There is no doubt that advances in technology and increasing client expectations are rapidly transforming the accounting profession. The 2025 State of the Tax Professionals Report highlights a clear trend: today’s clients expect more than compliance—they want actionable advice that helps them make smarter financial decisions.

In response, forward-looking accounting firms are future-proofing their businesses by offering more than just tax preparation. By successfully shifting to an advisory-based business model, more firms are unlocking new opportunities for growth and increased revenue, not to mention improved staff engagement. But where do you begin?

Ready to Advise is an AI-powered tax planning advisory solution that helps firms like yours meet growing expectations and achieve long-term success. Whether you’re just beginning to explore advisory offerings or looking to scale an existing practice, Ready to Advise empowers your staff to deliver valuable insights at scale. With automation, AI-guided delivery, and standardized workflows, you will be able to future-proof your operations and transform from compliance-focused work to advisory-driven insight. Let’s take a look.

Jump to ↓

| The demand for advice increases |

| A tailored AI solution for scaling advisory services |

| Future-proofing with AI: Benefits for accounting firms |

| Overcoming hesitations and embracing AI |

| Is your firm Ready to Advise? |

The demand for advice increases

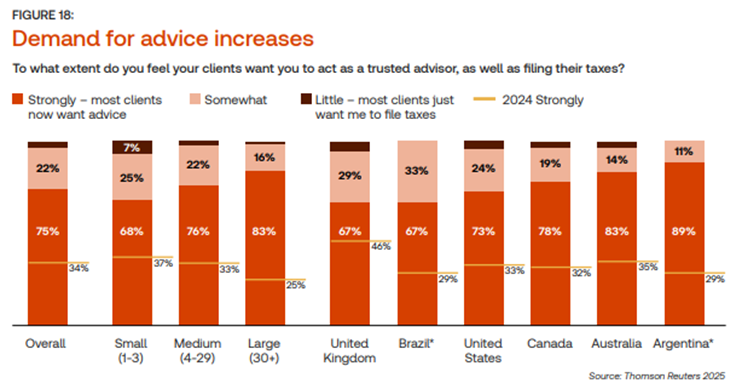

According to the 2025 State of the Tax Professionals Report, 75% of respondents say their clients strongly desire more tax and business advice beyond traditional tax preparation. This shift in client mindset is reshaping how firms think about service delivery. No longer is it enough to simply prepare returns — clients are actively seeking strategic insights to help navigate economic uncertainty, tax code changes, and business decisions.

Firms looking to expand their service offerings are finding tax strategy to be a logical entry point. It aligns well with their existing expertise and provides a natural way to upsell clients already relying on them for tax preparation.

According to the survey, most firms expect to introduce strategic tax services within the next 12 months, suggesting an industry-wide shift toward more proactive, consultative relationships. Solutions like Ready to Advise make this transition easier by equipping teams with the tools and insights they need to meet client expectations without overwhelming senior staff.

A tailored AI solution for scaling advisory services

So how does Ready to Advise work? First and foremost, it addresses one of the most common hurdles: how to deliver high-quality advice without relying solely on a few senior professionals. By automating the identification of tax opportunities and providing step-by-step guidance, Ready to Advise ensures that even less experienced staff can confidently engage clients in meaningful advisory conversations.

At the heart of the solution are three powerful capabilities: AI-driven analysis for uncovering relevant tax strategies; a client and project profile that gives teams a comprehensive understanding of project statuses, client goals, and client-specific strategies; and AI-guided delivery that standardizes execution.

Together, these features enable firms to move beyond reactive compliance work and into a proactive advisory role — empowering every team member to contribute to business development and client success. Whether serving individuals, sole proprietors, or small businesses, Ready to Advise delivers a consistent, scalable approach to strategic tax planning.

Future-proofing with AI: Benefits for accounting firms

According to the 2025 Generative AI in Professional Services Report the accounting profession is primed and ready for industry-specific AI adoption. A large proportion (41%) of respondents said they personally use publicly-available tools such as ChatGPT, and 17% said they personally use industry-specific GenAI tools. On an organization-wide level, the percentage of respondents who said their organizations were actively using GenAI nearly doubled over the past year, to 22% in 2025, compared to 12% in 2024. An additional 50% of respondents said their organizations are either creating plans to use GenAI or deciding whether or not to do so.

In addition, while just 13% say GenAI is currently central to their organization’s workflow, an additional 29% believe it will be central within the next year. Further, 95% of all respondents believe it will be central to their organization’s workflow within the next five years — demonstrating the need for firms to act now to future-proof their operations.

With increased demand and a clear path to growth, there has never been a better time to embrace advisory services powered by AI. Firms that provide proactive advice are more likely to retain clients, win referrals, and boost revenue. In fact, tax and accounting professionals who use advisory solutions like Ready to Advise report significant gains in monthly client revenue, which are sometimes as high as 50%.

The beauty of implementing Ready to Advise goes far beyond operational efficiency. By automating data analysis and surfacing personalized recommendations for clients, your firm can harness AI to deliver advisory services more consistently and at scale. In addition, using a secure, professional tool like Ready to Advise offers greater trust, accuracy, expert guidance, workflow consistency, data security, and integration capabilities compared to publicly available tools.

Overcoming hesitations and embracing AI

Despite the clear benefits, many firms are hesitant to adopt AI due to concerns about accuracy, complexity, or disruption to current processes. These are valid concerns, but with the right solution and strategy, they can be addressed proactively.

Ready to Advise is built on a trusted tax engine, ensuring that projections and recommendations are grounded in the latest legislation. It also integrates with your existing tax software, thus streamlining implementation and minimizing disruption. In other words, it’s designed to fit seamlessly into your firm’s existing ecosystem.

Early adoption is key. Firms that delay AI adoption risk falling behind competitors who are already leveraging technology to meet client demand. With clients actively asking for tax advice, a “wait and see” approach can lead to missed opportunities and client attrition. Embracing AI today positions your firm to lead with confidence and get a leg up on the competition.

Is your firm Ready to Advise?

The 2025 State of the Tax Professionals Report confirms what many firms are already seeing: clients want more insight, more support, and more value. By implementing Ready to Advise, your firm can meet this demand head-on by scaling advisory services, improving client outcomes, and unlocking new sources of revenue. The result is a stronger, more competitive firm that’s prepared for the future.

Don’t wait until the competition leapfrogs you. Take action now to future-proof your accounting firm and build deeper, more valuable relationships with your clients.

|

|