Explore practical ways that tax professionals can do to confidently prepare for the future of AI while achieving their career and job goals.

Jump to ↓

| Use cases: AI for tax work |

| Enhancing value to clients with AI |

| Reducing AI concerns |

| Adopting AI for the future |

Statistics from the Future of Professional Report

|

AI adoption is accelerating rapidly in tax and accounting, with professionals increasingly optimistic about how it will benefit their practices according to the most recent Future of Professionals Report from Thomson Reuters Institute.

Tax season is an appropriate time for these professionals to consider how AI can truly be a “force for good.” AI tools—specifically, generative AI (GenAI)—are impacting the tax profession in many ways: how tasks are performed, how clients are served, and how skill sets need to change. If there’s one word that can summarize that impact, it’s efficiency. This guide will discuss how tax, accounting, and finance professionals can maximize AI’s many benefits—and address the legitimate concerns they have about this evolving technology.

Use cases: AI for tax work

First, let’s look at the ways AI can benefit tax and accounting practices. Professionals in these fields are rigorous about details—they need to be. They must be painstaking when it comes to research, document assembly, and data analysis. But the time spent on this crucial work keeps tax professionals from focusing more of their hours on higher-value services. As the Future of Professionals Report reveals, among all professions, a higher percentage of tax and accounting practitioners believe that a shortage of skilled talent is likely to have a high or transformational impact on the future of their work. For these professionals, time is money in more ways than one.

Time-saving

There are several ways tax and accounting professionals can leverage AI’s time-saving capabilities. Powerful algorithms, when combined with access to vast datasets, enable AI to understand and respond to requests and prompts in ways that make their answers reliable and useful. AI also can power predictive modeling to glean insights from clients’ historical data, as well as external and non-financial sources, to identify expense reductions and income opportunities for clients’ businesses.

Similarly, AI can automate technical research. This work typically involves multiple searches, a painstaking review of relevant materials, and a summary presented in a format that clients and colleagues can understand. All this can take hours even for an experienced tax researcher. When automated by AI, this process is much faster and less tedious. In addition, AI’s capabilities can make conducting bookkeeping, compliance, and return preparation more efficient. And with tax season underway, tax professionals can leverage AI to automate repetitive tasks and optimize workflows, thus speeding up tax preparation and reducing stress levels (their own and their clients).

Efficiency

We can see the efficacy of AI on tax and accounting use cases by focusing on its applications in audits. Reviewing documents such as contracts and financial statements is frequently tedious and potentially prone to error. AI tools can quickly extract complex data, freeing up time that might have been spent on oversampling. AI’s analytic prowess also can help auditors identify potential risks by uncovering patterns, trends, and anomalies that might go unnoticed during manual reviews.

What’s more, AI can help clarify highly complex tax and finance challenges. A corporate tax accountant quoted in Thomson Reuters 2024 Generative AI in professional services report noted: “I have used ChatGPT for VAT compliance and have found it useful, particularly with international transactions where information and guidance from tax authorities based overseas can be difficult to find.”

Tax and accounting professionals who are intrigued by the opportunities that AI can deliver will naturally need to conduct due diligence on potential tools. One type of AI that deserves close scrutiny is a GenAI assistant. An AI-powered tax assistant can automatically deliver professionally summarized answers along with links to relevant editorial content and source materials, even transforming reporting and compliance. A GenAI assistant developed specifically for tax and accounting practices also can reduce the chance of inaccurate answers, thus mitigating potential risks to clients or companies while saving time and resources.

|

Key takeaway

CoCounsel

Bringing together generative AI, trusted content and expert insights

Meet your tax and accounting AI assistant ↗

Enhancing value to clients with AI

By opening up more hours for tax and accounting professionals, AI can make their client relationships more profitable. Not only can they respond more quickly to client needs and inquiries—they can provide new and beneficial service offerings. It’s worth noting, by the way, that smaller-size firms can derive the same benefits and profit from the same possibilities for new client services that AI offers as larger ones.

Value of expertise-driven work

Spending less time on routine tasks is something that many of those surveyed in the Future of Professionals Report anticipate: 42% hope that they can spend more time on expertise-driven work in the next five years.

Survey respondents (who include professionals outside the tax and accounting industries) identified several areas where AI could help provide more value to clients:

- Handling large volumes of data more effectively (59% of respondents cited this benefit)

- Improving client response times (44%)

- Reducing human error (38%)

- Providing advanced analytics for decision-making (36%)

To provide higher-value services to clients, AI will require tax and accounting professionals to reshape their skill sets in terms of technical judgment, decision-making, and critical thinking. One tax professional quoted in the report put it this way: “As tax laws become progressively more complex, the attention will shift from simple preparation to more complex analysis and strategic work.”

Improving tax services and pricing

Leveraging GenAI can drive opportunities for tax firms and departments to serve their clients and companies in new ways. These include advisory services such as tax and strategic planning, investment and wealth management, and cash flow forecasting. In addition, AI can help tax and accounting professionals handle specialized work—for example, ESG management, reporting, and compliance.

This AI-powered shift in practice patterns will require major changes in how tax and accounting professionals price what they provide. In the Future of Professionals Report, 44% of survey respondents foresee a decline in hourly rate billing models over the next five years as routine tasks are conducted and completed more efficiently. In response, many tax and accounting operations have begun innovating their service delivery and pricing models. For instance, a value-based approach assigns a price based on the value the professional’s services bring to the client.

|

Key takeaway

Reducing AI concerns

For all of AI’s promise and capabilities, tax and accounting professionals need to take a cautious approach to its use. And in fact, these practitioners aren’t leaping blindly into implementation regardless of their optimistic perceptions.

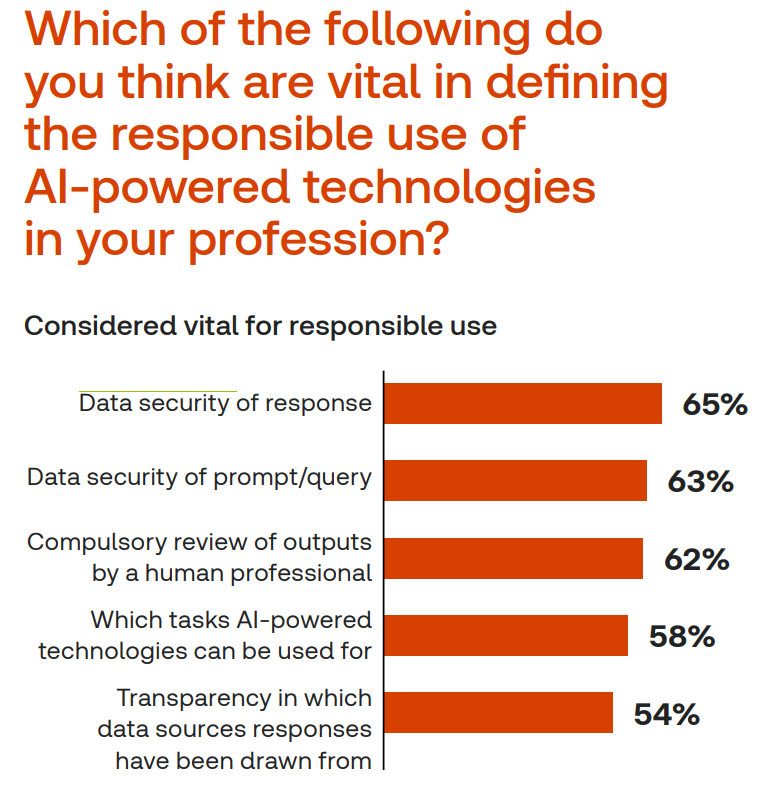

The tax, accounting, legal, and risk professionals surveyed in the Future of Professionals Report cited data security of response (cited by 65% of respondents) as one of their top ethical concerns.

Upholding ethical standards

Given their need for scrupulous precision, tax and accounting professionals need assurance that AI tools won’t compromise their ethical standards. As they implement AI, these professionals will want to establish clear rules for its responsible use to minimize its risks. For instance, tax and accounting firms and departments should draw up a data security checklist to protect both themselves and their clients.

It’s no surprise, then, that 57% of the professionals surveyed in the Future of Professionals Report express strong support for establishing AI certification processes and industry standards. These professionals already are thinking about the boundaries of the technology’s use to fight against any challenges. Only 43% of those surveyed in the report are comfortable with AI providing advice on tax planning or compliance issues without their oversight.

Professionals can help reduce their worries about AI’s impact by keeping abreast of changes in this ever-evolving technology, including new regulations and new developments such as agentic AI.

|

Key takeaway

Adopting AI for the future

To maximize AI’s benefits and minimize its risks, tax and accounting professionals should establish a rigorous process of integrating this technology into their workflows. By pursuing a carefully thought-out strategy for adoption, they can ensure their readiness for an AI-powered future.

We’ve summarized some practical steps that tax and accounting firms can follow:

- Identify what the firm or department needs from an AI platform. This list should be as comprehensive as possible, including routine or repetitive tasks that AI could automate.

- Perform due diligence on potential tools. Professionals will want to ascertain that a tool can handle all their required use cases and that it accesses trusted data sources.

- Prepare colleagues to use AI successfully and responsibly. This should include training and the development of best practices, such as data security protocols. Last 2024 fall, the U.S. Department of Labor promulgated a list of AI best practices that many workplaces will find helpful. Among these practices: Maintain human oversight.

An AI tool that can make it easier for tax and accounting professionals to integrate this ever-evolving technology into their practices is CoCounsel, a GenAI assistant from Thomson Reuters that performs many routine tax-specific tasks. CoCounsel includes Thomson Reuters Checkpoint Edge tax-research technology, and it recently began incorporating AI developer Anthropic’s Claude AI for tax-specific use cases.

To learn more about how tax and accounting professionals can make themselves ready for AI’s impact on their practices:

- Download the most recent most recent Future of Professionals Report from Thomson Reuters

- Explore how a GenAI assistant can transform tax and accounting practices.

|

Key takeaway

|

|

Subscribe to monthly newsletter ↗