Highlights

- CoCounsel Tax provides expert-built AI templates for complex corporate income tax nexus questions.

- Economic nexus rules vary significantly by state with different receipt thresholds and approaches.

- Digital activities have complicated P.L. 86-272 protections requiring detailed state-by-state analysis.

Our digital world presents unprecedented multistate corporate income tax nexus and sourcing uncertainties. As businesses navigate this evolving landscape, challenging questions often arise:

- Could remote hiring practices expose your business to income tax liability?

- Do licenses of your software as a service product in Florida or New York count toward the economic nexus threshold?

- How should you source sales of your new NFT?

The Thomson Reuters Checkpoint Catalyst state tax team thrives on tackling the toughest emerging issues and breaking them down in our Catalyst state topics and Nexus Assistant charts. We’re also taking things a step further by using AI capabilities from Thomson Reuters CoCounsel Tax, along with other Checkpoint resources and our own deep expertise, to develop ready-made prompts (we call them Templates) that deliver quick, accurate answers.

We engineered prompts that we would use daily if we were still in client practice. We tested the prompts until we were satisfied with the answers. Then we tested them again. And again!

Jump to ↓

Economic nexus: The receipts-based reality

The P.L. 86-272 problem: Every internet activity matters

Digital goods, digital sourcing headaches

What the Checkpoint Catalyst team is working on next

Economic nexus: The receipts-based reality

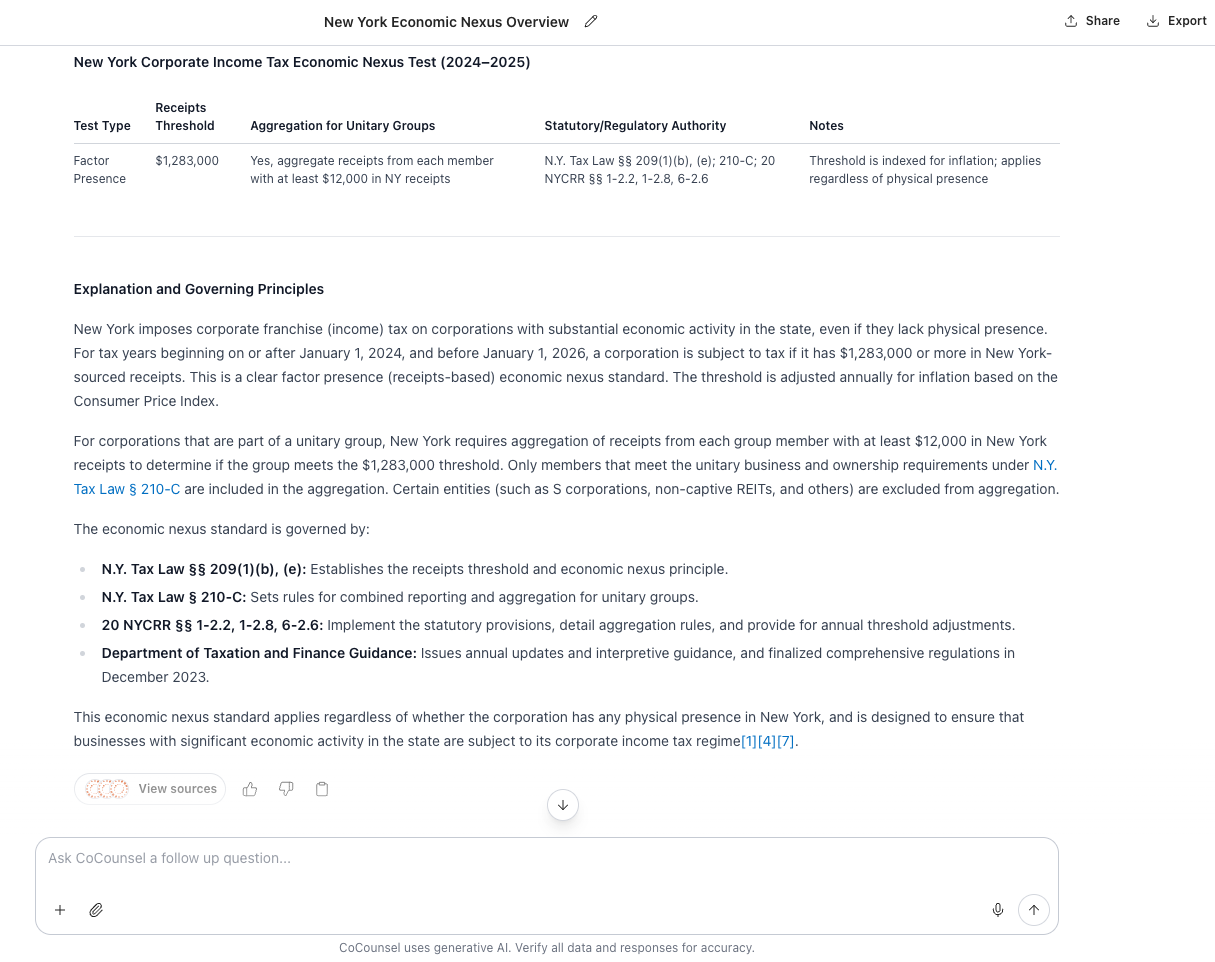

The days when you had to be physically present in a state for nexus are long gone. An increasing number of states are asserting nexus based on receipts thresholds, each bringing its own approach and complications.

From California to New York, Michigan, and Tennessee, states have established specific dollar amounts that trigger nexus obligations. Meanwhile, states like Florida and Arizona don’t use a receipts threshold at all for corporate income tax, making the analysis even more fact specific.

Our most popular Template lays out the state’s corporate income tax economic nexus standard, with Checkpoint citations embedded so you can take a closer look at the underlying sources. Or you can ask your own follow-up questions.

The P.L. 86-272 problem: Every internet activity matters

Back in the day, P.L. 86-272 provided straightforward protection: sell tangible personal property through pure solicitation, and you’re shielded from state income tax. For decades, that worked.

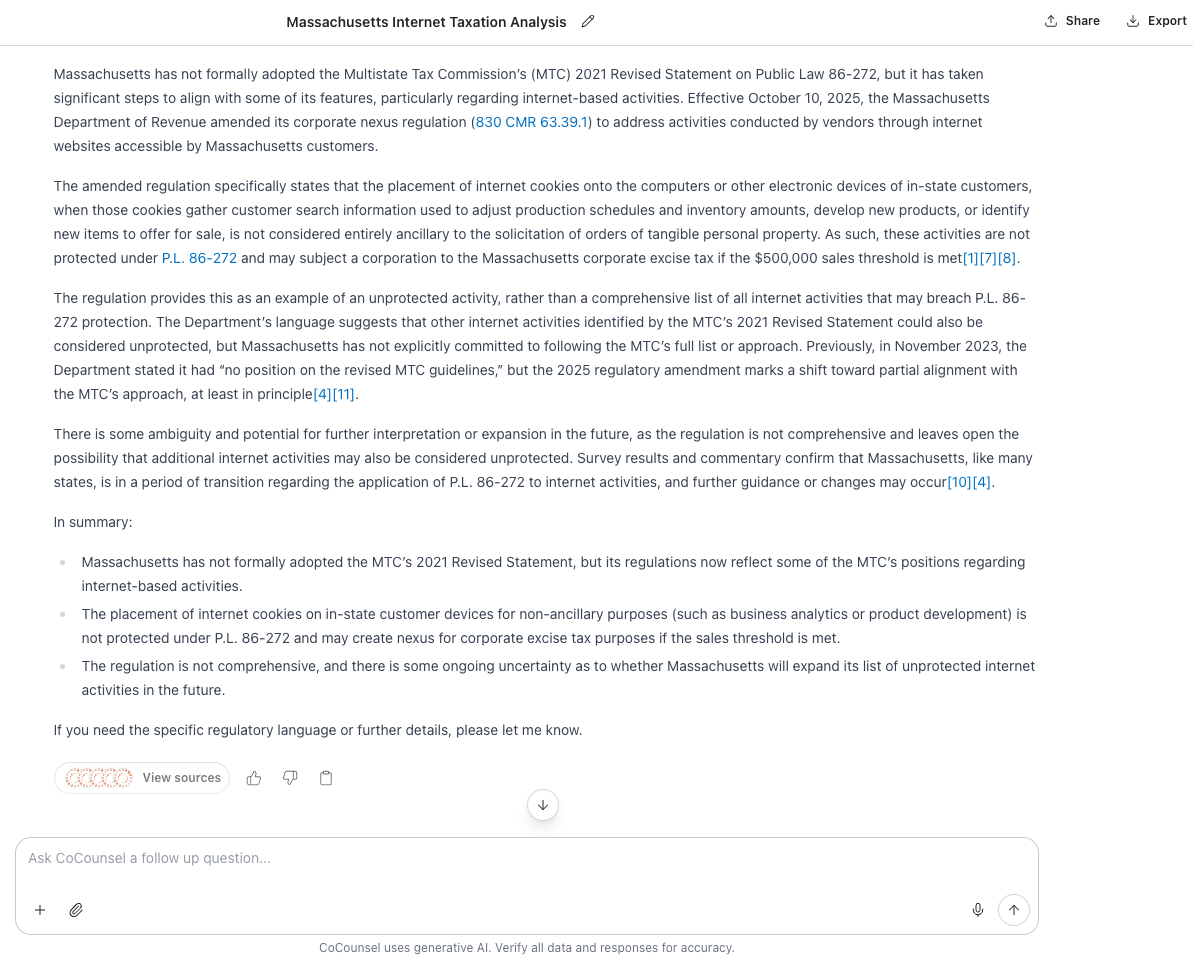

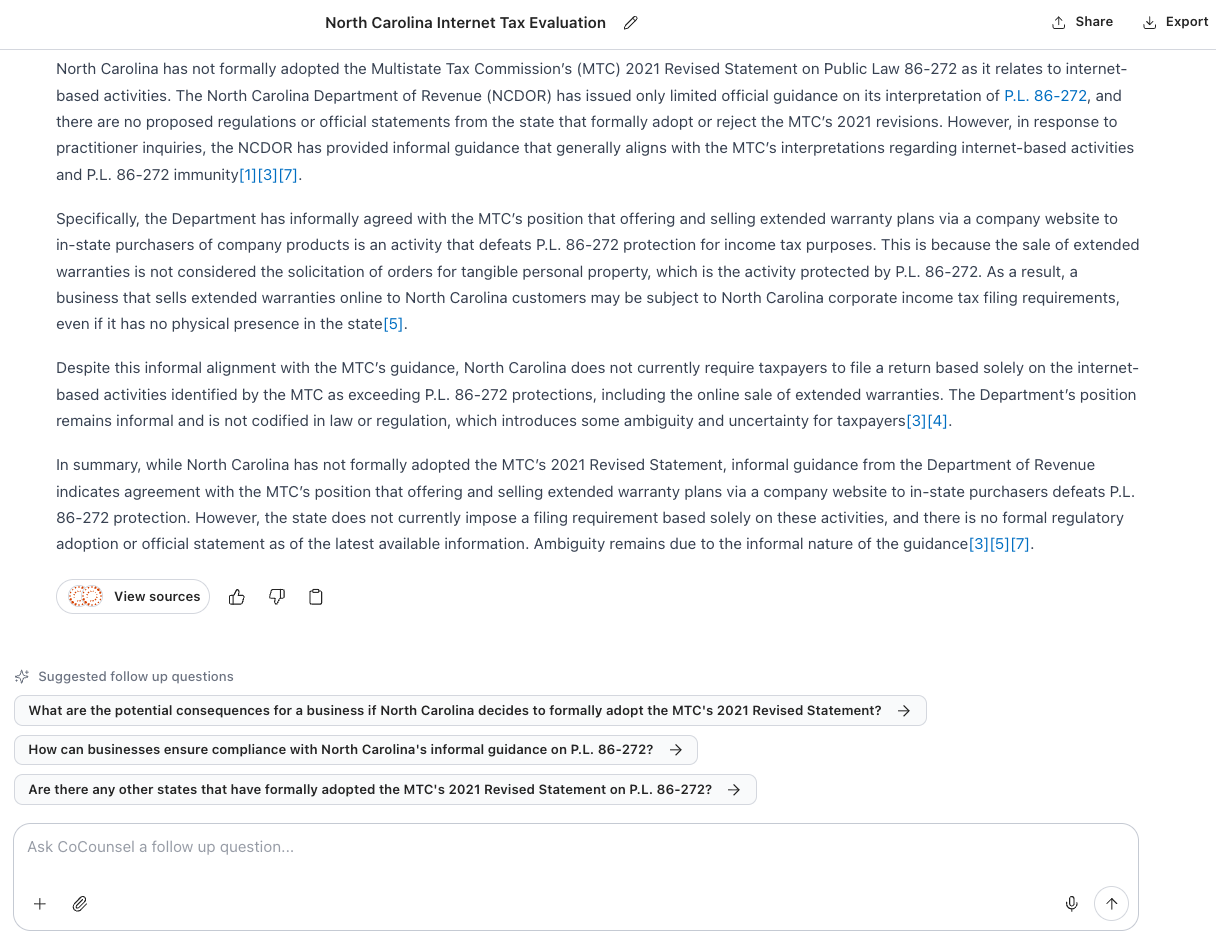

Then came websites. Chatbots. Downloadable content. Email support. Cookies that track user behavior. The MTC’s 2021 revisions to its Statement on P.L. 86-272 took aim at these and more activities, dramatically narrowing what counts as protected solicitation in the digital age.

As digital activities increasingly blur the traditional boundaries of solicitation, businesses are finding that every online interaction could have an impact. With states rapidly updating their interpretations in response to technological advances, it’s essential to understand how these changes affect your nexus exposure.

For example, a few questions and considerations include:

- Does your website allow customers to submit questions via chat? This capability might impact your protection.

- Do you use cookies to personalize content or track user engagement? This could mean you’re potentially unprotected.

- Can prospective employees upload resumes through your careers page? This activity could also raise concerns.

- Do you provide post-sale customer service via email? According to the MTC, this goes beyond mere solicitation and could put you at risk.

- All of these evolving rules and rapid changes can be confusing and overwhelming, but that’s exactly why we’ve developed resources and tools to bring clarity and confidence to your tax decision-making process.

Our 86-272 Template incorporates this level of detail. We’ve mapped every internet activity the MTC targeted and built detailed state-by-state analysis into the prompt. California, New Jersey, New York, and Massachusetts have moved to adopt the MTC’s position through regulations or guidance. Many states remain silent, until they raise the MTC stance on audit.

Practitioners report that some states are already applying the MTC’s revised interpretation of P.L. 86-272 during audits — even without formal guidance. In fact, a recent Checkpoint Catalyst survey revealed that several state tax agencies are informally following the latest Statement. Our 86-272 Template is built to cover every scenario: states with published guidance, states that have signaled their approach informally in response to our unique survey, and states where the rules remain unsettled, but the audit risk is real.

Digital goods, digital sourcing headaches

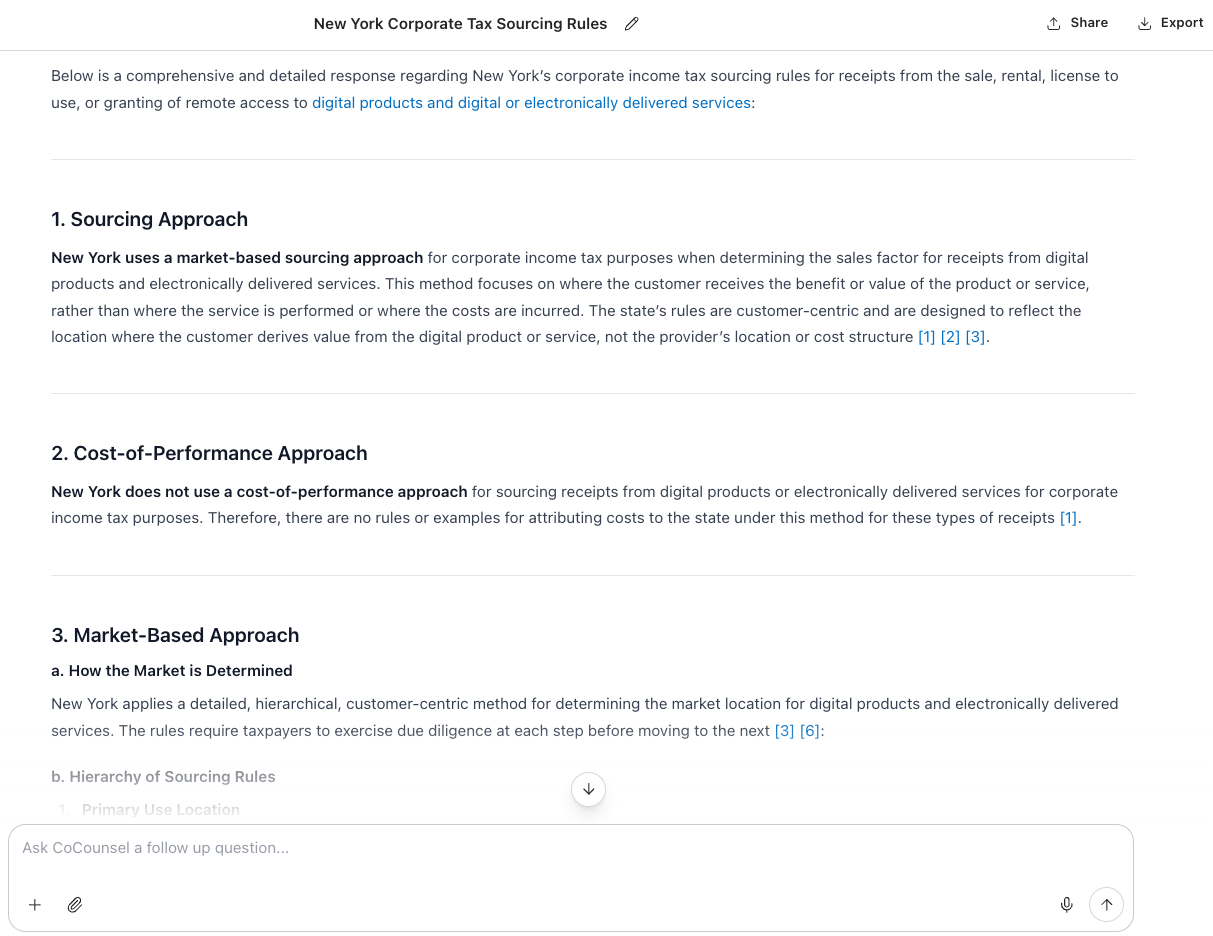

Electronically delivered goods and services are a major part of our economy, but allocation and apportionment approaches are literally all over the map.

Is your SaaS product a service? A digital good? A license? The answer may change your sourcing, and thus your nexus exposure and tax bill. Plus, it varies from state to state. New Jersey, for example, has rolled out nuanced sourcing rules for digital assets that raise questions about how sourcing methodologies using AI-based reasonable approximation will hold up under audit.

Our newest and most sophisticated Template provides a detailed roadmap for sourcing receipts from sales, licenses, or remote access to the most complex digital products and services.

What the Checkpoint Catalyst team is working on next

We’re refining these Templates constantly based on new guidance, new case law, and new questions from practitioners like you. Because the goal isn’t just to answer today’s questions, but to anticipate tomorrow’s.

What nexus and sourcing challenge is keeping you up at night? Reach out and let us know! We’d love to hear your feedback and learn about the nexus and sourcing challenges you’re facing.

Ready to get started?

If you’re new to CoCounsel Tax, discover how this AI-powered assistant can transform your tax practice with expert-built Templates designed for the complexities of modern state tax practice. Learn more about CoCounsel Tax – the AI tax assistant for tax professionals.

Already using CoCounsel? Access these nexus and sourcing Templates and explore our full library of ready-made prompts at Templates – Thomson Reuters™ CoCounsel.