Looking for information on the new 2020 W-4? The IRS issued the 2020 Form W-4 on December 5, 2019.

——————————————————————————————————————–

Let’s look at W-4s this month. As we all know, this is the document that employees turn in to an employer to calculate federal and (sometimes) state withholdings.

There was once a time when, if the employee turned in a W-4 with more than 10 exemptions, the W-4 needed to be sent to the federal government for verification. This requirement no longer exists, except for California state withholdings.

Elsewhere, a lock-in letter replaced this requirement. If an employer receives a lock-in letter from the IRS, the employer is then required to use the IRS calculation of exemptions instead of the employee W-4. The rare exception is if an employee submits a new W-4 with more taxes that are calculated than the lock-in letter-again, this is very rare. A lock-in letter trumps a W-4 and must be put in place by the employer no more than 60 days after it is received. Note the 2020 lock-in letter format will start being distributed by the IRS on May 2020. Until then the old 2019 format will continue to be used.

“How many times can an employee change their W-4?” is a common question. Actually, there is no minimum or maximum number of times. However, an employer has up to 30 days to implement the change.

Another common question is “Does a W-4 expire?” There is no expiration date for W-4s so you could be correct to use a 1984 (or any other year) W-4, if no change has ever been received from the employee. However, any new or change MUST use the 2020 W-4.

Let’s talk about what constitutes a legal and acceptable W-4. The form can only contain the employee demographic information, marital status, and the number of exemptions, with an area for additional dollar amount of withholding and a box for exempt. Any alteration of this, like set percentage or set dollar amount of withholding, voids the W-4. If the employer does not have a valid W-4 for the employee, the employer is required to use the 2020 Single with no adjustments. Also, make sure you are using the correct year W-4 when the employee submits it to the employer.

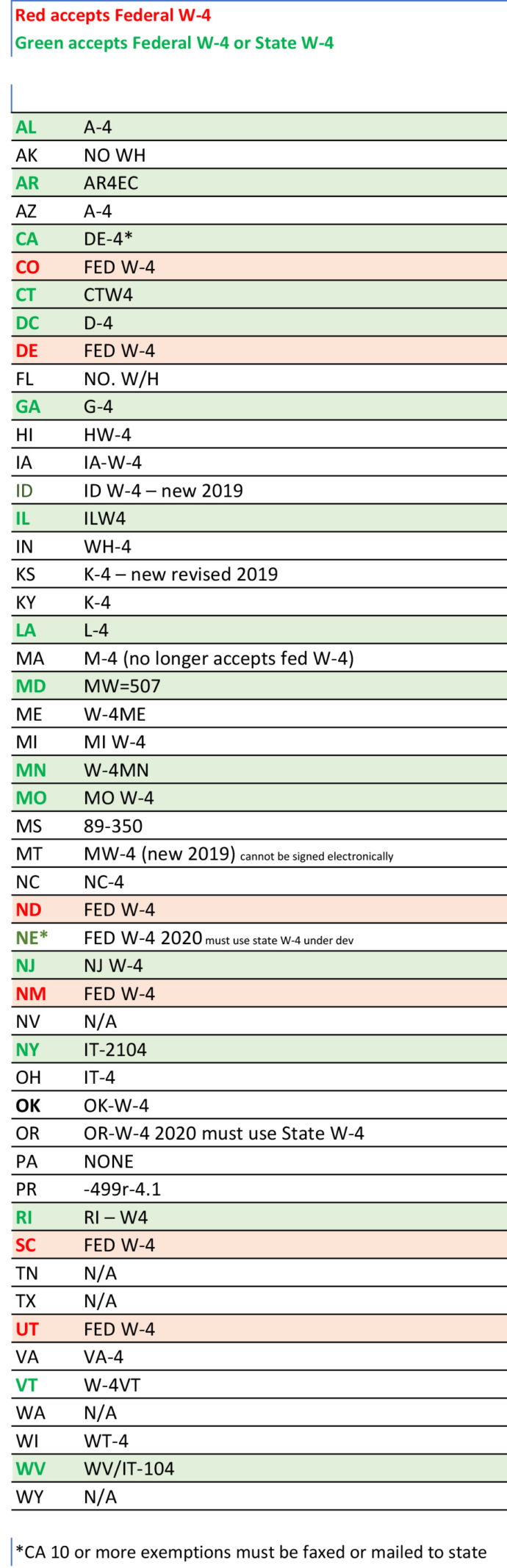

Now let’s look at the states. The W-4 is a federal document, and several states – but not all – accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings. You’ll notice that Pennsylvania does not have a state W-4-this is because the rate is a set percentage.

Knowing the federal and state W-4 rules will assist you in correct calculations of withholdings and can assist employees with the requirements.