6 common federal tax return forms and their perfection periods.

Jump to ↓

| What is the e-file rejection grace period for federal tax returns? |

| What is the e-file grace period for state returns? |

| Tax software with e-filing capabilities |

| Additional e-filing resources |

Preparers have the following perfection periods to correct and retransmit tax returns or extensions that were filed on time but were rejected by the filing deadline. The IRS considers returns that are resubmitted electronically during the applicable timeframe as timely-filed returns.

What is the e-file rejection grace period for federal tax returns?

Any taxpayer who received a rejected e-filed tax return has a rejection grace period of 5 calendar days after the official filing deadline (usually April 15) to retransmit the return or extension.

Form 1040

- E-filed returns: 5 calendar days

- E-filed extensions: 5 calendar days

Form 1041

- E-filed returns: 10 calendar days

- E-filed extensions: 5 calendar days

Form 1120*

- E-filed returns: 10 calendar days

- E-filed extensions: 5 calendar days

Form 1065*

- E-filed returns: 10 calendar days

- E-filed extensions: 5 calendar days

Form 990

- E-filed returns: 10 calendar days

- E-filed extensions: 5 calendar days

Notes

- *Forms 1120 and 1065: The yearly cutover period does not extend the 10 day Transmission Perfection Period. Historically, the perfection period has never been extended regardless of weekends, holidays or the end of the year cutoff.

- Form 5500 returns have no limit for the grace period on rejected returns but you should resubmit such returns as soon as possible. The return is filed and posted on the Department of Labor website even if the status is rejected.

Per Publication 4163, Modernized E-file (MeF) business returns have a “perfection period” of 10 days from the date of rejection. Extensions (Forms 7004 and 8868) have five (5) days from the date of rejection, which is not an extension of time to file; this is the period to correct errors in the e-file.

What is the e-file grace period for state returns?

For information on the resubmission period for state returns, please see the UltraTax CS federal and state e-file guide on our website, click the state for which you want information, and scroll to the Grace period section.

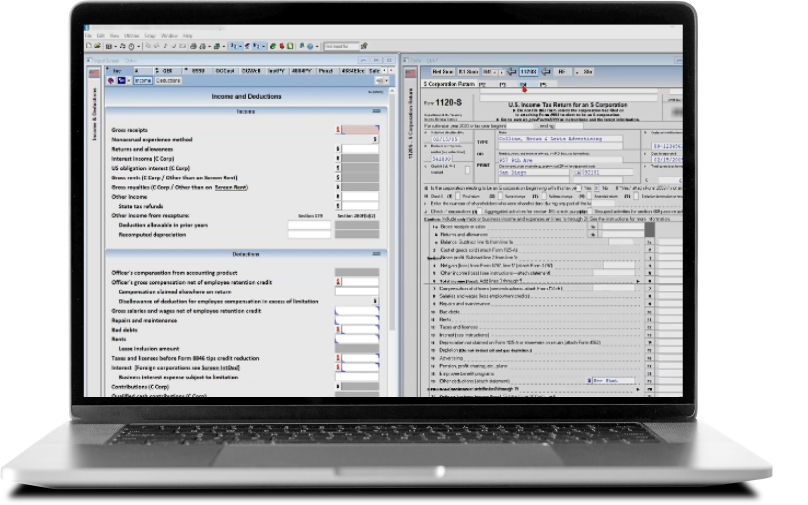

Tax software with e-filing capabilities

UltraTax CS offers the most advanced, timely, and dependable e-filing capabilities available to the tax and accounting profession. You get robust e-file tools to monitor each step of the e-file process, like extensive error-checking to ensure that returns are complete and accurate prior to being transmitted to the IRS and state taxing authorities.

And there’s detailed information to alert you to the status of a given tax return, including e-file acknowledgements from the IRS or a state — even the option to send the client an automatic email when an e-file return is accepted by the IRS. UltraTax CS supports multiple tax forms including 1040, 1041, 1120, 1120C, 1120S, 1065, 706, 709, 990, and 5500 as well as more than 200 individual and business state and local tax returns.

Additional e-filing resources

View the following related resources for more information on e-filing and federal returns.

- E-file program information

- IRS Publication 4163 (containing Modernized e-File Information)

- IRS Publication 1345

- How do I find my EFIN number and application summary?

- The benefits of early e-filing for accountants

- Filing tax extensions for 1040 and 1120 returns

- 2026 spring deadline due dates for transmitting e-filed returns

- 7 steps for an accurate and successful corporate tax return filing

UltraTax CS

Professional tax preparation software to reduce your workflow time and increase your productivity

Learn more ↗