from the free zone regime, i.e.; accounting and reporting functionality is needed to tie up each import entry into the free zone with the corresponding export entry (or entries) for the same product(s). Equally, each product export from the free zone can be traced back to its corresponding import entry (or entries),

Diagram 1: Tracking and tracing of product arrivals (splitting)

Diagram 1: Tracking and tracing of product arrivals (splitting)

Diagram 2: Tracking and tracing of product arrivals (combining)

Inventory tables and customs reports:

As part of the data suite for the stock tracking and tracing and Inventory Control System summarized above, JAFZA businesses would require procedure and stock and record management system to record the following information:

Inventory Movement:

Inbound:

- Item Code

- Description

- Ref.# (Transit.in/BOE/ FZ. Transfers)

- Doc Date

- HS Code

- Quantity

- Gross weight

- CIF Value

Outbound

- Ref.# (Transit out/Import Dec/ FZ. Transfers)

- Inbound ref#

- HS Code

- Item Code

- Description

- Quantity

- Gross weight

- CIF Value

Inter alia, it is also expected that these inventory records would be able to provide as-required reports on the following:

- A balance of in-hand free zone stock by HS code and associated import entry declarations

- A record of free zone stock consumption by HS code and associated import and export declarations

- Tracking of product weights and values by HS code and by import declarations versus corresponding export declarations (including internal free zone product transfers)

Technology for JAFZA Compliance

Depending on the “As Is” processes, when considering a technology solution to assist with JAFZA operations, it is important the solution can minimally:

- Provide computerized stock accounting commensurate to Dubai Customs requirements

- The validation mechanism of balances between the customs documents vs incoming documents vs ERP entry movement is managed to current counts

- Document reconciliation accounts for values, quantities and weights of products compared to reports issued by the customs authorities

- Documents are digitally stored

- The solution can ensure precise traceability and accountability of raw materials, parts and finished products to balances

- Interface with ERPs and other internal systems and service providers i.e.; Freight Forwarders, Customs Brokers…etc., or operate as a stand-alone FZ balanced accounts solution

- Produce audit reports

The Cost of Noncompliance

If a Dubai Customs’ comparison between a JAFZA Company’s inventory counts and the processed Customs declarations (Import and Export) results in a quantity, weight or value mismatch for a given period, then the company will be subject to a Customs audit whereby they will be asked to produce a Customs reconciliation.

The irreconcilable (quantity, weight or value) from the transit-in declarations against the transit-out declaration is considered as non-declared goods imported to Local (mainland UAE) from Free Zone. Pursuant to article 143 of the GCC Common customs Law, this action is deemed as smuggling and subject to fines.

The risks arising from improper management of the Free Zone Customs Compliance can be summarized as follows:

- It could be considered as a smuggling act.

- Payment of 5% customs duty.

- Fines will be imposed on the irreconcilable value.

- Loss of privileges and possible termination

Beyond Customs Compliance

A movement of goods from JAFZA into the mainland UAE is treated as an import of goods into the UAE. Administrative and tax evasion penalties can be imposed by the FTA (Federal Tax Authority), if a company fails to keep the required records and documentation or not pay the tax due. The FTA will apply risk-based selection criteria to determine companies to be audited and conduct audits separately from Dubai Customs, with as little as a 5 days’ notice.

The expectation from JAFZA is that companies will automate the process of tracing their product arrivals, removals, transformations and disposals into, from and within the free zone environment.