Keep your business compliant with evolving e-invoicing mandates using Thomson Reuters and Oracle's cutting-edge integrated solution.

In today’s fast-paced global market, the shift towards digital solutions is not just a trend but a necessity. E-invoicing has emerged as a critical component in this digital transformation, offering businesses a streamlined approach to manage e-invoicing processes with increased accuracy and compliance.

Recognizing the growing importance of e-invoicing, Thomson Reuters has expanded its partnership with Oracle to deliver a robust solution tailored for corporate tax professionals and finance teams. This strategic partnership aims to enhance e-invoicing compliance and operational efficiency, providing significant benefits to multinational organizations navigating complex tax challenges.

Laura Clayton McDonnell, President of Corporates at Thomson Reuters says, “We are excited to deepen our partnership with Oracle, bringing our market-leading e-invoicing capabilities directly to Oracle Cloud ERP. This collaboration is also supported by partners like Accenture and underscores our commitment to providing seamless, innovative solutions that drive compliance and efficiency for our global customers. This marks another step forward in making end-to-end tax solutions a reality for customers.”

Highlights:

|

Jump to ↓

| Understanding the integration: ONESOURCE Pagero with Oracle Fusion Cloud ERP |

| Streamlining compliance and operational efficiency |

| Navigating global compliance mandates |

| Collaborative support from industry leaders for an ERP tax integration |

| Leadership and recognition in e-invoicing |

| An opportunity to simplify business operations |

Understanding the integration: ONESOURCE Pagero with Oracle Fusion Cloud ERP

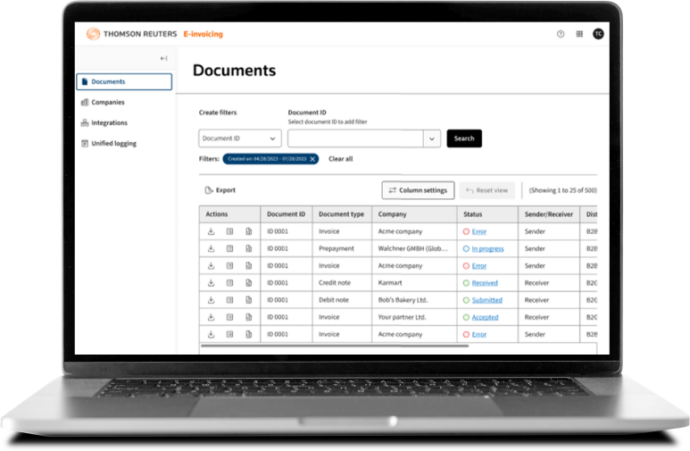

At the heart of this partnership lies the integration of ONESOURCE Pagero with Oracle Fusion Cloud ERP. This integration is designed to embed powerful e-invoicing capabilities directly within Oracle’s cloud-based ERP system, offering a seamless experience for users.

Key features include automated e-invoice processing, real-time data validation, and comprehensive reporting tools. These features collectively ensure that businesses can manage their e-invoicing processes with greater precision and efficiency.

The primary purpose of this ERP tax integration is to simplify the e-invoicing process, making it more accessible and manageable for corporate tax professionals. By embedding these capabilities within Oracle Cloud ERP, businesses can reduce the time and effort required to comply with various e-invoicing mandates, allowing them to focus on more strategic initiatives.

Streamlining compliance and operational efficiency

One of the most significant advantages of this integration is its ability to improve compliance and operational efficiency. E-invoicing processes are often complex, especially for multinational organizations dealing with diverse regulatory environments. The integration of ONESOURCE Pagero with Oracle Fusion Cloud ERP reduces this complexity by providing a unified platform for managing e-invoicing across different jurisdictions.

Improved data integrity is another critical benefit. By automating the e-invoicing process and ensuring real-time data validation, businesses can minimize errors and discrepancies, leading to more accurate financial reporting. This not only enhances compliance, but also supports better decision-making by providing reliable data insights.

|

|

Navigating global compliance mandates

To enhance tax compliance and reduce fraud, particularly in the digital economy, global e-invoicing mandates are continuously changing. An example of these evolving regulations is the European Commission’s VAT in the Digital Age (ViDA) initiative. Its goal is to update VAT obligations to better suit the digital economy’s demands. It introduces a uniform real-time digital reporting system based on e-invoicing for cross-border transactions within the EU. This system is designed to combat VAT fraud and support the digital transformation of businesses.

These developing mandates pose greater challenges for U.S. companies engaged in cross-border trade. Compliance with these unfolding mandates is crucial to avoid penalties and ensure smooth business operations. The strategic partnership between Thomson Reuters and Oracle plays a pivotal role in helping businesses navigate these issues.

By leveraging this integrated solution, companies can stay ahead of regulatory changes and ensure compliance with the latest e-invoicing requirements. This proactive approach helps mitigate penalty risks and enhances the efficiency of cross-border transactions, facilitating smoother trade operations.

Collaborative support from industry leaders for an ERP tax integration

The success of this integration is further bolstered by the collaborative support from industry leaders such as Accenture. As an early supporter of this partnership, Accenture brings valuable insights and expertise to enhance integration, ensuring that it meets the evolving needs of corporate tax professionals.

Collaboration among industry leaders is crucial in reinventing digital operations and streamlining business processes. By working together, these organizations can deliver a comprehensive solution that addresses the unique challenges faced by multinational businesses in the realm of e-invoicing.

Leadership and recognition in e-invoicing

Pagero is a recognized leader in the 2024 IDC Marketscape for European Compliant e-invoicing, underscoring the importance of choosing a trusted partner for e-invoicing solutions. This recognition highlights Pagero’s commitment to delivering high-quality, compliant solutions that meet the needs of businesses operating in complex regulatory environments.

For corporate tax professionals, selecting a partner with a proven track record is essential to ensure the success of their e-invoicing initiatives. The partnership between Thomson Reuters and Oracle, backed by Pagero’s expertise, offers a reliable and comprehensive solution that businesses can trust.

An opportunity to simplify business operations

The strategic partnership between Thomson Reuters and Oracle offers significant benefits for corporate tax professionals seeking to enhance their e-invoicing compliance and efficiency. By integrating ONESOURCE Pagero with Oracle Fusion Cloud ERP, businesses can streamline their e-invoicing processes, improve data integrity, and navigate global compliance mandates with ease.

For corporate tax professionals, this ERP integration represents an opportunity to simplify their operations and focus on strategic initiatives that drive business growth. We encourage you to explore how this partnership can transform your e-invoicing processes and enhance your compliance efforts.

|

|