With busy season behind you, now is the perfect time to get a head start on next year’s tax season. Check out these five tax practice tune up tips for the off season.

Tax season can be a hectic time for tax professionals, but the off-season is a perfect opportunity to take stock of your practice and make sure you’re ready for the upcoming year.

To capitalize on the extra time you have during the off-season, we’ve compiled five best practices that are sure to help you get ahead of the game and make the next tax season more productive and profitable.

Jump to ↓

| Embrace AI and automation |

| Standardize your workflow |

| Enhance client experience |

| Focus on data analytics |

| Increase profitability |

1. Embrace AI and automation

Technology can be a powerful asset to any tax practice, but amidst an ultra-competitive business environment, incorporating artificial intelligence (AI) and automation is no longer an option, but a necessity.

One of the primary benefits of integrating AI into your firm’s daily workflow is that AI-enabled tax software can analyze vast volumes of financial data in a fraction of the time it would take a human accountant — identifying patterns, anomalies, and trends with precision. Not only that, but automated processes reduce the likelihood of human error in calculations and data processing, leading to more accurate financial reporting and analysis.

In addition, AI-powered tax research can help staff find targeted search results in less time. By providing professionally summarized answers, complete with citation links to relevant editorial content and source materials, even junior staff can quickly answer complex client questions with confidence.

During the off-season, consider piloting AI-powered tax solutions to test their effectiveness and refine your implementation strategy. This minimizes disruptions and ensures a smoother transition when the technology is fully deployed during tax season.

2. Standardize your workflow

As the off-season continues, it’s important to take stock of your tax practice and ensure that you are prepared for the upcoming tax year. The first step in this process is to review and analyze your current workflow. Doing so will help you identify any areas where you can improve or make adjustments.

When reviewing your processes, it’s essential to evaluate existing technology and software to determine if it is meeting the needs of your practice. Consider whether there are features or additional tools that could make completing tasks more efficient for your team. Also, when assessing your processes, ensure that they adhere to all applicable laws and regulations.

With AI here to stay, look for areas where manual processes can be automated – such as billing, invoicing, or customer communication – as automating these tasks can save time and effort in the long run.

3. Enhance client experience

During the off-season, take some time to analyze client data and consider developing more tailored advisory services that address the unique challenges and goals of your clients.

For firms who’ve made the shift to advisory services, work is much more consistent throughout the year (as opposed to the hurried months of tax season). Consider using the off-season to conduct in-depth reviews of client financials and hold planning sessions for clients which may be a good fit for advisory. These sessions can help your clients understand their financial health, set goals, and develop strategies for the upcoming year so there aren’t any surprises come tax time.

Your firm can also use the slower pace to educate clients about new regulations, financial strategies, or changes in the market that may affect their businesses. This proactive approach can help clients make more informed decisions and feel more confident in their financial plans.

The off-season is also an excellent time to recruit new clients. Utilizing your network, attending events or seminars, and using automated onboarding processes are all great ways to attract customers to your practice.

|

|

4. Focus on data analytics

Tax season can be challenging, but taking the time during the off-season to review client data can make all the difference. With the power of AI and automation, you can gain deeper insights into client data which can ultimately become a competitive advantage for your firm.

Advanced data analytics offer valuable insights into client data and performance, allowing for more efficient and accurate tax preparation, improved data management, and ultimately better decision-making and strategic planning.

Analyzing trends and preferences in client data can give insight into what services are most requested and how satisfied clients are with the quality of service they are receiving. It also allows you to identify any areas of improvement for your practice.

In addition, taking time to organize your clients’ data according to the latest tax regulations provides accuracy and efficiency in your practice. Keeping track of changes in law or regulations confirms that you don’t miss any deductions or credits that could benefit your clients.

And of course, checking for errors or discrepancies in client data during the off-season reduces potential headaches later on down the line. Updating client records with new information keeps everything organized so you can provide the best service possible come busy time.

Tools like Checkpoint Edge with CoCounsel allow you to quickly access your clients’ documents and analyze filing trends with ease — saving time and money while providing better customer service overall. With AI-powered features like real-time document synchronization, you can instantly make sure that all of your client’s documents are up to date with changes in law or regulations and help reduce paperwork clutter throughout the season.

5. Increase profitability

Assessing the performance of your practice is an essential part of the off-season review process. Taking stock of how well you are serving your clients can help you to identify strengths and weaknesses in your services, which will inform decisions that will direct you towards improvement.

Taking a look at past customer feedback will give you valuable insight into aspects of your services that may require some adjustment. If multiple clients raise the same issue, it might be worth addressing. Additionally, keep track of client retention rates; if they are low, it could be a sign that customers aren’t finding enough value in what you offer, and changes may need to be made.

Evaluating customer service is also important when examining your practice’s performance. Make sure the customer experience runs as smoothly as possible and that their inquiries receive prompt, helpful replies along their journey with you. With an industry-specific AI-powered tax research assistant like Checkpoint Edge with CoCounsel, even junior staff are empowered to answer even the most complex client questions quickly and accurately.

Building a successful advisory practice is all about amplifying your strengths, drawing from your experiences, and deepening your relationship with clients. With trusted methodology, guidance and content solutions, Practice Forward can help your firm shift from a compliance-focused model to a lucrative advisory services approach that engages and sustains clients.

Use off-season tax work to your advantage

Remember: The off-season is an opportunity to ready your game plan for the next tax season. By following these best practices during the off-season, your firm can provide outstanding service while preparing for future growth.

If you put in the work now, you’ll be ready to tackle next year with confidence.

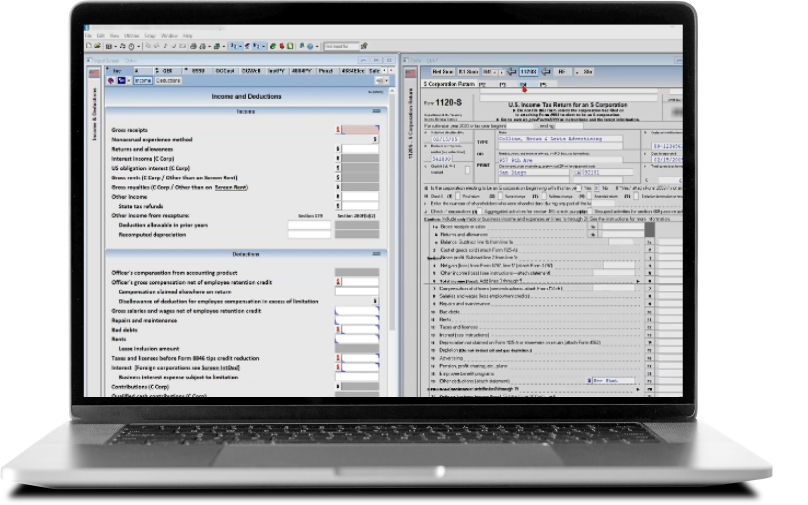

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗